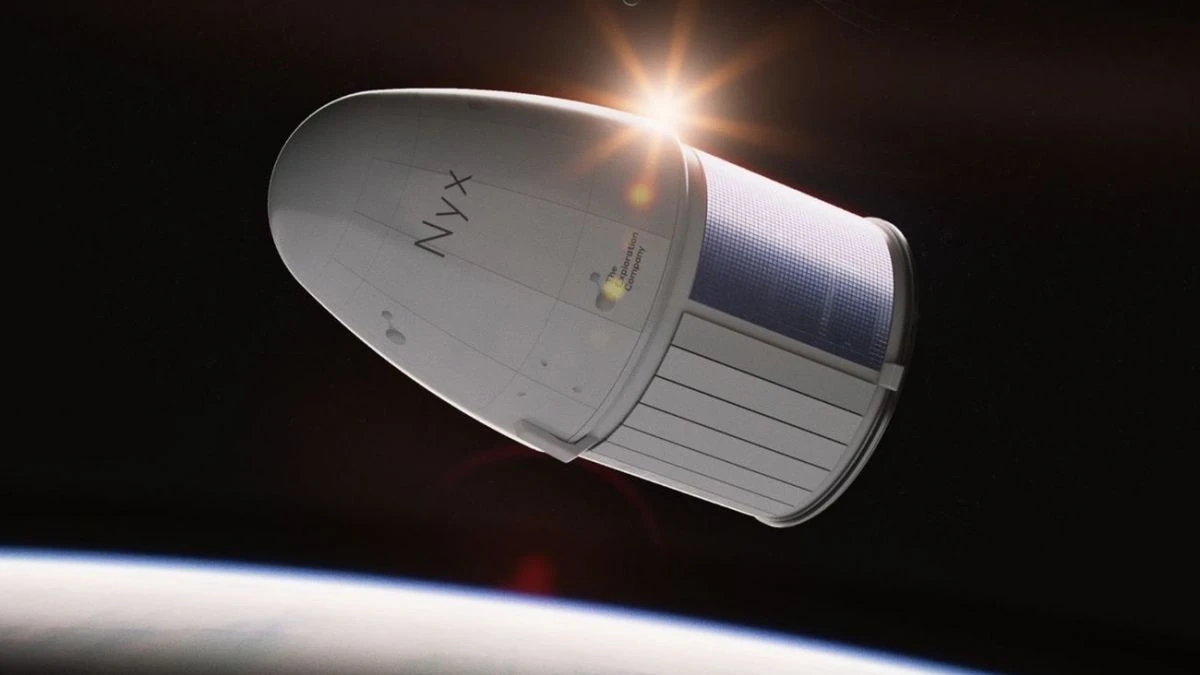

Exciting times ahead! The Nyx spacecraft is not just a marvel of technology; it's a symbol of hope and determination for all of us! Imagine a renewable transport system pushing the boundaries of space exploration, making the impossible possible! With Nyx, we are not just reaching for the stars; we are redefining what it means to dream big! Let's embrace these innovations and remind ourselves that every challenge is just an opportunity waiting to be seized. Together, we can achieve greatness!

#NyxSpacecraft #RenewableTransport #SpaceExploration #DreamBig #Innovation

#NyxSpacecraft #RenewableTransport #SpaceExploration #DreamBig #Innovation

✨🚀 Exciting times ahead! The Nyx spacecraft is not just a marvel of technology; it's a symbol of hope and determination for all of us! 🌌 Imagine a renewable transport system pushing the boundaries of space exploration, making the impossible possible! 💪💫 With Nyx, we are not just reaching for the stars; we are redefining what it means to dream big! Let's embrace these innovations and remind ourselves that every challenge is just an opportunity waiting to be seized. Together, we can achieve greatness! 🌠💖

#NyxSpacecraft #RenewableTransport #SpaceExploration #DreamBig #Innovation