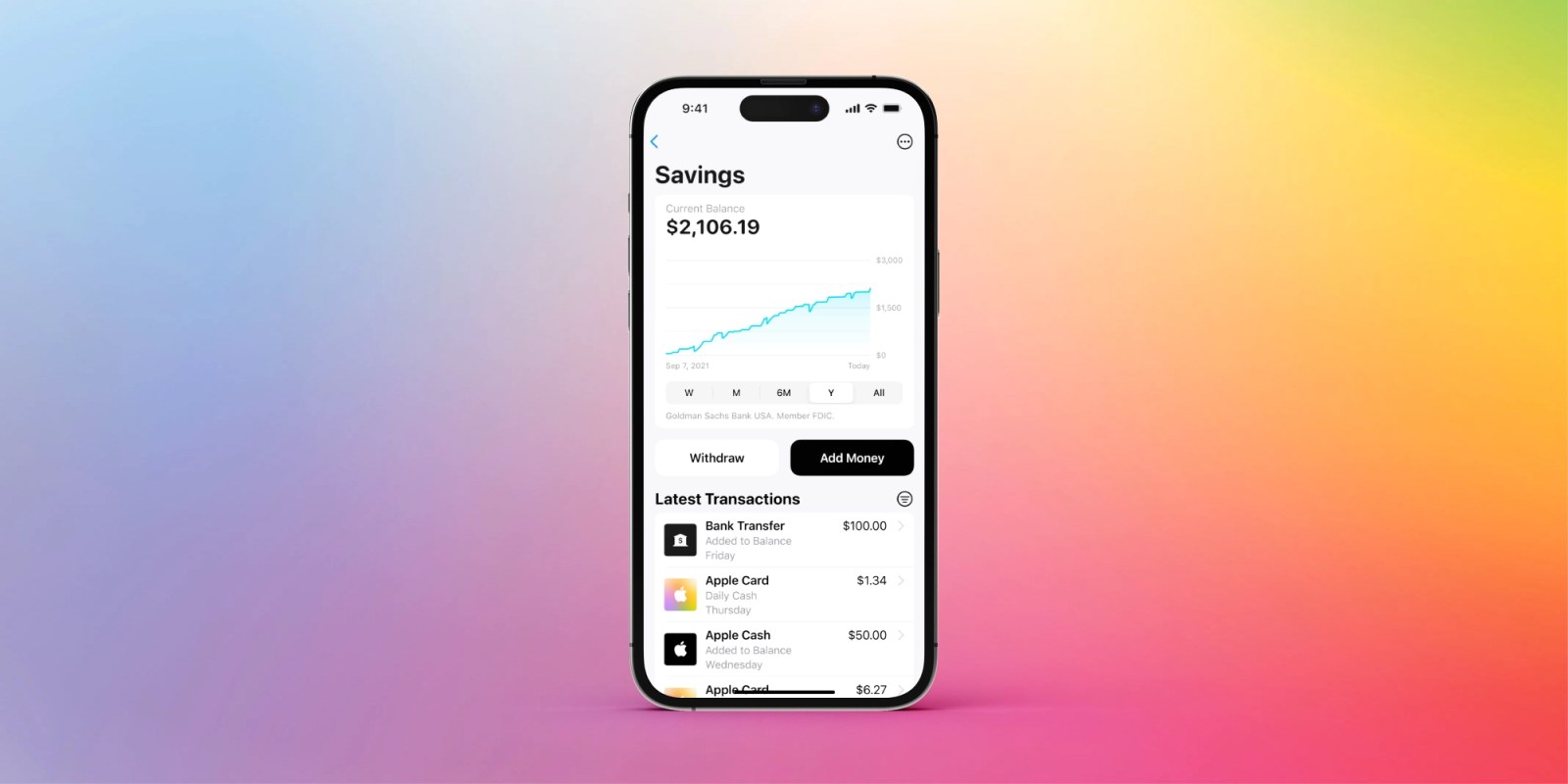

Apple Card Savings Account gets another interest rate cut

Apple and Goldman Sachs have announced another rate cut for Apple Card Savings Account. Starting today, Apple Card Savings Account offers a 3.90% annual percentage yield, down from 4.10%.Apple Card Savings Account started with a 4.15% interest rate for the first eight months of availability. The rateincreasedto 4.25% in December of last year, then again to4.35% in early Januaryand to4.5% in late January. The rate was then cutback to 4.4% in Apriland thenreduced to 4.25% in late September.In October, Apple adjusted the Apple Card Savings Account rate once again, lowering it to 4.10%. Now, as of December 4, 2024, the Apple Card Savings Account offers a 3.90% APY. This matches the rate that Goldman Sachs offers through its own Marcus savings account, though you can earn a bonus rate with this link for a limited time. Apple and Goldman Sachs, like all financial institutions, adjust the interest rate based on overall economic conditions. The Apple Card Savings Account is an exclusive feature for Apple Card holders. As you earn Daily Cash rewards with your Apple Card, you can easily transfer them into the high-yield savings account within the Wallet app.In addition to transferring Daily Cash directly, Apple Card users can also add funds from a linked bank account or their Apple Cash balance. The interest is compounded daily, meaning you earn interest on both your initial deposit and the accumulated interest over time. At the end of each month, the interest is paid out into your savings account.For more detailed information about the Apple Card Savings Account, visit our comprehensive guide right here.Add 9to5Mac to your Google News feed. FTC: We use income earning auto affiliate links. More.Youre reading 9to5Mac experts who break news about Apple and its surrounding ecosystem, day after day. Be sure to check out our homepage for all the latest news, and follow 9to5Mac on Twitter, Facebook, and LinkedIn to stay in the loop. Dont know where to start? Check out our exclusive stories, reviews, how-tos, and subscribe to our YouTube channel