ARSTECHNICA.COM

Nearly two years after its radical pivot, Fidelity slashes Relativitys valuation

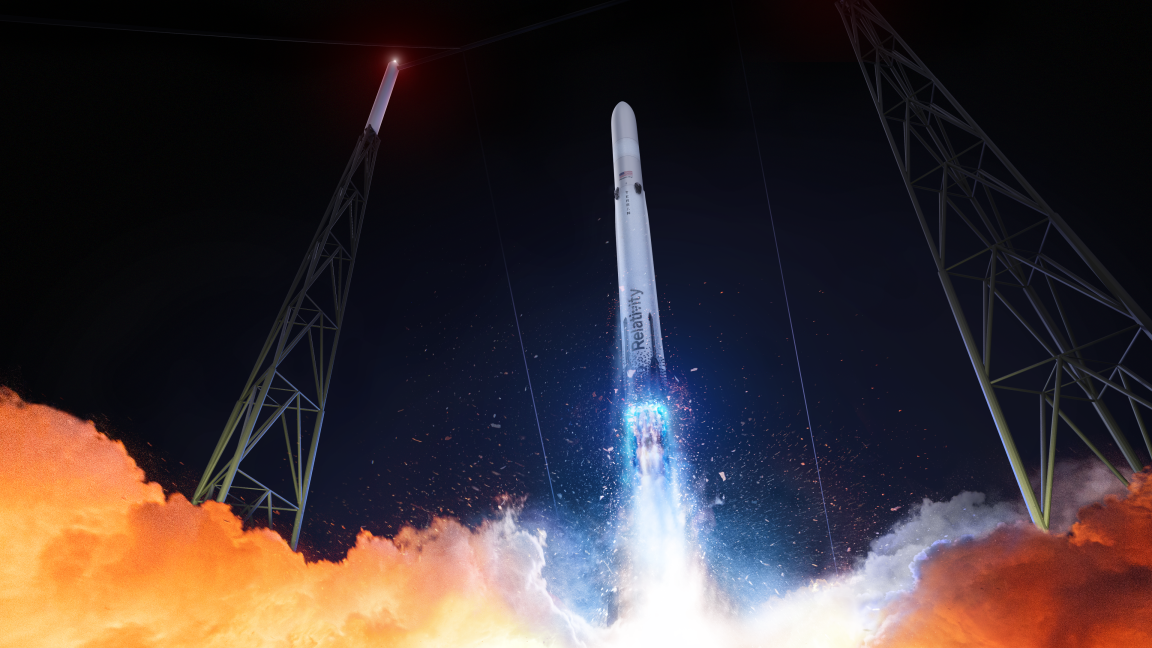

Digging into financials Nearly two years after its radical pivot, Fidelity slashes Relativitys valuation But a Silicon Valley billionaire might bail the company out. Eric Berger Jan 7, 2025 5:41 pm | 6 Artist's rendering of a Terran R rocket launching from Cape Canaveral, Florida. Credit: Relativity Space Artist's rendering of a Terran R rocket launching from Cape Canaveral, Florida. Credit: Relativity Space Story textSizeSmallStandardLargeWidth *StandardWideLinksStandardOrange* Subscribers only Learn moreFor several years, an innovative, California-based launch company named Relativity Space has been the darling of investors and media.Relativity promised to disrupt launch by taking a somewhat niche technology in the space industry at the time, 3D printing, and using it as the foundation for manufacturing rockets. The pitch worked. Relativity's chief executive Tim Ellis liked to brag that his first investor call was to Dallas Mavericks owner Mark Cuban, who cut the company's first check. Cuban invested half a million dollars.That was just the beginning of the torrent of fundraising by Ellis, who, by November 2023, turned the privately held Relativity into a $4.5 billion company following its latest, Series F funding. This was an impressive start for the company founded by Ellis and Jordan Noone, both engineers, in 2016.A big betThe Series F round occurred as Relativity was amid a bold gamble that, in hindsight, may have been a poor bet. In March 2023, the company launched its Terran 1 rocket for the firstand onlytime. After this flight, Ellis announced that the company was pivoting immediately to developing the much larger and more capable Terran R rocket."It's a big, bold bet," Ellis said in an interview. "But it's actually a really obvious decision."With an advertised capacity of more than 1 metric ton to low-Earth orbit and a "backlog" of launch contracts valued in the hundreds of millions of dollars, according to Ellis, Terran 1 had the potential to draw significant revenue. It could also have nabbed a share of launch contracts that have since been snared by competitors such as Rocket Lab, with its smaller Electron vehicle, and Firefly, with its comparably sized Alpha rocket.Instead, the lack of an operational rocket meant that Relativity has likely been subsisting on little revenue since the decision to go all in on the Terran R nearly two years ago. And it has not been an easy pivot. In September, Ars reported on some of the challenges that developing the much larger Terran R vehicle has entailed, including the need to procure large components of the rocket from outside suppliers rather than manufacturing or printing them in-house.Fidelity's financialsUntil recently, it was unclear how these financial pressures and technical issues have been received by the company's investors. However, new and publicly released financial reports provide some clues. The data come from holdings reports filed quarterly and monthly by two funds operated by Fidelity Investments, "Contrafund" and the "Blue Chip Growth Fund." The fund reports provide information on the quantity of shares held by the investment firm and its internal valuation of those shares.In its March 2024 quarterly report for Contrafund, Fidelity noted its holdings from the Series D, E, and F fundraising rounds held by Relativity. For example, Contrafund held 1.67 million shares from the Series D round, worth an estimated $31.8 million. Thus, Fidelity valued the privately held shares at $19 apiece. By the third quarter report last year, Fidelity's valuation of those shares had fallen a little to $16.However, in a report ending November 29 of last year, which was only recently published, Fidelity's valuation of Relativity plummeted. Its stake in Relativity, valued at $31.8 million last March, was now thought to be worth just $866,735a per-share value of 52 cents. Shares in the other fundraising rounds are also valued at less than $1 each.In other words, what was once valued as a $4.5 billion company might now be worth something around $100 million, at least according to one of its institutional investors. Moreover, the Fidelity documents indicate that the value of some "common stock" held by employeesworth about $15 a share a year agomay be worth close to zero.A Silicon Valley backer?Since this data is now about 30 days old, it may not reflect the present value of the company's shares. As Relativity is a private company, the public cannot know its financial situation. Typically, companies don't comment publicly on third-party reports, and the methodology by which Fidelity derived its valuation remains opaque.In response to a query from Ars, the company said Terran R remains on track."Our team is focused on achieving key milestones and accelerating our progress, positioning us for sustained success in the aerospace industry," a Relativity spokesperson said. "We remain confident in our ability to execute on our strategic vision. And we continue to align ourselves with strong capital partners who believe in our mission and are supporting our ambitious programs."Two sources said that a Silicon Valley engineer and multibillionaireArs is not naming this person at this time because his involvement could not be confirmedhas been financially supporting Relativity in recent months and may be considering a larger investment.A significant investment would give Relativity Space some funding runway to continue working on the Terran R rocket and possibly bring the booster to market within the next couple of years. Multiple people have told Ars that the development of the rocket's Aeon R main engine continues to go well. But there's still a way to go before the vehicle is ready for its debut launch.Eric BergerSenior Space EditorEric BergerSenior Space Editor Eric Berger is the senior space editor at Ars Technica, covering everything from astronomy to private space to NASA policy, and author of two books: Liftoff, about the rise of SpaceX; and Reentry, on the development of the Falcon 9 rocket and Dragon. A certified meteorologist, Eric lives in Houston. 6 Comments

0 Комментарии

0 Поделились

134 Просмотры