0 Комментарии

0 Поделились

143 Просмотры

Каталог

Каталог

-

Войдите, чтобы отмечать, делиться и комментировать!

-

WWW.TECHNOLOGYREVIEW.COMThe Download: feeding the world with poop, and 2024s performing storiesThis is todays edition ofThe Download,our weekday newsletter that provides a daily dose of whats going on in the world of technology.How poop could help feed the planetA new industrial facility in suburban Seattle is giving off a whiff of futuristic technology. It can safely treat fecal waste from people and livestock while recycling nutrients that are crucial for agriculture but in increasingly short supply across the nations farmlands.Making fertilizer from the nutrients that we and other animals excrete has a long and colorful history; for generations it helped Indigenous cultures around the world create exceptionally fertile soil.These systems fell out of favor in Western culture. But, if researchers and engineers across several companies get their way, that could be about to change. Read the full story.Bryn NelsonThis story is from the forthcoming magazine edition of MIT Technology Review, set to go live on January 6its all about the exciting breakthroughs happening in the world right now. If you dont already, subscribe to receive future copies.If youre interested in poops wider scientific potential, check out the latest entry in our Jobs of the Future series: stool bank manager. Pediatric gastroenterologist Nikhil Pai is helping to treat children with a common bacterial infection of the large intestine by transplanting healthy stool into a patients guta highly effective, albeit unconventional, treatment. Read the full story.Here are MIT Technology Reviews best-performing stories of 2024MIT Technology Review published hundreds of stories in 2024, covering everything from AI, climate tech, and biotech, to robotics, space, and more.As the new year begins, take a look at a small selection of the stories that resonated most with you, our readers. Read the full story.Abby Ivory-GanjaUnveiling the 10 Breakthrough Technologies of 2025Each year, MIT Technology Review selects the top ten breakthrough technologies that will have the greatest impact on how we live and work in the future. In the past, weve selected breakthrough technologies such as weight-loss drugs, a malaria vaccine, and GPT-3 (the precursor to ChatGPT).Amy Nordrum, our executive editor, will join our news editor Charlotte Jee to unveil the new list live during an exclusive Roundtable discussion for subscribers at 12.30pm ET today. Register here to be among the first to know.The must-readsIve combed the internet to find you todays most fun/important/scary/fascinating stories about technology.1 A US appeals court has struck down net neutrality rulesIts the end of a nearly two-decade effort to regulate broadband providers. (NYT $)+ Net neutrality has been in danger for a while, truthfully. (The Verge)+ Its bad news for the Biden administration as it prepares to hand over to Trump. (WP $)2 Car rental app Turo is under scrutinyBut concerns over the apps safety practices are nothing new. (WSJ $)+ The app was used to book vehicles used in both the New Orleans attack and Las Vegas Cybertruck explosion. (NYT $)+ Turo staff have been pulled off vacation to respond to the aftermath. (Bloomberg $)3 Nick Clegg is leaving MetaThe former British deputy prime minister is making way for prominent Republican Joel Kaplan. (Semafor)+ Its part of the companys desire to align itself with the incoming Trump administration. (WSJ $)+ How tech is turning MAGA. (Economist $)4 Yandex has been ordered to hide maps of a Russian oil refineryIn response to repeated attacks from Ukrainian drones. (Reuters)+ The Ryazan refinery was hit four times last year alone. (Bloomberg $)+ The uneasy coexistence of Yandex and the Kremlin. (MIT Technology Review)5 Apple has agreed to settle a $95 million class-action lawsuitOver claims the company violated user privacy by sharing Siri recordings. (WP $)6 Several Californian AI laws have gone into effectA new year means new regulations. (The Information $)+ There are more than 120 AI bills in Congress right now. (MIT Technology Review)7 Our understanding of genetic diseases is changingCell mutations suggest were far more genetically varied than we previously realized. (The Atlantic $)+ DeepMind is using AI to pinpoint the causes of genetic disease. (MIT Technology Review)8 African content creators are struggling to make moneyBut it appears as though the tide may be slowly turning. (The Guardian)+ What Africa needs to do to become a major AI player. (MIT Technology Review)9 Get the new year off to a starry start Theres a meteor shower due tonight! (Wired $)10 How to build a more sustainable refrigeratorA new kind of heat-absorbing crystal could hold the key. (New Scientist $)+ The future of urban housing is energy-efficient refrigerators. (MIT Technology Review)Quote of the dayHe is quite clearly the right person for the right job at the right time!Nick Clegg, Metas outgoing chief policy executive, wishes his replacement Joel Kaplan the best in a post on X.The big storyIs it possible to really understand someone elses mind?November 2023Technically speaking, neuroscientists have been able to read your mind for decades. Its not easy, mind you. First, you must lie motionless within a fMRI scanner, perhaps for hours, while you watch films or listen to audiobooks.If you do elect to endure claustrophobic hours in the scanner, the software will learn to generate a bespoke reconstruction of what you were seeing or listening to, just by analyzing how blood moves through your brain.More recently, researchers have deployed generative AI tools, like Stable Diffusion and GPT, to create far more realistic, if not entirely accurate, reconstructions of films and podcasts based on neural activity. So how close are we to genuine mind reading? Read the full story.Grace HuckinsWe can still have nice thingsA place for comfort, fun and distraction to brighten up your day. (Got any ideas? Drop me a line or skeet em at me.)+ Of course The Cures Robert Smith is an iPod fanatic.+ Japan may be associated with tasteful minimalism, but theres always room for a bit of clutter.+ Meet the people who release 3,000 pounds of confetti into New Yorks Times Square by hand every New Years Evethen clear it all up.+ How to start a healthy habit, and, crucially, stick to it. ($)0 Комментарии 0 Поделились 170 Просмотры

WWW.TECHNOLOGYREVIEW.COMThe Download: feeding the world with poop, and 2024s performing storiesThis is todays edition ofThe Download,our weekday newsletter that provides a daily dose of whats going on in the world of technology.How poop could help feed the planetA new industrial facility in suburban Seattle is giving off a whiff of futuristic technology. It can safely treat fecal waste from people and livestock while recycling nutrients that are crucial for agriculture but in increasingly short supply across the nations farmlands.Making fertilizer from the nutrients that we and other animals excrete has a long and colorful history; for generations it helped Indigenous cultures around the world create exceptionally fertile soil.These systems fell out of favor in Western culture. But, if researchers and engineers across several companies get their way, that could be about to change. Read the full story.Bryn NelsonThis story is from the forthcoming magazine edition of MIT Technology Review, set to go live on January 6its all about the exciting breakthroughs happening in the world right now. If you dont already, subscribe to receive future copies.If youre interested in poops wider scientific potential, check out the latest entry in our Jobs of the Future series: stool bank manager. Pediatric gastroenterologist Nikhil Pai is helping to treat children with a common bacterial infection of the large intestine by transplanting healthy stool into a patients guta highly effective, albeit unconventional, treatment. Read the full story.Here are MIT Technology Reviews best-performing stories of 2024MIT Technology Review published hundreds of stories in 2024, covering everything from AI, climate tech, and biotech, to robotics, space, and more.As the new year begins, take a look at a small selection of the stories that resonated most with you, our readers. Read the full story.Abby Ivory-GanjaUnveiling the 10 Breakthrough Technologies of 2025Each year, MIT Technology Review selects the top ten breakthrough technologies that will have the greatest impact on how we live and work in the future. In the past, weve selected breakthrough technologies such as weight-loss drugs, a malaria vaccine, and GPT-3 (the precursor to ChatGPT).Amy Nordrum, our executive editor, will join our news editor Charlotte Jee to unveil the new list live during an exclusive Roundtable discussion for subscribers at 12.30pm ET today. Register here to be among the first to know.The must-readsIve combed the internet to find you todays most fun/important/scary/fascinating stories about technology.1 A US appeals court has struck down net neutrality rulesIts the end of a nearly two-decade effort to regulate broadband providers. (NYT $)+ Net neutrality has been in danger for a while, truthfully. (The Verge)+ Its bad news for the Biden administration as it prepares to hand over to Trump. (WP $)2 Car rental app Turo is under scrutinyBut concerns over the apps safety practices are nothing new. (WSJ $)+ The app was used to book vehicles used in both the New Orleans attack and Las Vegas Cybertruck explosion. (NYT $)+ Turo staff have been pulled off vacation to respond to the aftermath. (Bloomberg $)3 Nick Clegg is leaving MetaThe former British deputy prime minister is making way for prominent Republican Joel Kaplan. (Semafor)+ Its part of the companys desire to align itself with the incoming Trump administration. (WSJ $)+ How tech is turning MAGA. (Economist $)4 Yandex has been ordered to hide maps of a Russian oil refineryIn response to repeated attacks from Ukrainian drones. (Reuters)+ The Ryazan refinery was hit four times last year alone. (Bloomberg $)+ The uneasy coexistence of Yandex and the Kremlin. (MIT Technology Review)5 Apple has agreed to settle a $95 million class-action lawsuitOver claims the company violated user privacy by sharing Siri recordings. (WP $)6 Several Californian AI laws have gone into effectA new year means new regulations. (The Information $)+ There are more than 120 AI bills in Congress right now. (MIT Technology Review)7 Our understanding of genetic diseases is changingCell mutations suggest were far more genetically varied than we previously realized. (The Atlantic $)+ DeepMind is using AI to pinpoint the causes of genetic disease. (MIT Technology Review)8 African content creators are struggling to make moneyBut it appears as though the tide may be slowly turning. (The Guardian)+ What Africa needs to do to become a major AI player. (MIT Technology Review)9 Get the new year off to a starry start Theres a meteor shower due tonight! (Wired $)10 How to build a more sustainable refrigeratorA new kind of heat-absorbing crystal could hold the key. (New Scientist $)+ The future of urban housing is energy-efficient refrigerators. (MIT Technology Review)Quote of the dayHe is quite clearly the right person for the right job at the right time!Nick Clegg, Metas outgoing chief policy executive, wishes his replacement Joel Kaplan the best in a post on X.The big storyIs it possible to really understand someone elses mind?November 2023Technically speaking, neuroscientists have been able to read your mind for decades. Its not easy, mind you. First, you must lie motionless within a fMRI scanner, perhaps for hours, while you watch films or listen to audiobooks.If you do elect to endure claustrophobic hours in the scanner, the software will learn to generate a bespoke reconstruction of what you were seeing or listening to, just by analyzing how blood moves through your brain.More recently, researchers have deployed generative AI tools, like Stable Diffusion and GPT, to create far more realistic, if not entirely accurate, reconstructions of films and podcasts based on neural activity. So how close are we to genuine mind reading? Read the full story.Grace HuckinsWe can still have nice thingsA place for comfort, fun and distraction to brighten up your day. (Got any ideas? Drop me a line or skeet em at me.)+ Of course The Cures Robert Smith is an iPod fanatic.+ Japan may be associated with tasteful minimalism, but theres always room for a bit of clutter.+ Meet the people who release 3,000 pounds of confetti into New Yorks Times Square by hand every New Years Evethen clear it all up.+ How to start a healthy habit, and, crucially, stick to it. ($)0 Комментарии 0 Поделились 170 Просмотры -

WWW.TECHNOLOGYREVIEW.COMRobotaxis: 10 Breakthrough Technologies 2025WHOBaidu, Pony AI, Waymo, Wayve, ZooxWHENNowIf you live in certain cities in America or China, youve probably spotted driverless cars dropping off passengers. Perhaps youve even ridden in one yourself. Thats a radical change from even three years ago, when these services were still learning the rules of the road. And robotaxis could soon be operating in many more cities.In cities across China, passengers now have their pick of robotaxis operated by Baidu, AutoX, and native startups WeRide and Pony AI, among others, which harbor ambitious plans to expand into Singapore, the Middle East, and the US. And although driverless cars have been a common sight on American roads for years as companies logged millions of miles collecting training data, the public has only recently begun to ride in them for real.Explore the full 2025 list of 10 Breakthrough Technologies. Waymo, which is owned by Googles parent company Alphabet, is the US industrys biggest player. Fresh off of launching its driverless-taxi service in San Francisco, Los Angeles, and Phoenix, the company plans to expand into Austin and Atlanta later this year through its partnership with Uber. Amazon-owned Zoox aims to launch its robotaxi service to the public in Las Vegas in 2025 and is now also running trials in San Francisco, Austin, and Miami. And UK startup Wayve is making the switch to driving on the right as it starts testing its technology in San Francisco.There are still plenty of potential roadblocks. In China, robotaxi rides are so cheap theyve sparked a backlash among the countrys 10 million cab drivers. In the US, General Motors Cruise halted operations in October 2023 after one of its vehicles struck a pedestrian, and GM announced last month that it would stop funding the robotaxi business. And Tesla must prove its technology and secure necessary permits before it can carry out its stated plan to introduce unsupervised ride-hailing services in California and Texas in 2025.The industry is pressing forward, though. More people are getting to experience robotaxis for the first time and becoming more comfortable with the technology. Expect to see the biggest players expand their operations to new cities and begin to compete on price.This story was updated to reflect new developments about GMs Cruise investments.0 Комментарии 0 Поделились 170 Просмотры

WWW.TECHNOLOGYREVIEW.COMRobotaxis: 10 Breakthrough Technologies 2025WHOBaidu, Pony AI, Waymo, Wayve, ZooxWHENNowIf you live in certain cities in America or China, youve probably spotted driverless cars dropping off passengers. Perhaps youve even ridden in one yourself. Thats a radical change from even three years ago, when these services were still learning the rules of the road. And robotaxis could soon be operating in many more cities.In cities across China, passengers now have their pick of robotaxis operated by Baidu, AutoX, and native startups WeRide and Pony AI, among others, which harbor ambitious plans to expand into Singapore, the Middle East, and the US. And although driverless cars have been a common sight on American roads for years as companies logged millions of miles collecting training data, the public has only recently begun to ride in them for real.Explore the full 2025 list of 10 Breakthrough Technologies. Waymo, which is owned by Googles parent company Alphabet, is the US industrys biggest player. Fresh off of launching its driverless-taxi service in San Francisco, Los Angeles, and Phoenix, the company plans to expand into Austin and Atlanta later this year through its partnership with Uber. Amazon-owned Zoox aims to launch its robotaxi service to the public in Las Vegas in 2025 and is now also running trials in San Francisco, Austin, and Miami. And UK startup Wayve is making the switch to driving on the right as it starts testing its technology in San Francisco.There are still plenty of potential roadblocks. In China, robotaxi rides are so cheap theyve sparked a backlash among the countrys 10 million cab drivers. In the US, General Motors Cruise halted operations in October 2023 after one of its vehicles struck a pedestrian, and GM announced last month that it would stop funding the robotaxi business. And Tesla must prove its technology and secure necessary permits before it can carry out its stated plan to introduce unsupervised ride-hailing services in California and Texas in 2025.The industry is pressing forward, though. More people are getting to experience robotaxis for the first time and becoming more comfortable with the technology. Expect to see the biggest players expand their operations to new cities and begin to compete on price.This story was updated to reflect new developments about GMs Cruise investments.0 Комментарии 0 Поделились 170 Просмотры -

WWW.TECHNOLOGYREVIEW.COMStem-cell therapies that work: 10 Breakthrough Technologies 2025WHOCalifornia Institute for Regenerative Medicine, Neurona Therapeutics, Vertex PharmaceuticalsWHEN5 yearsA quarter-century ago, researchers isolated powerful stem cells from embryos created through in vitro fertilization. These cells, theoretically able to morph into any tissue in the human body, promised a medical revolution. Think: replacement parts for whatever ails you.But stem-cell science didnt go smoothly. Not at first. Even though scientists soon learned to create these make-anything cells without embryos, coaxing them to become truly functional adult tissue proved harder than anyone guessed.Now, though, stem cells are finally on the brink of delivering. Take the case of Justin Graves, a man with debilitating epilepsy who received a transplant of lab-made neurons, engineered to quell the electrical misfires in his brain that cause epileptic attacks.Since the procedure, carried out in 2023 at the University of California, San Diego, Graves has reported having seizures about once a week, rather than once per day as he used to. Its just been an incredible, complete change, he says. I am pretty much a stem-cell evangelist now.The epilepsy trial, from a company called Neurona Therapeutics, is at an early stageonly 15 patients have been treated. But the preliminary results are remarkable.Last June, a different stem-cell study delivered dramatic results. This time it was in type 1 diabetes, the autoimmune condition formerly called juvenile diabetes, in which a persons body attacks the beta islet cells in the pancreas. Without working beta cells to control their blood sugar levels, people with type 1 diabetes rely on daily blood glucose monitoring and insulin injections or infusions to stay alive.Explore the full 2025 list of 10 Breakthrough Technologies. In this ongoing study, carried out by Vertex Pharmaceuticals in Boston, some patients who got transfusions of lab-made beta cells have been able to stop taking insulin. Instead, their new cells make it when its needed.No more seizures. No more insulin injections. Those are the words patients have always wanted to hear. And it means stem-cell researchers are close to achieving functional cureswhen patients can get on with life because their bodies are able to self-regulate.0 Комментарии 0 Поделились 185 Просмотры

WWW.TECHNOLOGYREVIEW.COMStem-cell therapies that work: 10 Breakthrough Technologies 2025WHOCalifornia Institute for Regenerative Medicine, Neurona Therapeutics, Vertex PharmaceuticalsWHEN5 yearsA quarter-century ago, researchers isolated powerful stem cells from embryos created through in vitro fertilization. These cells, theoretically able to morph into any tissue in the human body, promised a medical revolution. Think: replacement parts for whatever ails you.But stem-cell science didnt go smoothly. Not at first. Even though scientists soon learned to create these make-anything cells without embryos, coaxing them to become truly functional adult tissue proved harder than anyone guessed.Now, though, stem cells are finally on the brink of delivering. Take the case of Justin Graves, a man with debilitating epilepsy who received a transplant of lab-made neurons, engineered to quell the electrical misfires in his brain that cause epileptic attacks.Since the procedure, carried out in 2023 at the University of California, San Diego, Graves has reported having seizures about once a week, rather than once per day as he used to. Its just been an incredible, complete change, he says. I am pretty much a stem-cell evangelist now.The epilepsy trial, from a company called Neurona Therapeutics, is at an early stageonly 15 patients have been treated. But the preliminary results are remarkable.Last June, a different stem-cell study delivered dramatic results. This time it was in type 1 diabetes, the autoimmune condition formerly called juvenile diabetes, in which a persons body attacks the beta islet cells in the pancreas. Without working beta cells to control their blood sugar levels, people with type 1 diabetes rely on daily blood glucose monitoring and insulin injections or infusions to stay alive.Explore the full 2025 list of 10 Breakthrough Technologies. In this ongoing study, carried out by Vertex Pharmaceuticals in Boston, some patients who got transfusions of lab-made beta cells have been able to stop taking insulin. Instead, their new cells make it when its needed.No more seizures. No more insulin injections. Those are the words patients have always wanted to hear. And it means stem-cell researchers are close to achieving functional cureswhen patients can get on with life because their bodies are able to self-regulate.0 Комментарии 0 Поделились 185 Просмотры -

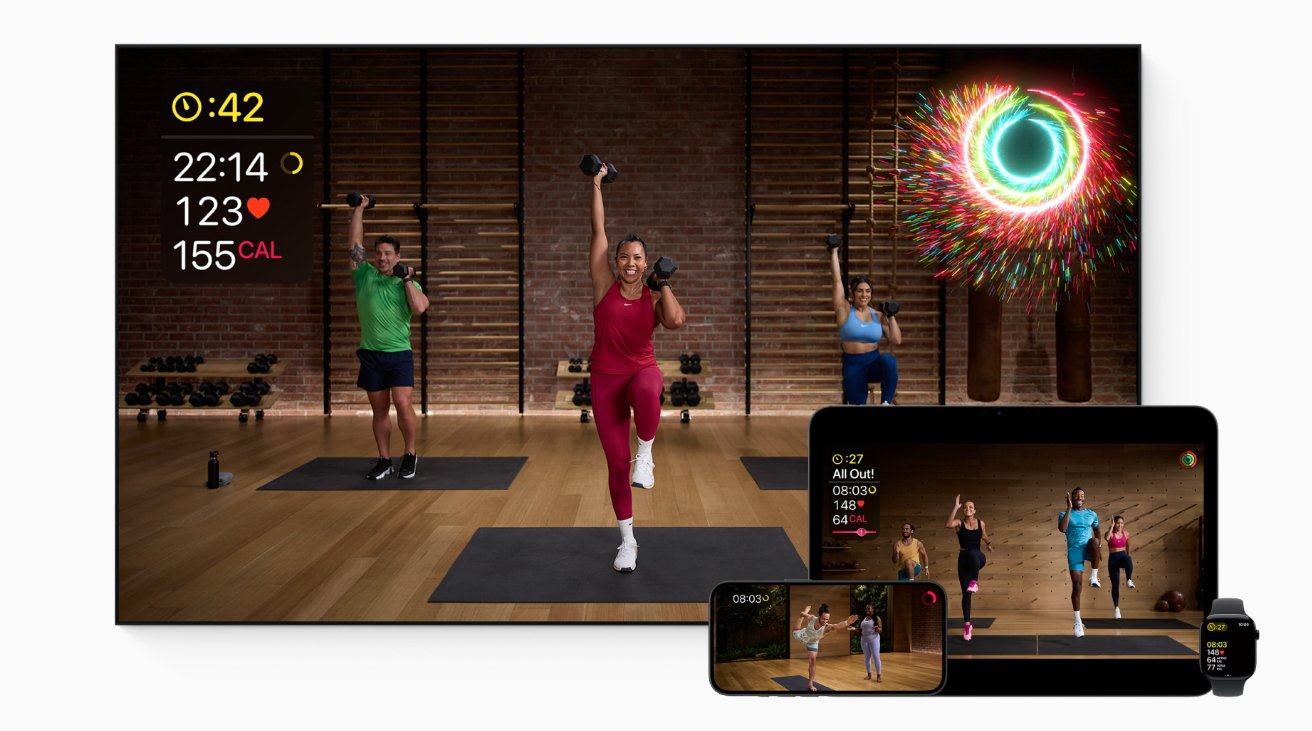

APPLEINSIDER.COMNew Year update to Apple Fitness+ adds Strava integrationIn its now annual launch of new features, Apple Fitness+ has highlighted its collaboration with fitness app Strava, as well as adding strength, yoga, pickelball, and breath meditation sessions.Apple Fitness+ has welcomed in the New Year with a raft of extra workoutsIn January 2023, Apple Fitness+ added kickboxing, though the service was still being criticized for its lack of range. In January 2024, it added more workouts and meditation.Now starting on January 6, 2025, Apple Fitness+ is starting what it claims is its biggest lineup of programming, "bringing users more ways to stay active and mindful." There's now a progressive strength training program, a conditioning program using pickleball, plus more celebrities in its Artist Spotlight and Time to Walk series. Continue Reading on AppleInsider | Discuss on our Forums0 Комментарии 0 Поделились 151 Просмотры

APPLEINSIDER.COMNew Year update to Apple Fitness+ adds Strava integrationIn its now annual launch of new features, Apple Fitness+ has highlighted its collaboration with fitness app Strava, as well as adding strength, yoga, pickelball, and breath meditation sessions.Apple Fitness+ has welcomed in the New Year with a raft of extra workoutsIn January 2023, Apple Fitness+ added kickboxing, though the service was still being criticized for its lack of range. In January 2024, it added more workouts and meditation.Now starting on January 6, 2025, Apple Fitness+ is starting what it claims is its biggest lineup of programming, "bringing users more ways to stay active and mindful." There's now a progressive strength training program, a conditioning program using pickleball, plus more celebrities in its Artist Spotlight and Time to Walk series. Continue Reading on AppleInsider | Discuss on our Forums0 Комментарии 0 Поделились 151 Просмотры -

APPLEINSIDER.COMChinese smartphone market continues to be tough for Apple and other foreign brandsA drop in foreign-branded smartphone sales in China continues to hit the iPhone, with the year-on-year dip continuing for the fourth month in a row.Apple Intelligence's Siri animation on an iPhoneChina is a major market for Apple, but the company has had trouble maintaining its position in recent years. A government-affiliated report now indicates the market is even tougher for Apple to compete in.Data from the China Academy of Information and Communications Technology (CAICT) indicates that shipments of foreign-branded smartphones in China reached 3.04 million in November. Reuters reports this is a 47.4% drop from the 5.77 million units reported for November 2023. Continue Reading on AppleInsider | Discuss on our Forums0 Комментарии 0 Поделились 164 Просмотры

APPLEINSIDER.COMChinese smartphone market continues to be tough for Apple and other foreign brandsA drop in foreign-branded smartphone sales in China continues to hit the iPhone, with the year-on-year dip continuing for the fourth month in a row.Apple Intelligence's Siri animation on an iPhoneChina is a major market for Apple, but the company has had trouble maintaining its position in recent years. A government-affiliated report now indicates the market is even tougher for Apple to compete in.Data from the China Academy of Information and Communications Technology (CAICT) indicates that shipments of foreign-branded smartphones in China reached 3.04 million in November. Reuters reports this is a 47.4% drop from the 5.77 million units reported for November 2023. Continue Reading on AppleInsider | Discuss on our Forums0 Комментарии 0 Поделились 164 Просмотры -

APPLEINSIDER.COMWeak iPad Pro sales prompt OLED supplier to switch to making more iPhone screensLower than expected sales of the latest iPad Pro have reportedly left production lines under-used, with LG Display planning to repurpose them for the iPhone.Apple's ultra-thin OLED iPad Pro fails to spark sales surgeAs well-received as the 2024 iPad Pro and its OLED screen was, it failed to spark as many buyers to upgrade as expected. Now a new report says that the low demand, and little prospect of it increasing, has prompted LG Display to change from iPad Pro to iPhone screens.According to The Elec, despite switching from one size OLED screen to another, the repurposing of the production line is a major endeavor. The work will cost an estimated $1.4 billion. Continue Reading on AppleInsider | Discuss on our Forums0 Комментарии 0 Поделились 159 Просмотры

APPLEINSIDER.COMWeak iPad Pro sales prompt OLED supplier to switch to making more iPhone screensLower than expected sales of the latest iPad Pro have reportedly left production lines under-used, with LG Display planning to repurpose them for the iPhone.Apple's ultra-thin OLED iPad Pro fails to spark sales surgeAs well-received as the 2024 iPad Pro and its OLED screen was, it failed to spark as many buyers to upgrade as expected. Now a new report says that the low demand, and little prospect of it increasing, has prompted LG Display to change from iPad Pro to iPhone screens.According to The Elec, despite switching from one size OLED screen to another, the repurposing of the production line is a major endeavor. The work will cost an estimated $1.4 billion. Continue Reading on AppleInsider | Discuss on our Forums0 Комментарии 0 Поделились 159 Просмотры -

ARCHITIZER.COMPlaying With Mass: 9 Projects That Speak Volumes About Contemporary Iranian ArchitectureThe latest edition of Architizer: The Worlds Best Architecture a stunning, hardbound book celebrating the most inspiring contemporary architecture from around the globe is now available. Order your copy today.Irans architectural history is one of the richest in the world, rooted in centuries of cultural, climatic and artistic considerations. From the grandeur of ancient structures like Persepolis to the intricate geometry of Safavid mosques, Iranian architecture reflects a deep understanding of form, material and human experience. Central to this legacy are elements like the Iwan, courtyard gardens, brick faades and the poetic use of light and shadedesign principles that remain timeless.Today, architects across Iran are reinterpreting these vernacular elements to respond to modern needs while maintaining a connection to the past. These projects navigate contemporary challenges such as urban density, privacy and environmental concerns, while celebrating Irans architectural identity. Through thoughtful use of local materials, contextual designs and innovative construction techniques, they transform traditional motifs into striking modern forms.The following projects illustrate how Irans architectural heritage continues to shape its contemporary landscape, offering creative solutions that honor tradition while addressing the complexities of todays world.Turbosealtech New Incubator and Office BuildingBy New Wave Architecture(Lida Almassian / Shahin Heidari), Tehran, IranThis angular glass pyramid commands attention in Pardis Technology Park, rising naturally from the landscape. The glass faade invites natural light, while aluminum profiles manage heat efficiently.Inside, five levels are designed for function and collaboration, with open workshops on the lower floors and offices above. A rooftop terrace and green corridor provide fresh air and shared spaces, while a rainwater collection system supports sustainable practices. Bold yet practical, the building reflects its purpose as a space for innovation and progress.Hitra Office & Commercial BuildingBy Hooba Design Group, Tehran, IranPopular Winner, 10th Annual A+Awards, Office Mid-Rise (5-15 Floors)Set on a sloped site in Tehrans Velenjak neighborhood, this building takes advantage of its 15% elevation difference to create green patios and urban plazas at street level. These terraces connect directly to the commercial zone while providing much-needed public spaces for the neighborhood.The faade features a double-skin design with brick and turquoise metal frames, creating a textured and layered exterior. Continuous inner glass panels allow for natural light while reducing energy use and openings in the outer shell provide access to the faade. This design rethinks office building forms, balancing public accessibility, urban integration and functional efficiency.Presence in Hormuz 2 (Majara Residence)By ZAV Architects, IranJury Winner, 9th Annual A+Awards, Architecture +ColorLocated on the surreal, colorful landscapes of Hormuz Island, Majara Residence is part of a broader initiative to empower the local community through sustainable tourism and economic opportunity. This cluster of small domes, built using the Superadobe technique developed by Nader Khalili, draws inspiration from the islands natural topography and traditional architecture.Constructed with dredged sand from the Hormuz dock, the domes are both economical and rooted in the local environment. The use of local materials and labor prioritizes the community, with training programs transforming residents into skilled superadobe masons.The adaptable design of the domes allows the space to respond to future needs, creating a flexible framework for the client and island. By investing in local craftsmanship and resources, the project fosters social and economic growth while honoring the unique identity of Hormuz.Tagh BeheshtBy Rvad Studio, Mashhad, IranJury Winner, 9th Annual A+Awards, Unbuilt CommercialInspired by Mashhads historic bazaars and the terraced architecture of Kang village, Tagh Behesht combines public and commercial spaces with layered gardens and pedestrian walkways. Open connections to Mellat Park and elevated bridges create accessible paths and green platforms for visitors.Suspended courtyards between office spaces bring light and greenery to all floors, while the brick mesh faade filters sunlight and reduces heat. A central pond cools the air and reflects the regions connection to water, offering a thoughtful response to Mashhads hot climate.Cloaked in BricksBy Admun Studio, Tehran, IranJury and Popular Winner, 4th Annual A+Awards, Architecture +BrickThis project addresses the loss of privacy in contemporary Iranian residential architecture by reinterpreting traditional design principles. The faade is covered in a grid of rotating bricks, creating openings that balance light, ventilation and privacy while reducing noise from the busy neighborhood.Inspired by the chaotic skyline of the area, the brick texture reflects the surrounding context. Rotation angles are carefully adjusted based on sunlight, views and privacy needs, maintaining a dialogue between inside and outside.Using brick, a traditional material in Iran, connects the design to its cultural roots. Despite the intricate appearance, the faades construction was simplified with a coding system for easy execution, offering a prototype for modern residential architecture in Tehran.The Courtyard VillaBy Next Office, Lavasan, IranThis project reimagines the traditional Iranian courtyard house through curved volumes and a central courtyard that connects the interior with the outdoors. Openings in the walls, a pool at the base and arched forms allow light and air to flow while maintaining privacy.The light-toned brick faade draws on vernacular materials, while the courtyard serves as a gathering space, reflecting the cooling and social functions of historic Persian architecture. The villa balances contemporary design with a strong connection to local traditions and its environment.Narbon VillaBy Gera Studio, Kerman, IranLocated in a historic pomegranate garden in Kerman, this residence retains the original thatched wall, adding a glass entryway to connect the gardens sycamore trees and watercourse with the community. This approach reflects the Iranian tradition of shared garden spaces.A sunken courtyard, inspired by local architectural practices, provides shade in Kermans hot climate. Two deep sky rifts channel air and light, improving ventilation and framing views of the sky, echoing the poetic relationship between architecture and nature in Persian design.The layered roofs and shaded walls, rooted in Iranian rooftop culture, create spaces for stargazing, gatherings and relaxation. Built around cracked brick cores, the residence reinterprets vernacular forms, connecting the building to its cultural and climatic setting.Woof ShadowBy Faezeh Hadian Studio, North Bahar, Tehran, IranWoof Shadow reinterprets traditional Iranian ideas of light, shade and privacy through a modern brick faade. Inspired by origami, the folded surface creates depth and texture, using bricksa material central to Irans architectural heritage.The faade filters light and reduces visual pollution, while window frames offer varied city views. Crafted with dry construction methods and supported by steel threads, the brickwork reflects a balance of tradition and contemporary design, connecting the building to Tehrans architectural identity.DEHKADEH IWANBy SUPER VOID SPACE, Dehkade, Iran This project reimagines the traditional Iranian Iwan, integrating it into a 50-year-old modernist villa. The elevated Iwan connects the living room to the courtyard, opening on both sides to frame views of greenery and a central pool.A second courtyard Iwan creates a dialogue between old and new, with a swing suspended from its arch, inspired by ancient Persian games. The gray cement exterior reflects modernity, while the brick interior recalls traditional warmth, linking the villas past and present.The latest edition of Architizer: The Worlds Best Architecture a stunning, hardbound book celebrating the most inspiring contemporary architecture from around the globe is now available. Order your copy today.The post Playing With Mass: 9 Projects That Speak Volumes About Contemporary Iranian Architecture appeared first on Journal.0 Комментарии 0 Поделились 198 Просмотры

ARCHITIZER.COMPlaying With Mass: 9 Projects That Speak Volumes About Contemporary Iranian ArchitectureThe latest edition of Architizer: The Worlds Best Architecture a stunning, hardbound book celebrating the most inspiring contemporary architecture from around the globe is now available. Order your copy today.Irans architectural history is one of the richest in the world, rooted in centuries of cultural, climatic and artistic considerations. From the grandeur of ancient structures like Persepolis to the intricate geometry of Safavid mosques, Iranian architecture reflects a deep understanding of form, material and human experience. Central to this legacy are elements like the Iwan, courtyard gardens, brick faades and the poetic use of light and shadedesign principles that remain timeless.Today, architects across Iran are reinterpreting these vernacular elements to respond to modern needs while maintaining a connection to the past. These projects navigate contemporary challenges such as urban density, privacy and environmental concerns, while celebrating Irans architectural identity. Through thoughtful use of local materials, contextual designs and innovative construction techniques, they transform traditional motifs into striking modern forms.The following projects illustrate how Irans architectural heritage continues to shape its contemporary landscape, offering creative solutions that honor tradition while addressing the complexities of todays world.Turbosealtech New Incubator and Office BuildingBy New Wave Architecture(Lida Almassian / Shahin Heidari), Tehran, IranThis angular glass pyramid commands attention in Pardis Technology Park, rising naturally from the landscape. The glass faade invites natural light, while aluminum profiles manage heat efficiently.Inside, five levels are designed for function and collaboration, with open workshops on the lower floors and offices above. A rooftop terrace and green corridor provide fresh air and shared spaces, while a rainwater collection system supports sustainable practices. Bold yet practical, the building reflects its purpose as a space for innovation and progress.Hitra Office & Commercial BuildingBy Hooba Design Group, Tehran, IranPopular Winner, 10th Annual A+Awards, Office Mid-Rise (5-15 Floors)Set on a sloped site in Tehrans Velenjak neighborhood, this building takes advantage of its 15% elevation difference to create green patios and urban plazas at street level. These terraces connect directly to the commercial zone while providing much-needed public spaces for the neighborhood.The faade features a double-skin design with brick and turquoise metal frames, creating a textured and layered exterior. Continuous inner glass panels allow for natural light while reducing energy use and openings in the outer shell provide access to the faade. This design rethinks office building forms, balancing public accessibility, urban integration and functional efficiency.Presence in Hormuz 2 (Majara Residence)By ZAV Architects, IranJury Winner, 9th Annual A+Awards, Architecture +ColorLocated on the surreal, colorful landscapes of Hormuz Island, Majara Residence is part of a broader initiative to empower the local community through sustainable tourism and economic opportunity. This cluster of small domes, built using the Superadobe technique developed by Nader Khalili, draws inspiration from the islands natural topography and traditional architecture.Constructed with dredged sand from the Hormuz dock, the domes are both economical and rooted in the local environment. The use of local materials and labor prioritizes the community, with training programs transforming residents into skilled superadobe masons.The adaptable design of the domes allows the space to respond to future needs, creating a flexible framework for the client and island. By investing in local craftsmanship and resources, the project fosters social and economic growth while honoring the unique identity of Hormuz.Tagh BeheshtBy Rvad Studio, Mashhad, IranJury Winner, 9th Annual A+Awards, Unbuilt CommercialInspired by Mashhads historic bazaars and the terraced architecture of Kang village, Tagh Behesht combines public and commercial spaces with layered gardens and pedestrian walkways. Open connections to Mellat Park and elevated bridges create accessible paths and green platforms for visitors.Suspended courtyards between office spaces bring light and greenery to all floors, while the brick mesh faade filters sunlight and reduces heat. A central pond cools the air and reflects the regions connection to water, offering a thoughtful response to Mashhads hot climate.Cloaked in BricksBy Admun Studio, Tehran, IranJury and Popular Winner, 4th Annual A+Awards, Architecture +BrickThis project addresses the loss of privacy in contemporary Iranian residential architecture by reinterpreting traditional design principles. The faade is covered in a grid of rotating bricks, creating openings that balance light, ventilation and privacy while reducing noise from the busy neighborhood.Inspired by the chaotic skyline of the area, the brick texture reflects the surrounding context. Rotation angles are carefully adjusted based on sunlight, views and privacy needs, maintaining a dialogue between inside and outside.Using brick, a traditional material in Iran, connects the design to its cultural roots. Despite the intricate appearance, the faades construction was simplified with a coding system for easy execution, offering a prototype for modern residential architecture in Tehran.The Courtyard VillaBy Next Office, Lavasan, IranThis project reimagines the traditional Iranian courtyard house through curved volumes and a central courtyard that connects the interior with the outdoors. Openings in the walls, a pool at the base and arched forms allow light and air to flow while maintaining privacy.The light-toned brick faade draws on vernacular materials, while the courtyard serves as a gathering space, reflecting the cooling and social functions of historic Persian architecture. The villa balances contemporary design with a strong connection to local traditions and its environment.Narbon VillaBy Gera Studio, Kerman, IranLocated in a historic pomegranate garden in Kerman, this residence retains the original thatched wall, adding a glass entryway to connect the gardens sycamore trees and watercourse with the community. This approach reflects the Iranian tradition of shared garden spaces.A sunken courtyard, inspired by local architectural practices, provides shade in Kermans hot climate. Two deep sky rifts channel air and light, improving ventilation and framing views of the sky, echoing the poetic relationship between architecture and nature in Persian design.The layered roofs and shaded walls, rooted in Iranian rooftop culture, create spaces for stargazing, gatherings and relaxation. Built around cracked brick cores, the residence reinterprets vernacular forms, connecting the building to its cultural and climatic setting.Woof ShadowBy Faezeh Hadian Studio, North Bahar, Tehran, IranWoof Shadow reinterprets traditional Iranian ideas of light, shade and privacy through a modern brick faade. Inspired by origami, the folded surface creates depth and texture, using bricksa material central to Irans architectural heritage.The faade filters light and reduces visual pollution, while window frames offer varied city views. Crafted with dry construction methods and supported by steel threads, the brickwork reflects a balance of tradition and contemporary design, connecting the building to Tehrans architectural identity.DEHKADEH IWANBy SUPER VOID SPACE, Dehkade, Iran This project reimagines the traditional Iranian Iwan, integrating it into a 50-year-old modernist villa. The elevated Iwan connects the living room to the courtyard, opening on both sides to frame views of greenery and a central pool.A second courtyard Iwan creates a dialogue between old and new, with a swing suspended from its arch, inspired by ancient Persian games. The gray cement exterior reflects modernity, while the brick interior recalls traditional warmth, linking the villas past and present.The latest edition of Architizer: The Worlds Best Architecture a stunning, hardbound book celebrating the most inspiring contemporary architecture from around the globe is now available. Order your copy today.The post Playing With Mass: 9 Projects That Speak Volumes About Contemporary Iranian Architecture appeared first on Journal.0 Комментарии 0 Поделились 198 Просмотры -

GAMINGBOLT.COMRust Celebrates 260,000 Concurrent Players on PCFacepunch Studios director Alistair McFarlane has announced a new milestone reached by multiplayer survival game Rust. Taking to social media platform X, McFarlane announced that Rust has seen a new peak concurrent player count of 259,646 players.Rust going strength to strength! said McFarlane, celebrating the games latest milestone. We just beat our all-time CCU, beating covid and all other significant events.McFarlane goes on to celebrate the accomplishment by thanking the games players for their support.For the past several months, weve been hitting new monthly records, this was a huge one we were unsure if wed ever beat, not unless there was another global pandemic, posted McFarlane on X. Huge thanks to everyone supporting Rust. The team have worked tirelessly for the past 11 years on Rust. 2026 will be no different, lots of great things coming.Shortly after McFarlanes post, SteamDB revealed that the game had reached further heights, with Rust getting 260,000 concurrent players. This is the first time the game has seen such a player base since its original Early Access release.McFarlane has revealed some more details about Rust throughout 2024, including the fact that the game had more than 5.5 million unique players, with over 40 million hours played across over 325 million game sessions.Among the updates gotten by Rust over 2024 were the addition of new vehicles like bicycles and motorbikes, a complete revamp of the games world map that added new points of interest, the addition of backpacks as new equipment, and much more, including new weapons and quality of life features.Rust going strength to strength! we just beat our all-time CCU, beating covid and all other significant events.For the past several months, weve been hitting new monthly records, this was a huge one we were unsure if wed ever beat, not unless there was another global pic.twitter.com/8U0YD5b8Ez Alistair McFarlane (@Alistair_McF) January 2, 2025Rust has reached 260,000 concurrent players on Steam for the first time https://t.co/Ch1ErdTWUI SteamDB (@SteamDB) January 2, 20250 Комментарии 0 Поделились 139 Просмотры

GAMINGBOLT.COMRust Celebrates 260,000 Concurrent Players on PCFacepunch Studios director Alistair McFarlane has announced a new milestone reached by multiplayer survival game Rust. Taking to social media platform X, McFarlane announced that Rust has seen a new peak concurrent player count of 259,646 players.Rust going strength to strength! said McFarlane, celebrating the games latest milestone. We just beat our all-time CCU, beating covid and all other significant events.McFarlane goes on to celebrate the accomplishment by thanking the games players for their support.For the past several months, weve been hitting new monthly records, this was a huge one we were unsure if wed ever beat, not unless there was another global pandemic, posted McFarlane on X. Huge thanks to everyone supporting Rust. The team have worked tirelessly for the past 11 years on Rust. 2026 will be no different, lots of great things coming.Shortly after McFarlanes post, SteamDB revealed that the game had reached further heights, with Rust getting 260,000 concurrent players. This is the first time the game has seen such a player base since its original Early Access release.McFarlane has revealed some more details about Rust throughout 2024, including the fact that the game had more than 5.5 million unique players, with over 40 million hours played across over 325 million game sessions.Among the updates gotten by Rust over 2024 were the addition of new vehicles like bicycles and motorbikes, a complete revamp of the games world map that added new points of interest, the addition of backpacks as new equipment, and much more, including new weapons and quality of life features.Rust going strength to strength! we just beat our all-time CCU, beating covid and all other significant events.For the past several months, weve been hitting new monthly records, this was a huge one we were unsure if wed ever beat, not unless there was another global pic.twitter.com/8U0YD5b8Ez Alistair McFarlane (@Alistair_McF) January 2, 2025Rust has reached 260,000 concurrent players on Steam for the first time https://t.co/Ch1ErdTWUI SteamDB (@SteamDB) January 2, 20250 Комментарии 0 Поделились 139 Просмотры -

GAMINGBOLT.COMPrimal Carnage: Evolution Gets New Trailer Announcing 2025 Release Window on PlayStationDeveloper and publisher Circle 5 have announced that competitive shooter Primal Carnage: Evolution will be coming to PS4 and PS5 in 2025. The announcement was made with a trailer, which you can check out below.A follow-up to Primal Carnage: Extinction, Primal Carnage: Evolution currently has a store listing on the PlayStation Store, where the game can be wishlisted. Among other features, the game supports multiplayer for up to 16 players, and has support for PS4 Pros enhanced hardware. No mention has been made on the games store page of features pertaining to the PS5, such as the DualSense controller.Offering a contrast to Extinction, Primal Carnage: Evolution also doesnt seem to have a PC release planned, with the trailer mentioning only PlayStation platforms.Much like its predecessor, Primal Carnage: Evolution will feature multiplayer action where one team of players take on the role of dinosaurs while other players are hunters, armed to the teeth to take on the dinosaurs. Evolution will feature an expanded roster of dinosaurs to play with over Extinction, as well as plenty of customisation options.0 Комментарии 0 Поделились 174 Просмотры

GAMINGBOLT.COMPrimal Carnage: Evolution Gets New Trailer Announcing 2025 Release Window on PlayStationDeveloper and publisher Circle 5 have announced that competitive shooter Primal Carnage: Evolution will be coming to PS4 and PS5 in 2025. The announcement was made with a trailer, which you can check out below.A follow-up to Primal Carnage: Extinction, Primal Carnage: Evolution currently has a store listing on the PlayStation Store, where the game can be wishlisted. Among other features, the game supports multiplayer for up to 16 players, and has support for PS4 Pros enhanced hardware. No mention has been made on the games store page of features pertaining to the PS5, such as the DualSense controller.Offering a contrast to Extinction, Primal Carnage: Evolution also doesnt seem to have a PC release planned, with the trailer mentioning only PlayStation platforms.Much like its predecessor, Primal Carnage: Evolution will feature multiplayer action where one team of players take on the role of dinosaurs while other players are hunters, armed to the teeth to take on the dinosaurs. Evolution will feature an expanded roster of dinosaurs to play with over Extinction, as well as plenty of customisation options.0 Комментарии 0 Поделились 174 Просмотры