3DPRINTINGINDUSTRY.COM

Metal 3D printer shipments down 11%, bright spots at Flashforge, Formlabs New CONTEXT Report on State of 3D Printing Market

Market intelligence firm CONTEXT has published its latest report revealing weak performance across all 3D printer segments in Q4 2024.

As reported by the market intelligence firm, vendors struggled to maintain momentum as broader economic pressures took hold. Inflation remained stubbornly high, interest rates stayed elevated, and worries about global M&A uncertainty, tariff disputes, and recession risks continued to weigh on capital spending.

In Q4 2024, shipments dropped across the board. Industrial printers priced above $100,000 fell 6% compared to Q4 2023. Midrange printers, ranging from $20,000 to $100,000, saw a sharper 18% decline. Professional systems priced between $2,500 and $20,000 dropped 11%, and even Entry-level 3D printers, previously a growth engine, saw shipments slide 10% Y/Y.

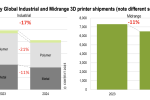

From a full-year (FY) perspective, the Entry-level segment was the only one to grow. Shipments of printers under $2,500 rose 26% thanks to brands like Bambu Lab and the “continued strength” of Creality. But that growth also cannibalized the Professional market, which finished 2024 down 15%. Midrange shipments fell 11%, while Industrial systems dropped 17% compared to FY 2023.

As Chris Connery, VP of global analysis at CONTEXT, put it, “2024 was a tough year across the globe for many 3D printer system vendors, marked by macroeconomic pressures and a shifting competitive landscape. But beneath the surface, there’s a clear sense of continued strong bottled-up demand that could reshape the industry in 2025 and beyond.”

Yearly Global Industrial and Midrange 3D printer shipments (note different scales). Image via CONTEXT.

Industrial systems stall, with metals hitting hardest

Industrial 3D printer shipments, priced above $100,000, fell 6% in Q4 2024, with metal systems performing especially poorly in markets like China. Although polymer systems showed signs of life late in the year, it wasn’t enough to counter the decline. For FY 2024, Industrial shipments dropped 17%, including a 21% fall in polymer and 11% in metal systems.

Zooming in on Q4, polymer systems actually saw a modest rebound. Shipments rose 10% Y/Y, driven mainly by a 23% increase in vat photopolymerisation machines. China led that resurgence, with shipments into the region jumping 53%, most of which came from UnionTech.

The country accounted for 34% of global shipments, overtaking North America, which came in at 29% but saw a 14% drop in unit volumes. Still, when looking at the full year, every subcategory of polymer systems declined: vat photopolymerisation down 30%, polymer powder bed fusion (PBF) down 6%, material extrusion down 16%, and material jetting down 10%.

In the metal space, PBF systems continued to dominate, making up 71% of Industrial metal printer shipments in Q4, but the category still saw a 20% Y/Y decline. However, Directed Energy Deposition (DED) systems grew by 15% in the quarter, mostly thanks to Meltio’s entry-level pricing strategy.

Interestingly, BLT managed to regain its position as the top global vendor for metal PBF printers, even though its own shipments were down 11%. In fact, all of the top five vendors were based in China. But it wasn’t just Chinese manufacturers feeling the squeeze, Western companies saw a 22% drop in metal PBF shipments in Q4, while Chinese vendors posted a 20% decline.

Metal 3D printed shoe mold by BLT. Photo by Michael Petch.

Metal revenues hold steadier despite falling shipments

While shipment volumes painted a grim picture, revenues in the Industrial metal segment told a slightly different story. In Q4 2024, global revenue from metal PBF systems declined just 10% Y/Y. Western vendors weathered the storm better than most. EOS posted strong results, and Nikon SLM Solutions reclaimed the top spot in global revenue rankings for metal PBF machines.

For the full year, DED was the only subcategory that managed to grow, with shipments up 7%. Other categories declined across the board: PBF down 12%, material extrusion down 29%, material jetting down 18%, and binder jetting down 17%. Only four vendors shipped more Industrial metal printers in 2024 than in 2023, Meltio, ZRapid Tech, Eplus3D, and TRUMPF, the latter only slightly.

Overall system revenues dropped 11%, but there were notable exceptions. Nikon SLM Solutions saw a 29% revenue increase, and Eplus3D posted an even stronger 40% gain, largely driven by demand for large-format, multi-laser systems.

Midrange 3D printers see steepest quarterly drop

Midrange systems, priced between $20,000 and $100,000, suffered the sharpest decline of any segment in Q4 2024, with shipments falling 18% Y/Y. That said, not every technology within the category struggled. Material jetting systems grew 25%, climbing to the top of the Midrange tech stack.

Flashforge played a big role here, doubling its shipments compared to Q4 2023 with its wax-based jetting solution geared toward the jewellery sector. Stratasys also saw gains, particularly in polymer systems targeting the dental market.

Still, those wins couldn’t save the full-year numbers. Shipments of Midrange printers fell 11% in 2024, as eight of the top ten vendors posted lower volumes than the year before. Industry mainstays like Stratasys, 3D Systems, Formlabs, and Markforged all indeed saw declines. Nexa3D exited the segment entirely. By contrast, Chinese vendors performed more strongly. Flashforge grew shipments by 123%, and ZRapid Tech posted an 11% increase.

Geographically, China overtook North America to become the top market for Midrange systems. Shipments to China rose 5% in 2024, while those to North America fell 22%. The regional shift highlights the growing importance of domestic Chinese demand, even as global conditions remained uneven.

Stratasys booth at RAPID + TCT 2025, featuring the CALLUM SKYE electric vehicle. Photo via CALLUM.

Professional market splits along technology lines

Professional printers, typically priced between $2,500 and $20,000, ended 2024 with mixed results depending on the technology. In Q4, overall shipments dropped 11% Y/Y. But a deeper look reveals that material extrusion systems, mostly Fused Deposition Modeling (FDM) or Fused Filament Fabrication (FFF), fell sharply, down 40%, while vat photopolymerisation systems grew 18%.

The divide was even more apparent across the full year, as Professional material extrusion printer shipments fell 37% in 2024, with vendors like Raise3D and UltiMaker losing ground to entry-level players such as Bambu Lab. Meanwhile, vat photopolymerisation brands shifted from laser and DLP systems to masked stereolithography.

This shift paid off. Formlabs and SprintRay posted strong results in Q4 and helped swing the market split in favor of vat photopolymerisation. What had been an even 50-50 split with material extrusion systems a year ago shifted to a 67-33 advantage for vat photopolymerisation by the end of 2024. Formlabs, in particular, shipped 29% more units, contributing to a 13% Y/Y increase in global vat photopolymerisation shipments.

Entry-level growth cools after strong start

Entry-level 3D printers, those under $2,500, were the only segment to post annual growth, with shipments rising 26% in FY 2024. But that success was mostly concentrated in the first half of the year. By Q4, the segment lost steam, with shipments down 10% compared to Q4 2023 and just under a million units shipped.

Creality maintained its lead in the category with a 40% market share, though Q4 shipments fell 25%. Bambu Lab, despite some late-year PR challenges, saw shipments rise 76%, capturing 20% of the market. Emerging as a “bright spot,” Flashforge also had a strong close, growing Q4 shipments by 77% as it continued evolving its product line.

Notably, 96% of all entry-level printers sold globally in 2024 came from Chinese vendors. A few smaller companies tested the idea of moving production to the United States to hedge against potential tariffs, but the economics didn’t work in their favor. For now, manufacturing low-cost machines in high-wage regions remains a tough proposition.

Yearly Global Professional and Entry-level 3D printer shipments (note different scales). Image via CONTEXT.

Outlook: A delayed rebound, not a derailed one

Even with a rough Q4 behind them, industry players aren’t writing off 2025. The year has already brought several milestones. EOS shipped its 5,000th 3D printer. Eplus3D reached its 100th super-meter metal PBF unit. Xact Metal passed 150 systems shipped. Nikon SLM Solutions hit 1,000 units, including 50 of its NXG large-format, multi-laser platforms.

The funding landscape also showed signs of life. Stratasys secured $120 million. Velo3D brought in new investment. And Desktop Metal’s acquisition by Nano Dimension finally closed, with Markforged possibly next in line. All of these moves suggest that the industry is gearing up for a return to profitability, and maybe even a resurgence in capital spending once macroeconomic conditions ease.

At the high end, demand is expected to grow from global onshoring, with capital spending set to accelerate once interest rates decline, said Connery. “The timing of such interest rate drops is the great unknown, and the situation is further complicated by sticky inflation, tariff wars and M&A questions, especially in the US.”

As it stands, expectations for 2025 have been adjusted downward. CONTEXT forecasts flat to single-digit shipment growth this year, with mid-double-digit gains likely in 2026 and momentum picking up after that.

Meanwhile, M&A will once again make the news, with the industry watching closely for new product categories that could shake things up, including a possible low-cost approx. $3,100 full-color material jetting 3D printer. If it materialises, it might blur the lines between Professional and Midrange pricing, and help the sector turn the page.

What 3D printing trends should you watch out for in 2025?

How is the future of 3D printing shaping up?

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter, or like our page on Facebook.

While you’re here, why not subscribe to our Youtube channel? Featuring discussion, debriefs, video shorts, and webinar replays.

Featured image shows Yearly Global Industrial and Midrange 3D printer shipments (note different scales). Image via CONTEXT.

Ada Shaikhnag

With a background in journalism, Ada has a keen interest in frontier technology and its application in the wider world. Ada reports on aspects of 3D printing ranging from aerospace and automotive to medical and dental.

0 Reacties

0 aandelen

76 Views