3DPRINTINGINDUSTRY.COM

New VDMA Survey: 77% of AM companies expect domestic growth over the next two years

German Mechanical Engineering Industry Association VDMA‘s Additive Manufacturing Working Group has released its spring 2025 survey results, highlighting optimism among companies operating in the AM sector.

As one of Europe’s largest industry associations, VDMA represents more than 3,600 mechanical engineering companies, mostly based in Germany and other EU countries. The Additive Manufacturing Working Group focuses on industrial 3D printing with over 180 members in the AM industry, including the likes of AddUp (France), Concept Laser , DMG Mori Additive GmbH, ExOne GmbH, GEFERTEC, Q.Big 3D, and Quantica (Germany) among others.

While challenges remain, the findings suggest gradual signs of improvement in sales performance and market outlook. It was noted by Dr. Markus Heering, Managing Director of the group, that the “member companies continue to demonstrate remarkable stability and adaptability in a changing market environment.”

This survey was concluded on March 28, just before new U.S. tariffs were announced. It collected input from companies including producers of 3D printing systems and components, post-processing machinery, materials, software, and service providers, as well as research institutions. According to the group, the range of participating companies reflects the complexity and interconnectedness of the industry.

“Our members regularly discuss topics along the entire additive process chain and share their perspectives and experiences,” said Dr. Heering, adding that this helps clarify development needs and supports the industry’s path toward industrialization.

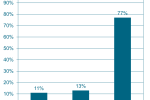

How does your company expect the domestic market in the AM sector to develop over the next 24 months? Image via VDMA.

Market optimism meets global competition

Survey results show that more businesses reported an increase in turnover compared to the previous fall, despite 34% still experiencing a drop in sales over the past 12 months. In a shorter-term view, only 20% of companies reported declining turnover over the last six months, a trend interpreted as an early sign of stabilization. Dr. Heering pointed to this improvement as an indication that conditions may be slowly recovering.

Projections for the next two years remain broadly positive. Approximately 77% of respondents anticipate growth in the domestic market, while 64% expect international sales to rise, a noticeable increase from the 58% figure reported in late 2024.

The EU-27 continues to be the leading export destination for nearly 70% of surveyed companies. The US follows closely, cited by 64% of respondents, with non-EU European countries accounting for 29%. While the US plays a major role in export activity, Dr. Heering acknowledged uncertainty around how future exports may be affected by evolving trade policy.

As per the survey, competitive pressure remains significant, particularly from China and the US. Roughly half of all member companies identified Chinese providers as key rivals, and 43% reported competing with American firms. Dr. Heering remarked this as a slight uptick from previous results and that “competition from China is becoming more and more noticeable.”

Despite global headwinds, investment confidence appears to be returning. Around 40% of participants plan to boost their investment activity in the coming year. Among the factors expected to contribute positively to business performance, 60% of companies cited advances in technology. Other important drivers include the development of new applications and entry into new markets. In addition, 20% of respondents expressed hope that research and development efforts would provide further momentum this year.

Dr. Heering emphasized that a focused effort is required in key areas identified across the survey. He noted the importance of improving process reliability and repeatability, controlling costs to strengthen competitiveness, and pushing the development of technologies suitable for serial production. He also stated that “finding new industrial applications will help us to increase market acceptance.”

What development of exports (sales abroad) does your company expect in the AM sector in the next 24 months? Image via VDMA.

A silver lining after all?

If recent reports are any indication, the 3D printing industry may be headed for a steadier year in 2025.

The 2025 3D Printing Industry Executive Survey reflects a moderately positive outlook, with 62.1% of leaders expecting overall favorable business conditions and 67.8% expressing a positive view of internal operations.

Although 2024 fell short of earlier forecasts, sentiment has improved, pointing to gradual recovery across the sector. As inflation slows and interest rates ease, specific market segments may see renewed growth. Still, leaders are approaching the year with measured optimism, recognizing the need to remain flexible in the face of operational challenges and evolving economic conditions.

In December 2024, market intelligence firm CONTEXT projected a rebound for the 3D printing market in 2025, particularly in high end 3D printer shipments. Industrial systems priced over $100,000 are expected to grow 15%, driven by demand for metal 3D printers, especially laser powder bed fusion (LPBF) systems in China, returning the market to 2021 levels.

Despite a weak 2024 marked by shipment declines across most segments, CONTEXT forecasts renewed growth across all categories in 2025, including a 14% rise in Midrange and 8% in Professional systems. Entry level 3D printers remain strong, with double digit growth expected. Industrial shipments are projected to grow at a 19% annual rate.

What 3D printing trends should you watch out for in 2025?

How is the future of 3D printing shaping up?

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter, or like our page on Facebook.

While you’re here, why not subscribe to our Youtube channel? Featuring discussion, debriefs, video shorts, and webinar replays.

Featured image shows how does your company expect the domestic market in the AM sector to develop over the next 24 months? Image via VDMA.

Ada Shaikhnag

With a background in journalism, Ada has a keen interest in frontier technology and its application in the wider world. Ada reports on aspects of 3D printing ranging from aerospace and automotive to medical and dental.

0 Commentarios

0 Acciones

66 Views