0 Commentarii

0 Distribuiri

138 Views

Director

Director

-

Vă rugăm să vă autentificați pentru a vă dori, partaja și comenta!

-

NEWS.BLIZZARD.COMDiablo IV: Pursue Celestial Fortune in the Lunar Awakening Event!Diablo IVPursue Celestial Fortune in Lunar AwakeningBlizzard EntertainmentThe long-awaited celestial journey has returned! From February 4, 10 a.m.February 18, 10 a.m. PST players in both Seasonal and Eternal Realms can bask in the moonlight of the Lunar Awakening limited-time event. A mysterious phenomenon is manifesting throughout the shrines of Sanctuary, enchanting them with immense and prosperous power. Celebrators attribute this behavior to their Ancestors blessing them from beyond the grave in commemoration of this joyous occasion.Activate any Shrine found in Sanctuary (Nahantu included) to earn 100% bonus experience (multiplicative) for 2 minutes and an enhanced power, all while earning Ancestral Favor Reputation.Lunar Awakening has DawnedTo fully enjoy the revelry of Lunar Awakening, travel to Ked Bardu and head to the Northern section of town. Once there youll meet Ying-Yue, the leader of the Lunar Night Market. This market is your central hub for Lunar Awakening, where youll redeem your Ancestral Favor Reputation for Unceasing Gifts from the Ancestors caches and decorative Lunar Renewal-themed rewards.Lunar Shrines are spread throughout Sanctuary. Fight your way through both dungeons and the wilderness, activating Lunar Shrines and slaying monsters to earn copious amounts of Ancestral Favor Reputation.Lunar Shrines and Ancestors FavorLunar Shrines hum with the auspicious powers granted to them by the returning spirits of ancestors. During Lunar Awakening, all Shrines have been replaced with Lunar Shrineswhich bestow a 100% experience bonus when activatedwith an updated appearance to honor the year of the snake! Lunar Shrines function similarly to typical Shrines, but they have been augmented for an extra punch to celebrate this festive event. These shrines also have a unique Map icon, so you can spot them from a distance.Lunar Shrines provide an exciting bonus effect on top of their regular Shrine power; the Lunar Shrine effects are listed below.Augmented Lunar Shrine Effects:Artillery Shrine Casts have a chance to summon a holy bomb.Blast Wave Shrine Each explosion summons a cluster bombardment.Channeling Shrine- Increased attack speed and chance to reset cooldowns.Conduit Shrine Summon frequent, powerful, shocking strikes.Greed Shrine Chance to summon a Treasure Goblin. While the Shrine is active, kills summon a Treasure Goblin.Lethal Shrine Chance to instantly execute a struck monster, causing Fear on surrounding monsters. Note: this includes Elites, but excludes Bosses and other Players.Protection Shrine You reflect all incoming damage. Damage reflected scales with Level and Difficulty.On top of these powerfully amplified effects, Miserly Spirits spawn immediately when a Lunar Shrine is activated, allowing you to immediately capitalize on the Shrines specific gameplay augmentation.Conquer Reputation Levels to Earn RewardsThere are 10 Ancestral Favor Reputation Levels in total to earn with rewards such as a Resplendent Spark, and 6 different Lunar-themed cosmetic rewards to unlock, including the new TragOuls Consort mount*. Once youve climbed through the reputation levels, continue earning additional rewards in the form of Unceasing Gifts from the Ancestors.*Previous Lunar rewards such as the Lunar Scepter, Dragons Courage, Moonshot Bow, Dragons Tapestry, Moons Bounty, and TragOuls Consort cosmetics can only be earned once.Opulent Garments AwaitLunar Awakening themed garments will also be available in Tejals shop. Head over to adorn your wanderer in elegant Armor Cosmetics like the Scholar of the Lonely Moon for the Sorcerer, and spruce up your trusty steed with the Dragon of the Lonely Moon mount armor.Celebrate with Ying-Yue and bask in the soft glow of Lunar Awakening when it arrives on February 4!0 Commentarii 0 Distribuiri 148 Views

NEWS.BLIZZARD.COMDiablo IV: Pursue Celestial Fortune in the Lunar Awakening Event!Diablo IVPursue Celestial Fortune in Lunar AwakeningBlizzard EntertainmentThe long-awaited celestial journey has returned! From February 4, 10 a.m.February 18, 10 a.m. PST players in both Seasonal and Eternal Realms can bask in the moonlight of the Lunar Awakening limited-time event. A mysterious phenomenon is manifesting throughout the shrines of Sanctuary, enchanting them with immense and prosperous power. Celebrators attribute this behavior to their Ancestors blessing them from beyond the grave in commemoration of this joyous occasion.Activate any Shrine found in Sanctuary (Nahantu included) to earn 100% bonus experience (multiplicative) for 2 minutes and an enhanced power, all while earning Ancestral Favor Reputation.Lunar Awakening has DawnedTo fully enjoy the revelry of Lunar Awakening, travel to Ked Bardu and head to the Northern section of town. Once there youll meet Ying-Yue, the leader of the Lunar Night Market. This market is your central hub for Lunar Awakening, where youll redeem your Ancestral Favor Reputation for Unceasing Gifts from the Ancestors caches and decorative Lunar Renewal-themed rewards.Lunar Shrines are spread throughout Sanctuary. Fight your way through both dungeons and the wilderness, activating Lunar Shrines and slaying monsters to earn copious amounts of Ancestral Favor Reputation.Lunar Shrines and Ancestors FavorLunar Shrines hum with the auspicious powers granted to them by the returning spirits of ancestors. During Lunar Awakening, all Shrines have been replaced with Lunar Shrineswhich bestow a 100% experience bonus when activatedwith an updated appearance to honor the year of the snake! Lunar Shrines function similarly to typical Shrines, but they have been augmented for an extra punch to celebrate this festive event. These shrines also have a unique Map icon, so you can spot them from a distance.Lunar Shrines provide an exciting bonus effect on top of their regular Shrine power; the Lunar Shrine effects are listed below.Augmented Lunar Shrine Effects:Artillery Shrine Casts have a chance to summon a holy bomb.Blast Wave Shrine Each explosion summons a cluster bombardment.Channeling Shrine- Increased attack speed and chance to reset cooldowns.Conduit Shrine Summon frequent, powerful, shocking strikes.Greed Shrine Chance to summon a Treasure Goblin. While the Shrine is active, kills summon a Treasure Goblin.Lethal Shrine Chance to instantly execute a struck monster, causing Fear on surrounding monsters. Note: this includes Elites, but excludes Bosses and other Players.Protection Shrine You reflect all incoming damage. Damage reflected scales with Level and Difficulty.On top of these powerfully amplified effects, Miserly Spirits spawn immediately when a Lunar Shrine is activated, allowing you to immediately capitalize on the Shrines specific gameplay augmentation.Conquer Reputation Levels to Earn RewardsThere are 10 Ancestral Favor Reputation Levels in total to earn with rewards such as a Resplendent Spark, and 6 different Lunar-themed cosmetic rewards to unlock, including the new TragOuls Consort mount*. Once youve climbed through the reputation levels, continue earning additional rewards in the form of Unceasing Gifts from the Ancestors.*Previous Lunar rewards such as the Lunar Scepter, Dragons Courage, Moonshot Bow, Dragons Tapestry, Moons Bounty, and TragOuls Consort cosmetics can only be earned once.Opulent Garments AwaitLunar Awakening themed garments will also be available in Tejals shop. Head over to adorn your wanderer in elegant Armor Cosmetics like the Scholar of the Lonely Moon for the Sorcerer, and spruce up your trusty steed with the Dragon of the Lonely Moon mount armor.Celebrate with Ying-Yue and bask in the soft glow of Lunar Awakening when it arrives on February 4!0 Commentarii 0 Distribuiri 148 Views -

9TO5MAC.COMM4 MacBook Air will be a no-brainer upgrade from M1, heres whyApple is expected to launch the M4 MacBook Air very soon. When it arrives, the device will offer a compelling upgrade for existing MacBook Air users, particularly anyone using the M1 model.Upgrading from M1 to M4 MacBook Air gets you a lotFor most users, buying every new laptop Apple makes isnt a good option. Year-over-year upgrades tend to be relatively minor. But waiting several years between upgrades? That can mean youre in for a real treat with a new MacBook.Heres a sampling of new features the M4 MacBook Air will provide compared to the M1 model:M4 performance boost: Per Apple, compared to M1 the M4 chip is up to 1.7x faster for daily tasks like browsing and app use, up to 2.1x faster for more demanding workflows like gaming and media editing, and its Neural Engine is over 3x fastergiving it much more headroom for AI.New design: This one will be a positive for most buyers (more on that shortly). The new, sleek design first introduced with the M2 model will provide a big visual difference if you buy an M4.Much better camera: The M2 and M3 Air upgraded the M1s 720p camera to 1080p, but the M4 is expected to go further with a new 12MP Center Stage camera with Desk View support.Extended battery life: The M4 chips efficiency results in battery improvements. With the iPad Pro, Apple shrunk the device while maintaining the same battery life. The MacBook Pro, meanwhile, offered extended battery life. Expect the Air to follow the MacBook Pros path.Multiple external displays: The M1 MacBook Air only lets you run a single external display, but the M4 will support two external monitors even with the lid open.Bigger, brighter, nano-textured screen: Back in the M1 era, there was only one 13.3-inch size option for the Air. Now, the small model has a 13.6-inch display and theres a 15.3-inch model too. The M4s display will also be brighter than the M1s, and likely include a nano-texture option.More RAM (probably): All new M4 Macs start at 16GB RAM and go up to a max of 32GB, so depending on your M1 specs, that could be a big upgrade.4-speaker sound system: I personally dont use built-in Mac speakers much, but if you do, youll get a 4-speaker array in the M4 Air that the M1 didnt have.MagSafe and port versatility: Apple continues to include just two USB-C ports on the MacBook Air. However, recent models have added MagSafe, which the M1 lacksthus enabling safer charging and freeing up a USB-C port.This isnt an exhaustive list, but it does make pretty clear how big of an upgrade the M4 model will be over the M1 MacBook Air.Two possible drawbacksI have to admit, its not necessarily all positive change. Depending on your preferences, there are two aspects of the M4 MacBook Airs design that could be negatives:the display notchand the new (M2-style) overall designWhile the notch on the iPhone never bothered me much, I find it much more of an eyesore on Macs. Im also very fond of the classic tapered MacBook Air design that the M1 had. The new design is nice, to be sure, but it doesnt evoke the same affection.M4 offers the most reasons to upgrade yetAnecdotally, Ive noticed that quite a few users of the M1 MacBook Pro upgraded to the M4 when it arrived last November, and were very happy with their choice.Similarly, I think the M4 MacBook Air will make an ideal upgrade for M1 users.The M1 is no slouch. I used an M1 Air myself until last year. But its been around for over four years nowa perfectly solid run.Youll notice that some of the upgrades I shared abovemany, in factalso come with the M3 or M2 models. But if youre the kind of person who only upgrades your laptop every 4+ years, youre best off getting the latest and greatest. Future-proofing matters, especially with a device you plan to hold on to a while.The M4 MacBook Air will be here soon, and by accumulating all the improvements of the M3 and M2, while adding its own, it will be the most compelling M1 upgrade yet.Do you plan to upgrade to the M4 MacBook Air from an M1? Let us know in the comments.Best Mac accessoriesAdd 9to5Mac to your Google News feed. FTC: We use income earning auto affiliate links. More.Youre reading 9to5Mac experts who break news about Apple and its surrounding ecosystem, day after day. Be sure to check out our homepage for all the latest news, and follow 9to5Mac on Twitter, Facebook, and LinkedIn to stay in the loop. Dont know where to start? Check out our exclusive stories, reviews, how-tos, and subscribe to our YouTube channel0 Commentarii 0 Distribuiri 123 Views

9TO5MAC.COMM4 MacBook Air will be a no-brainer upgrade from M1, heres whyApple is expected to launch the M4 MacBook Air very soon. When it arrives, the device will offer a compelling upgrade for existing MacBook Air users, particularly anyone using the M1 model.Upgrading from M1 to M4 MacBook Air gets you a lotFor most users, buying every new laptop Apple makes isnt a good option. Year-over-year upgrades tend to be relatively minor. But waiting several years between upgrades? That can mean youre in for a real treat with a new MacBook.Heres a sampling of new features the M4 MacBook Air will provide compared to the M1 model:M4 performance boost: Per Apple, compared to M1 the M4 chip is up to 1.7x faster for daily tasks like browsing and app use, up to 2.1x faster for more demanding workflows like gaming and media editing, and its Neural Engine is over 3x fastergiving it much more headroom for AI.New design: This one will be a positive for most buyers (more on that shortly). The new, sleek design first introduced with the M2 model will provide a big visual difference if you buy an M4.Much better camera: The M2 and M3 Air upgraded the M1s 720p camera to 1080p, but the M4 is expected to go further with a new 12MP Center Stage camera with Desk View support.Extended battery life: The M4 chips efficiency results in battery improvements. With the iPad Pro, Apple shrunk the device while maintaining the same battery life. The MacBook Pro, meanwhile, offered extended battery life. Expect the Air to follow the MacBook Pros path.Multiple external displays: The M1 MacBook Air only lets you run a single external display, but the M4 will support two external monitors even with the lid open.Bigger, brighter, nano-textured screen: Back in the M1 era, there was only one 13.3-inch size option for the Air. Now, the small model has a 13.6-inch display and theres a 15.3-inch model too. The M4s display will also be brighter than the M1s, and likely include a nano-texture option.More RAM (probably): All new M4 Macs start at 16GB RAM and go up to a max of 32GB, so depending on your M1 specs, that could be a big upgrade.4-speaker sound system: I personally dont use built-in Mac speakers much, but if you do, youll get a 4-speaker array in the M4 Air that the M1 didnt have.MagSafe and port versatility: Apple continues to include just two USB-C ports on the MacBook Air. However, recent models have added MagSafe, which the M1 lacksthus enabling safer charging and freeing up a USB-C port.This isnt an exhaustive list, but it does make pretty clear how big of an upgrade the M4 model will be over the M1 MacBook Air.Two possible drawbacksI have to admit, its not necessarily all positive change. Depending on your preferences, there are two aspects of the M4 MacBook Airs design that could be negatives:the display notchand the new (M2-style) overall designWhile the notch on the iPhone never bothered me much, I find it much more of an eyesore on Macs. Im also very fond of the classic tapered MacBook Air design that the M1 had. The new design is nice, to be sure, but it doesnt evoke the same affection.M4 offers the most reasons to upgrade yetAnecdotally, Ive noticed that quite a few users of the M1 MacBook Pro upgraded to the M4 when it arrived last November, and were very happy with their choice.Similarly, I think the M4 MacBook Air will make an ideal upgrade for M1 users.The M1 is no slouch. I used an M1 Air myself until last year. But its been around for over four years nowa perfectly solid run.Youll notice that some of the upgrades I shared abovemany, in factalso come with the M3 or M2 models. But if youre the kind of person who only upgrades your laptop every 4+ years, youre best off getting the latest and greatest. Future-proofing matters, especially with a device you plan to hold on to a while.The M4 MacBook Air will be here soon, and by accumulating all the improvements of the M3 and M2, while adding its own, it will be the most compelling M1 upgrade yet.Do you plan to upgrade to the M4 MacBook Air from an M1? Let us know in the comments.Best Mac accessoriesAdd 9to5Mac to your Google News feed. FTC: We use income earning auto affiliate links. More.Youre reading 9to5Mac experts who break news about Apple and its surrounding ecosystem, day after day. Be sure to check out our homepage for all the latest news, and follow 9to5Mac on Twitter, Facebook, and LinkedIn to stay in the loop. Dont know where to start? Check out our exclusive stories, reviews, how-tos, and subscribe to our YouTube channel0 Commentarii 0 Distribuiri 123 Views -

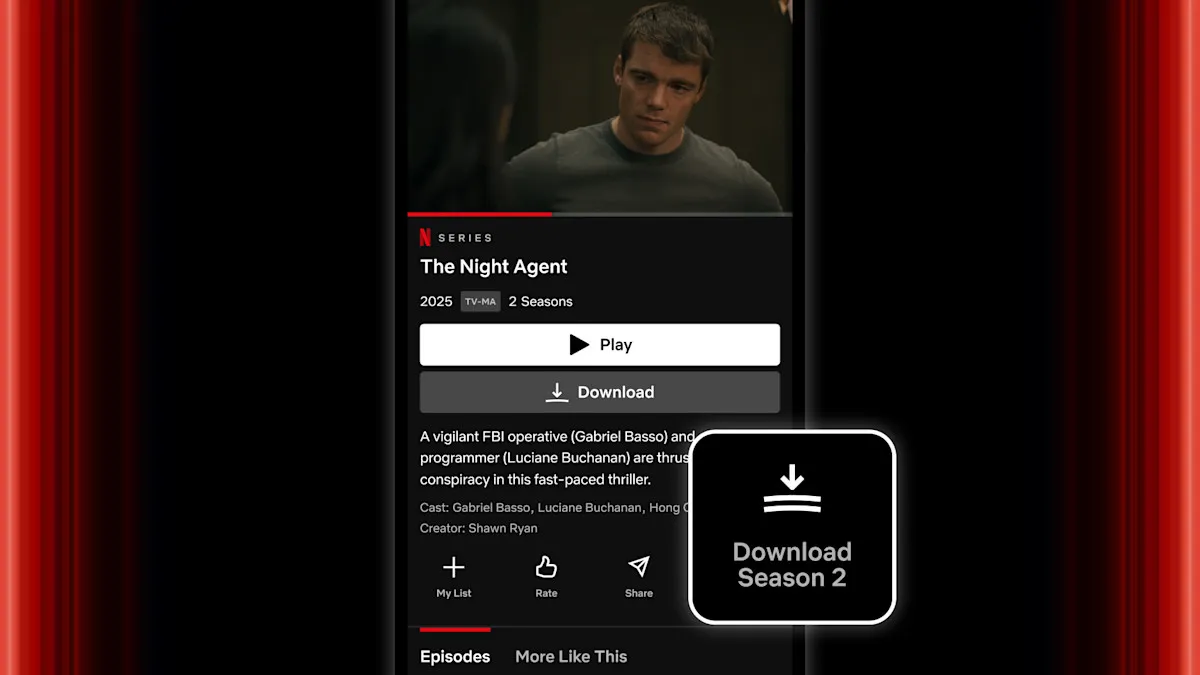

9TO5MAC.COMNetflix solved a major complaint about its iPhone and iPad app with one buttonRejoice iPhone and iPad users, Netflix has added a new button that will surely save you time and improve your overall life.Thats right. A single tap to download a full season of a series. Just like a civilized society deserves (and something Android users have had for years). Welcome to an elevated existence, iPhone and iPad Netflix viewers.Today, were adding a much-requested Season Download button for all iPhone and iPad users. This feature, which Android users already know and love, allows you to download every episode in a season with just one tap.[]On a shows display page, look for the button right next to the Share option. Tap it, and the entire season will start downloading automatically no more downloading episodes one at a time! Want to keep tabs on your downloads or manage individual episodes? Head to the Downloads section under the My Netflix tab everything will be there.Those recent price increases are already paying off. Grab the latest Netflix app for iPhone and iPad from the App Store today. Happy streaming.Top iPhone accessoriesAdd 9to5Mac to your Google News feed. FTC: We use income earning auto affiliate links. More.Youre reading 9to5Mac experts who break news about Apple and its surrounding ecosystem, day after day. Be sure to check out our homepage for all the latest news, and follow 9to5Mac on Twitter, Facebook, and LinkedIn to stay in the loop. Dont know where to start? Check out our exclusive stories, reviews, how-tos, and subscribe to our YouTube channel0 Commentarii 0 Distribuiri 121 Views

9TO5MAC.COMNetflix solved a major complaint about its iPhone and iPad app with one buttonRejoice iPhone and iPad users, Netflix has added a new button that will surely save you time and improve your overall life.Thats right. A single tap to download a full season of a series. Just like a civilized society deserves (and something Android users have had for years). Welcome to an elevated existence, iPhone and iPad Netflix viewers.Today, were adding a much-requested Season Download button for all iPhone and iPad users. This feature, which Android users already know and love, allows you to download every episode in a season with just one tap.[]On a shows display page, look for the button right next to the Share option. Tap it, and the entire season will start downloading automatically no more downloading episodes one at a time! Want to keep tabs on your downloads or manage individual episodes? Head to the Downloads section under the My Netflix tab everything will be there.Those recent price increases are already paying off. Grab the latest Netflix app for iPhone and iPad from the App Store today. Happy streaming.Top iPhone accessoriesAdd 9to5Mac to your Google News feed. FTC: We use income earning auto affiliate links. More.Youre reading 9to5Mac experts who break news about Apple and its surrounding ecosystem, day after day. Be sure to check out our homepage for all the latest news, and follow 9to5Mac on Twitter, Facebook, and LinkedIn to stay in the loop. Dont know where to start? Check out our exclusive stories, reviews, how-tos, and subscribe to our YouTube channel0 Commentarii 0 Distribuiri 121 Views -

FUTURISM.COMElon Musk's Long Term Friend Says He's a Narcissist With an Obsessive "Lust for Power"One of Elon Musk's old pals is calling out the billionaire's power hunger and egotism.In a lengthy essay cross-posted on Facebook and LinkedIn, Philip Low, the founder of the brain-computer interface (BCI) company NeuroVigil, insisted that despite Musk's apparent Sieg Heil and subsequent Holocaust jokes, his former friend and business partner of 14 years "is not a Nazi, per se."If anything, though, his explanation somehow sounds even more sinister."Nazis believed that an entire race was above everyone else," Low wrote. "Elon believes he is above everyone else.""Everything Elon does is about acquiring and consolidating power," he continued. "That is why he likes far right parties, because they are easier to control."Throughout the meandering post, the tech founder and erstwhile Musk confidante made a number of bold claims, including that one of Musk's exes came on to him and that the multi-hyphenate business owner who invested in Low's NeuroVigil company in 2015 and still owns a small amount of stock in it started Neuralink in 2016 as an attempt to compete with him."His lust for power is also why he did xAI and Neuralink, to attempt to compete with OpenAI and NeuroVigil, respectively, despite being affiliated with them," the tech founder wrote. "Unlike Tesla and Twitter, he was unable to conquer those companies and tried to create rivals."To be clear, Low's insistence that Musk started Neuralink to compete with NeuroVigil is somewhat fuzzy.For one, their approaches to BCI are vastly different. Unlike Neuralink, which involves a coin-sized chip being placed inside the skull and attached to the brain, NeuroVigil is entirely non-invasive and reads brainwaves from the outside while users are asleep to monitor their brain activity and, apparently, help diagnose medical conditions.The way Low presents the timeline of his falling out with Musk is also pretty murky.As the NeuroVigil founder correctly noted in his post, Musk was terminated with cause from NeuroVigil's board in late 2021. According to Low, that firing occurred after the billionaire essentially tried to tank the company's stock by returning his holdings instead of selling them outright."I fired him with cause in December 2021 when he tried to undermine NV," Low wrote. "It is ironic that years later, he clearly tried to undermine Twitter before buying it."Though there's weight to the argument that Musk tried to "undermine" Twitter before buying it, that didn't happen "years later" his purchase began just a few months later in April 2022, and was finalized that October, which was less than a year after Low fired him from the NeuroVigil board.Still, Low's overall assessment of his former friend and business partner is compelling even if there may be too many emotions tied up in their falling out.More on Musk friendships: Trump Gives Elon Musk Access to All Unclassified Data in the US GovernmentShare This Article0 Commentarii 0 Distribuiri 145 Views

FUTURISM.COMElon Musk's Long Term Friend Says He's a Narcissist With an Obsessive "Lust for Power"One of Elon Musk's old pals is calling out the billionaire's power hunger and egotism.In a lengthy essay cross-posted on Facebook and LinkedIn, Philip Low, the founder of the brain-computer interface (BCI) company NeuroVigil, insisted that despite Musk's apparent Sieg Heil and subsequent Holocaust jokes, his former friend and business partner of 14 years "is not a Nazi, per se."If anything, though, his explanation somehow sounds even more sinister."Nazis believed that an entire race was above everyone else," Low wrote. "Elon believes he is above everyone else.""Everything Elon does is about acquiring and consolidating power," he continued. "That is why he likes far right parties, because they are easier to control."Throughout the meandering post, the tech founder and erstwhile Musk confidante made a number of bold claims, including that one of Musk's exes came on to him and that the multi-hyphenate business owner who invested in Low's NeuroVigil company in 2015 and still owns a small amount of stock in it started Neuralink in 2016 as an attempt to compete with him."His lust for power is also why he did xAI and Neuralink, to attempt to compete with OpenAI and NeuroVigil, respectively, despite being affiliated with them," the tech founder wrote. "Unlike Tesla and Twitter, he was unable to conquer those companies and tried to create rivals."To be clear, Low's insistence that Musk started Neuralink to compete with NeuroVigil is somewhat fuzzy.For one, their approaches to BCI are vastly different. Unlike Neuralink, which involves a coin-sized chip being placed inside the skull and attached to the brain, NeuroVigil is entirely non-invasive and reads brainwaves from the outside while users are asleep to monitor their brain activity and, apparently, help diagnose medical conditions.The way Low presents the timeline of his falling out with Musk is also pretty murky.As the NeuroVigil founder correctly noted in his post, Musk was terminated with cause from NeuroVigil's board in late 2021. According to Low, that firing occurred after the billionaire essentially tried to tank the company's stock by returning his holdings instead of selling them outright."I fired him with cause in December 2021 when he tried to undermine NV," Low wrote. "It is ironic that years later, he clearly tried to undermine Twitter before buying it."Though there's weight to the argument that Musk tried to "undermine" Twitter before buying it, that didn't happen "years later" his purchase began just a few months later in April 2022, and was finalized that October, which was less than a year after Low fired him from the NeuroVigil board.Still, Low's overall assessment of his former friend and business partner is compelling even if there may be too many emotions tied up in their falling out.More on Musk friendships: Trump Gives Elon Musk Access to All Unclassified Data in the US GovernmentShare This Article0 Commentarii 0 Distribuiri 145 Views -

FUTURISM.COMElon Puts Kid Who Just Graduated From High School in Charge of Disemboweling the US GovernmentAmerica's oligarch-in-chief Elon Musk is extending his tendrils beyond the half-baked Department of Government Efficiency and into the Office of Personnel Management,which is essentially the HR body for federal agencies.The top brass of the OPM has been hollowed out to make room for Musk's former henchmen, according to federal sources tapped by Wired, where they're poised to "monitor and enforce" loyalty to Trump across the federal government, University of Michigan's Don Moynihan told the magazine.Though Trump's pick for OPM director, Scott Kupor, still has to pass Senate and DHS scrutiny, the soil is already being prepared for his arrival by appointees, some of whom are so inexperienced that their qualifications sound like a surreal joke about Musk's penchant for nepotism."One, a senior adviser to the director, is a 21-year-old whose online resume touts his work for Palantir," per Wired, while another "who reports directly to Scales, graduated from high school in 2024." A copy of the latter's resume include his summer internship with Musk's Neuralink, alongside jobs as we assure you that we are not joking a camp counselor and bike mechanic.Although both these tykes are ostensibly poised to rip and tear through America's federal agencies, Wired declined to name them "because of their ages" a somewhat baffling choice given that both appear to be of legal age. (And if they're not, well, that's a much bigger problem.)Populating the OPM with naive-yet-loyal yes men seems to be a key strategy in Trump's plan to drastically cut down the federal workforce. It also follows Musk's disastrous playbook at Twitter the two young OPM hires are reminiscent of a move the billionaire pulled when he hired his alarmingly junior and inexperienced cousins to facilitate three massive rounds of layoffs as he took over the platform.Other high-profile Musk-adjacent picks include Chief of Staff Amanda Scales, formerly of Musk's xAI, and senior advisor Ricardo Biasini, former director of operations for Musk's extremely underwhelming and poorly constructed Vegas Hyperloop.For the OPM's general counsel, Trump and Musk have installed the self-described "raging misogynist" Andrew Kloster, a disaster of a pick who was subject to a 2022 restraining order for domestic violence allegations.And if the official staff list is giving you a sinking feeling of despair, other people calling the shots at OPM aren't government personnel at all.On Monday, some federal HR chiefs received a memo from the OPM's acting director regarding hiring freezes and return-to-office orders, making concrete some of Trump's promises to drastically cut down the federal workforce. Eagle-eyed redditors quickly found the memos contained metadata which linked back to Noah Peters and James Sherk two right-wing lobbyists who aren't officially affiliated with the OPM, but who are officially connected to the ultra-right Project 2025.That memo led to a class-action lawsuit on behalf of two federal employees, alleging that the OPM set up its own internal server for the purpose of storing federal employee data in one central location. The suit alleges that OPM chief of staff Amanda Scales received and stored the information without ever running a privacy assessment directly violating a United States Digital Service statute from 2002.The OPM's growing menagerie of Musk-lackeys is troubling news, indicating that the tech mogul has been granted carte-blanche to hand out the keys to the kingdom to anyone he wants even if they can't legally buy alcohol.Share This Article0 Commentarii 0 Distribuiri 146 Views

FUTURISM.COMElon Puts Kid Who Just Graduated From High School in Charge of Disemboweling the US GovernmentAmerica's oligarch-in-chief Elon Musk is extending his tendrils beyond the half-baked Department of Government Efficiency and into the Office of Personnel Management,which is essentially the HR body for federal agencies.The top brass of the OPM has been hollowed out to make room for Musk's former henchmen, according to federal sources tapped by Wired, where they're poised to "monitor and enforce" loyalty to Trump across the federal government, University of Michigan's Don Moynihan told the magazine.Though Trump's pick for OPM director, Scott Kupor, still has to pass Senate and DHS scrutiny, the soil is already being prepared for his arrival by appointees, some of whom are so inexperienced that their qualifications sound like a surreal joke about Musk's penchant for nepotism."One, a senior adviser to the director, is a 21-year-old whose online resume touts his work for Palantir," per Wired, while another "who reports directly to Scales, graduated from high school in 2024." A copy of the latter's resume include his summer internship with Musk's Neuralink, alongside jobs as we assure you that we are not joking a camp counselor and bike mechanic.Although both these tykes are ostensibly poised to rip and tear through America's federal agencies, Wired declined to name them "because of their ages" a somewhat baffling choice given that both appear to be of legal age. (And if they're not, well, that's a much bigger problem.)Populating the OPM with naive-yet-loyal yes men seems to be a key strategy in Trump's plan to drastically cut down the federal workforce. It also follows Musk's disastrous playbook at Twitter the two young OPM hires are reminiscent of a move the billionaire pulled when he hired his alarmingly junior and inexperienced cousins to facilitate three massive rounds of layoffs as he took over the platform.Other high-profile Musk-adjacent picks include Chief of Staff Amanda Scales, formerly of Musk's xAI, and senior advisor Ricardo Biasini, former director of operations for Musk's extremely underwhelming and poorly constructed Vegas Hyperloop.For the OPM's general counsel, Trump and Musk have installed the self-described "raging misogynist" Andrew Kloster, a disaster of a pick who was subject to a 2022 restraining order for domestic violence allegations.And if the official staff list is giving you a sinking feeling of despair, other people calling the shots at OPM aren't government personnel at all.On Monday, some federal HR chiefs received a memo from the OPM's acting director regarding hiring freezes and return-to-office orders, making concrete some of Trump's promises to drastically cut down the federal workforce. Eagle-eyed redditors quickly found the memos contained metadata which linked back to Noah Peters and James Sherk two right-wing lobbyists who aren't officially affiliated with the OPM, but who are officially connected to the ultra-right Project 2025.That memo led to a class-action lawsuit on behalf of two federal employees, alleging that the OPM set up its own internal server for the purpose of storing federal employee data in one central location. The suit alleges that OPM chief of staff Amanda Scales received and stored the information without ever running a privacy assessment directly violating a United States Digital Service statute from 2002.The OPM's growing menagerie of Musk-lackeys is troubling news, indicating that the tech mogul has been granted carte-blanche to hand out the keys to the kingdom to anyone he wants even if they can't legally buy alcohol.Share This Article0 Commentarii 0 Distribuiri 146 Views -

WWW.INFORMATIONWEEK.COMInfogram TestTechTarget and Informa Techs Digital Business Combine.TechTarget and InformaTechTarget and Informa Techs Digital Business Combine.Together, we power an unparalleled network of 220+ online properties covering 10,000+ granular topics, serving an audience of 50+ million professionals with original, objective content from trusted sources. We help you gain critical insights and make more informed decisions across your business priorities.Cyber ResilienceInfogram TestInfogram TestJanuary 29, 20251 Min ReadNever Miss a Beat: Get a snapshot of the issues affecting the IT industry straight to your inbox.SIGN-UPYou May Also LikeWebinarsMore WebinarsReportsMore Reports0 Commentarii 0 Distribuiri 146 Views

WWW.INFORMATIONWEEK.COMInfogram TestTechTarget and Informa Techs Digital Business Combine.TechTarget and InformaTechTarget and Informa Techs Digital Business Combine.Together, we power an unparalleled network of 220+ online properties covering 10,000+ granular topics, serving an audience of 50+ million professionals with original, objective content from trusted sources. We help you gain critical insights and make more informed decisions across your business priorities.Cyber ResilienceInfogram TestInfogram TestJanuary 29, 20251 Min ReadNever Miss a Beat: Get a snapshot of the issues affecting the IT industry straight to your inbox.SIGN-UPYou May Also LikeWebinarsMore WebinarsReportsMore Reports0 Commentarii 0 Distribuiri 146 Views -

SCREENCRUSH.COMEvery Clue that Doctor Doom Was Always in the MCUFans seem to be pretty mixed on the casting of Robert Downey Jr. as Doctor Doomso far. Some are vocally upset with Marvels decision to useDoom to replace Kang as the main villain of the Marvel Cinematic Universes ongoing Multiverse Saga. As it stands now, we should get our first official look at Downeys Doom in one of Marvels upcoming movies, likelyThe Fantastic Four: First Steps, leading into his first big movie,Avengers: Doomsday.But what if we told you that this pivot, while certainly created in the last few years to cover Jonathan Majors dismissal and the end of the Kang storyline, actually makes total sense within the overall story of the MCU? What if we told you that if you look closely, you might just spot hints that Doom has been pulling the strings in the MCU all along? Thats right, and in our latest Marvel video, well explain how Marvel has been leavingclues about Doom everywhere, and point out all thehints that sets upDoomsday and the upcomingAvengers: Secret Wars.Watch our look at Doom,Doomsday, and the MCU below:READ MORE: The Worst Marvel Comics EverIf you liked that video on all of the clues that Doctor Doom was the secret Big Bad in the Marvel Cinematic Universe all along, check out more of our videos below, including one on the controversial casting of Robert Downey Jr. as Doctor Doom and whether Marvel is making a mistake with the shift away from Kang, one on some of the most notable deleted scenes in the history of Marvel, and how they could have changed the MCU forever, and one on why Eternals isnt as bad as you think and why we still want a sequel. Plus, theres tons more videos over atScreenCrushs YouTube channel. Be sure to subscribe to catch all our future episodes.The next Marvel Cinematic Universe movie, Captain America: Brave New World, is scheduled to open in theaters on February 14, 2025.Sign up for Disney+ here.Get our free mobile appEvery Marvel Cinematic Universe Movie, Ranked From Worst to BestIt started with Iron Man and its continued and expanded ever since. Its the Marvel Cinematic Universe, with 34 movies and counting. But whats the best and the worst? We ranked them all.0 Commentarii 0 Distribuiri 156 Views

SCREENCRUSH.COMEvery Clue that Doctor Doom Was Always in the MCUFans seem to be pretty mixed on the casting of Robert Downey Jr. as Doctor Doomso far. Some are vocally upset with Marvels decision to useDoom to replace Kang as the main villain of the Marvel Cinematic Universes ongoing Multiverse Saga. As it stands now, we should get our first official look at Downeys Doom in one of Marvels upcoming movies, likelyThe Fantastic Four: First Steps, leading into his first big movie,Avengers: Doomsday.But what if we told you that this pivot, while certainly created in the last few years to cover Jonathan Majors dismissal and the end of the Kang storyline, actually makes total sense within the overall story of the MCU? What if we told you that if you look closely, you might just spot hints that Doom has been pulling the strings in the MCU all along? Thats right, and in our latest Marvel video, well explain how Marvel has been leavingclues about Doom everywhere, and point out all thehints that sets upDoomsday and the upcomingAvengers: Secret Wars.Watch our look at Doom,Doomsday, and the MCU below:READ MORE: The Worst Marvel Comics EverIf you liked that video on all of the clues that Doctor Doom was the secret Big Bad in the Marvel Cinematic Universe all along, check out more of our videos below, including one on the controversial casting of Robert Downey Jr. as Doctor Doom and whether Marvel is making a mistake with the shift away from Kang, one on some of the most notable deleted scenes in the history of Marvel, and how they could have changed the MCU forever, and one on why Eternals isnt as bad as you think and why we still want a sequel. Plus, theres tons more videos over atScreenCrushs YouTube channel. Be sure to subscribe to catch all our future episodes.The next Marvel Cinematic Universe movie, Captain America: Brave New World, is scheduled to open in theaters on February 14, 2025.Sign up for Disney+ here.Get our free mobile appEvery Marvel Cinematic Universe Movie, Ranked From Worst to BestIt started with Iron Man and its continued and expanded ever since. Its the Marvel Cinematic Universe, with 34 movies and counting. But whats the best and the worst? We ranked them all.0 Commentarii 0 Distribuiri 156 Views -

WWW.CNET.COMThe Fed Didn't Budge on Interest Rates. Here's Why That's a Big DealThe Federal Reserve paused interest rate cuts at today's meeting. Suffice it to say, this wasn'tthe most interesting decision of 2025 so far.Still, given that the Fed cut interest rates three times in 2024, we were hoping for a path toward lower borrowing costs. Last week, President Donald Trump said he would demand that interest rates drop immediately.The Fed is currently in a holding pattern. There's too much uncertainty about the incoming administration's policies, especially regarding immigration and trade, to make any major policy shifts.While the Fed is expected to hold interest rates steady for a while, anything could change in the next few months. Future decisions about interest rates will impact our finances, including how much we earn from oursavings accounts,how much extra we owe for carrying credit card debt and whether we can afford to take out a car loan or a mortgage.Here's a quick primer on interest rates and what today's Fed decision could mean for your money.Read more: Trump Can't Lower Interest Rates. But What Power Does the President Have Over the Fed?How the Fed determines interest ratesThe Fed meets eight times a year to assess the economy's health and set monetary policy, primarily through changes to the federal funds rate, the benchmark interest rate used by US banks to lend or borrow money to each other overnight.Imagine a situation where the financial institutions and banks make up an orchestra, and the Fed is the conductor, directing the markets and controlling the money supply. So although the Fed doesn't directly set the percentage we owe on our credit cards and mortgages, its policies have a ripple effect on the everyday consumer.Interest is the cost you pay to borrow money, whether that's through a loan or credit card. When the central bank "maestro" increases interest rates, many banks tend to follow. This can make the debt we're carrying more expensive (such as a 22% credit card APR vs. a 17% APR), but it can also lead to higher savings yields (a 5% APY vs. a 2% APY).When the Fed lowers rates, as it did three times last year, banks tend to drop their interest rates, too. Our debt could become slightly less cumbersome (though not by much), and we won't get as high a yield on our savings.How inflation and the job market affect the FedFinancial experts and market watchers spend a lot of time predicting the timing of interest rate cuts and hikes based on the direction of the economy, with a special focus on inflation and the labor market.Economists are concerned that the Trump administration is implementing policies that will reignite inflation. Because economic activity has continued to expand and inflation remains somewhat elevated, the Fed isn't likely to make any interest rate cuts until later this year.Generally, when inflation is high and the economy is in overdrive, the Fed tries to pump the brakes by setting higher interest rates and decreasing the money supply. Between March 2022 and July 2023, the Fed raised the federal funds rate 11 times, which helped slow down record-high price growth.However, the Fed takes a risk if it brings inflation down too much. Any major, rapid decline in economic activity can cause a major spike in joblessness, leading to a recession. You might hear the phrase "soft landing," which refers to the balancing act of keeping inflation in check and unemployment low.The economy can't be too hot or too cold. Like the porridge for Goldilocks, it has to be just right.Read more: What This Week's Fed Decision Means for Mortgage RatesWhat today's Fed decision means for your moneyOver the last few years, high interest rates have made credit and loans more expensive. Although last year's interest rate cuts didn't immediately improve our financial situation, the government's monetary policy this year will definitely impact your money over the long term.Here's what today's decision means for credit card APRs, mortgage ratesand savings rates. Credit card APRsHolding the federal funds rate steady could cause credit card issuers to charge the same annual percentage rate on your outstanding balance each month. However, every issuer has different rules about changing APRs."Some credit card APRs have inched down slightly after the Fed's rate cuts last year, but they're still really high. Even if you can't pay off the full balance, try to make more than the minimum payment each month to avoid additional interest. If you qualify for a balance transfer card or personal loan with a lower interest rate, either could potentially help you pay off your debt faster."--Tiffany Connors, CNET Money editor Mortgage ratesThe Fed's decisions impact overall borrowing costs and financial conditions, which in turn influence the housing market andhome loan rates, although this is not a one-to-one relationship."Even as the Fed holds interest rates steady, mortgage rates will continue to fluctuate in response to new economic data and political announcements. For the Fed to resume cutting interest rates and for mortgage rates to drop, further progress on inflation is needed. Even then, mortgage rates tend to rise quickly and fall slowly. It could take until the end of the year for rates to get into the low-6% range." --Katherine Watt, CNET Money housing reporter Savings ratesSavings rates are variable and move in lockstep with the federal funds rate, so your annual percentage yield may go down following more rate cuts later this year. Just remember that not all banks are created equal, and we regularly track the best high-yield savings accounts and certificates of deposits at CNET."A rate pause means we're not likely to see any significant change in CD and savings account APYs, at least for the time being. That gives savers more time to maximize their earnings by locking in a high CD rate or taking advantage of high savings rates while they're still around."--Kelly Ernst, CNET Money editorWhat's next for interest rate cutsExperts anticipate the potential for two rate cuts sometime in 2025, though market watchers and economists usually have varying opinions about the Fed's monetary decisions. The pace of interest rate reductions will depend on the job market, inflation pressures and other political and financial developments.0 Commentarii 0 Distribuiri 133 Views

WWW.CNET.COMThe Fed Didn't Budge on Interest Rates. Here's Why That's a Big DealThe Federal Reserve paused interest rate cuts at today's meeting. Suffice it to say, this wasn'tthe most interesting decision of 2025 so far.Still, given that the Fed cut interest rates three times in 2024, we were hoping for a path toward lower borrowing costs. Last week, President Donald Trump said he would demand that interest rates drop immediately.The Fed is currently in a holding pattern. There's too much uncertainty about the incoming administration's policies, especially regarding immigration and trade, to make any major policy shifts.While the Fed is expected to hold interest rates steady for a while, anything could change in the next few months. Future decisions about interest rates will impact our finances, including how much we earn from oursavings accounts,how much extra we owe for carrying credit card debt and whether we can afford to take out a car loan or a mortgage.Here's a quick primer on interest rates and what today's Fed decision could mean for your money.Read more: Trump Can't Lower Interest Rates. But What Power Does the President Have Over the Fed?How the Fed determines interest ratesThe Fed meets eight times a year to assess the economy's health and set monetary policy, primarily through changes to the federal funds rate, the benchmark interest rate used by US banks to lend or borrow money to each other overnight.Imagine a situation where the financial institutions and banks make up an orchestra, and the Fed is the conductor, directing the markets and controlling the money supply. So although the Fed doesn't directly set the percentage we owe on our credit cards and mortgages, its policies have a ripple effect on the everyday consumer.Interest is the cost you pay to borrow money, whether that's through a loan or credit card. When the central bank "maestro" increases interest rates, many banks tend to follow. This can make the debt we're carrying more expensive (such as a 22% credit card APR vs. a 17% APR), but it can also lead to higher savings yields (a 5% APY vs. a 2% APY).When the Fed lowers rates, as it did three times last year, banks tend to drop their interest rates, too. Our debt could become slightly less cumbersome (though not by much), and we won't get as high a yield on our savings.How inflation and the job market affect the FedFinancial experts and market watchers spend a lot of time predicting the timing of interest rate cuts and hikes based on the direction of the economy, with a special focus on inflation and the labor market.Economists are concerned that the Trump administration is implementing policies that will reignite inflation. Because economic activity has continued to expand and inflation remains somewhat elevated, the Fed isn't likely to make any interest rate cuts until later this year.Generally, when inflation is high and the economy is in overdrive, the Fed tries to pump the brakes by setting higher interest rates and decreasing the money supply. Between March 2022 and July 2023, the Fed raised the federal funds rate 11 times, which helped slow down record-high price growth.However, the Fed takes a risk if it brings inflation down too much. Any major, rapid decline in economic activity can cause a major spike in joblessness, leading to a recession. You might hear the phrase "soft landing," which refers to the balancing act of keeping inflation in check and unemployment low.The economy can't be too hot or too cold. Like the porridge for Goldilocks, it has to be just right.Read more: What This Week's Fed Decision Means for Mortgage RatesWhat today's Fed decision means for your moneyOver the last few years, high interest rates have made credit and loans more expensive. Although last year's interest rate cuts didn't immediately improve our financial situation, the government's monetary policy this year will definitely impact your money over the long term.Here's what today's decision means for credit card APRs, mortgage ratesand savings rates. Credit card APRsHolding the federal funds rate steady could cause credit card issuers to charge the same annual percentage rate on your outstanding balance each month. However, every issuer has different rules about changing APRs."Some credit card APRs have inched down slightly after the Fed's rate cuts last year, but they're still really high. Even if you can't pay off the full balance, try to make more than the minimum payment each month to avoid additional interest. If you qualify for a balance transfer card or personal loan with a lower interest rate, either could potentially help you pay off your debt faster."--Tiffany Connors, CNET Money editor Mortgage ratesThe Fed's decisions impact overall borrowing costs and financial conditions, which in turn influence the housing market andhome loan rates, although this is not a one-to-one relationship."Even as the Fed holds interest rates steady, mortgage rates will continue to fluctuate in response to new economic data and political announcements. For the Fed to resume cutting interest rates and for mortgage rates to drop, further progress on inflation is needed. Even then, mortgage rates tend to rise quickly and fall slowly. It could take until the end of the year for rates to get into the low-6% range." --Katherine Watt, CNET Money housing reporter Savings ratesSavings rates are variable and move in lockstep with the federal funds rate, so your annual percentage yield may go down following more rate cuts later this year. Just remember that not all banks are created equal, and we regularly track the best high-yield savings accounts and certificates of deposits at CNET."A rate pause means we're not likely to see any significant change in CD and savings account APYs, at least for the time being. That gives savers more time to maximize their earnings by locking in a high CD rate or taking advantage of high savings rates while they're still around."--Kelly Ernst, CNET Money editorWhat's next for interest rate cutsExperts anticipate the potential for two rate cuts sometime in 2025, though market watchers and economists usually have varying opinions about the Fed's monetary decisions. The pace of interest rate reductions will depend on the job market, inflation pressures and other political and financial developments.0 Commentarii 0 Distribuiri 133 Views -

WWW.CNET.COMThe Fed Paused Rates. Here's What That Means for CD and Savings Account APYsKey takeaways The Federal Reserve paused rates at its January meeting.Today's best savings accounts and CDs offer up APYs as high as 5%.Rate cuts are expected later this year, so now's the time to maximize your earnings. After cutting interest rates at its last three meetings, the Federal Reserve opted to pause rates today, keeping them at a target range of 4.25% to 4.5%. In its post-meeting statement, the Fed noted that "economic activity has continued to expand at a solid pace," but "the economic outlook is uncertain." Pausing rates allows the Fed to see how factors like the new administration's policies affect inflation and other economic indicators.That's good news for savers, who can still take advantage of certificate of deposit and savings account rates as high as 5% annual percentage yield, or APY."I expect CD and savings rates to hold steady where they are currently while the dust settles a bit," said Dana Menard, CFP, founder and lead financial planner at Twin Cities Wealth Strategies.Here's what you need to know about how the Fed's latest decision affects your savings -- and what you should do to maximize your money now.How the Federal Reserve influences deposit ratesThe Fed meets eight times a year to assess the health of the US economy and vote on the federal funds rate, the rate banks use to lend and borrow money. While the Fed's decision to change rates doesn't directly affect savings rates, changes in APYs typically follow. The changes can take several weeks or even months to take effect.Although some banks set their deposit account APYs according to the direction of the federal funds rate, timing and specific rates may vary. "Some big banks are swimming in deposits and they don't need to pay up to bring in more," said Greg McBride, chief financial analyst at Bankrate.As such, there may be dramatic differences in account interest rates from bank to bank. "People should shop around, and they shouldn't just shop around today; they should shop around a week from now, a month from now and three months from now," said Gary Zimmerman, CEO of MaxMyInterest.The Fed paused rates. Now what?Jordan Gilberti, certified financial planner and senior lead planner at Facet, recommends preparing for the worst-case scenario when thinking about strategies for growing your savings, whether you're setting aside cash for an emergency or building a sinking fund. Now that rates are on pause, purchasing a CD or moving your money to a high-yield savings account as soon as possible is the best way to maximize your interest earnings."For savers, it's probably a good idea to lock in a higher rate now if you're looking at longer-term CDs," said Taylor Kovar, CFP, founder and CEO of 11 Financial. "If you want more flexibility, short-term options might make sense in case rates shift again.You can also consider building a CD ladder, suggests John Buran, CEO of Flushing Financial, the parent company of Flushing Bank. This strategy allows you to take advantage of still-high interest rates in the short term but also lock in rates for the longterm in case APYs continue to drop.The best savings accounts to open nowUnderstanding the pros and cons of each deposit account type can help you make the best choice for your needs.Traditional savings accountsMost financial institutions offer traditional savings accounts. If you already have a relationship with a bank, opening a traditional savings account with it can be convenient. These accounts often pay minimal interest on your savings. The average annual percentage yield for a traditional savings account is only 0.41%, according to the Federal Deposit Insurance Corporation.ProsTraditional savings accounts are widely available at most financial institutions.Your money is easily accessible when you need it.If your account is held at an FDIC- or NCUA-insured institution, it's protected up to $250,000 per person, per institution.ConsInterest rates are typically lower than the national average.Variable rates can change at any time.High-yield savings accountA high-yield savings account is an interest-earning account often offered by online banks, credit unions or other financial service institutions. The best APYs available on high-yield savings accounts go up to 5%.ProsSome high-yield savings accounts earn more than 10 times more than traditional savings accounts.Your money is easily accessible when you need it.If your account is held at an FDIC- or NCUA-insured institution, it's protected up to $250,000 per person, per institution if the institution fails.ConsAvailability can be limited. These accounts aren't offered by all banks or credit unions.Often available from online-only banks with no physical branches. You must be comfortable with a digital banking environment.Many accounts are provided by online-only banks with no physical branches. You must be comfortable with an entirely digital banking experience.Variable rates can change at any time.Certificate of depositA certificate of deposit is a deposit account that offers a fixed rate for a specific time, or term. In exchange for fixed growth, you agree not to withdraw your money before the term ends. The main benefit of a CD is that your money grows over time at a predetermined APY.Top CDs, for example, currently earn APYs as high as 4.65%.ProsA fixed rate applies to the CD's entire term.CDs are widely available at most banks or credit unions.If your account is held at an FDIC- or NCUA-insured institution, it's protected up to $250,000 per person, per institution.ConsYour money is tied up for the duration of the CD's term.Early withdrawal penalties reduce returns if you need to take out money before the term ends.No-penalty CDA no-penalty CD is a specialty CD that offers a fixed rate for a specific term, like traditional CDs. This deposit account doesn't impose an early withdrawal penalty if you need to access your money before the term ends. These CDs are generally less widely available, and the APYs are lower, but the additional flexibility can be worth a slight drop in rates.ProsA fixed rate applies to the CD's entire term.Withdrawals before the CD matures don't incur penalties.If your account is held at an FDIC- or NCUA-insured institution, it's protected up to $250,000 per person.ConsNo-penalty CDs aren't widely available at most banks or credit unions.These CDs generally earn a lower APY than a traditional CD.Tips for finding the right savings account or CDKeep in mind that larger, brand-name banks with bigger marketing budgets may not offer the most competitive rates on savings accounts and CDs. Community or regional banks, credit unions and online-only banks often offer higher rates on deposit accounts to attract new customers.The best high-yield savings accounts continue to offer APYs up to 5%, low fees and no minimum balance requirements. The best CD rates are as high as 4.65% APY.When evaluating a savings account, note any fees associated with opening or maintaining the account. CDs offer a safe, fixed rate of growth -- as long as you can leave the funds in the account until the maturity date to avoid early withdrawal penalties. Terms can last anywhere from three months to five years or more.Additionally, confirm that your deposit is insured by either the FDIC (for banks) or the National Credit Union Administration (for credit unions). This protects your money for up to $250,000 per person, per institution if the bank fails. You should also compare APYs and how easily you can access your money before making your decision.Elevated savings rates are still availableWith interest rates currently paused, there's still time to maximize your earnings with a high-yield savings account or CD. But the sooner you act, the better. Experts expect the Fed will resume rate cuts later this year.If you're not already earning a competitive interest rate on your savings, consider locking in one of today's best CD rates or moving your funds to a high-yield savings account to boost your earnings.More on the Fed's rate pause0 Commentarii 0 Distribuiri 127 Views

WWW.CNET.COMThe Fed Paused Rates. Here's What That Means for CD and Savings Account APYsKey takeaways The Federal Reserve paused rates at its January meeting.Today's best savings accounts and CDs offer up APYs as high as 5%.Rate cuts are expected later this year, so now's the time to maximize your earnings. After cutting interest rates at its last three meetings, the Federal Reserve opted to pause rates today, keeping them at a target range of 4.25% to 4.5%. In its post-meeting statement, the Fed noted that "economic activity has continued to expand at a solid pace," but "the economic outlook is uncertain." Pausing rates allows the Fed to see how factors like the new administration's policies affect inflation and other economic indicators.That's good news for savers, who can still take advantage of certificate of deposit and savings account rates as high as 5% annual percentage yield, or APY."I expect CD and savings rates to hold steady where they are currently while the dust settles a bit," said Dana Menard, CFP, founder and lead financial planner at Twin Cities Wealth Strategies.Here's what you need to know about how the Fed's latest decision affects your savings -- and what you should do to maximize your money now.How the Federal Reserve influences deposit ratesThe Fed meets eight times a year to assess the health of the US economy and vote on the federal funds rate, the rate banks use to lend and borrow money. While the Fed's decision to change rates doesn't directly affect savings rates, changes in APYs typically follow. The changes can take several weeks or even months to take effect.Although some banks set their deposit account APYs according to the direction of the federal funds rate, timing and specific rates may vary. "Some big banks are swimming in deposits and they don't need to pay up to bring in more," said Greg McBride, chief financial analyst at Bankrate.As such, there may be dramatic differences in account interest rates from bank to bank. "People should shop around, and they shouldn't just shop around today; they should shop around a week from now, a month from now and three months from now," said Gary Zimmerman, CEO of MaxMyInterest.The Fed paused rates. Now what?Jordan Gilberti, certified financial planner and senior lead planner at Facet, recommends preparing for the worst-case scenario when thinking about strategies for growing your savings, whether you're setting aside cash for an emergency or building a sinking fund. Now that rates are on pause, purchasing a CD or moving your money to a high-yield savings account as soon as possible is the best way to maximize your interest earnings."For savers, it's probably a good idea to lock in a higher rate now if you're looking at longer-term CDs," said Taylor Kovar, CFP, founder and CEO of 11 Financial. "If you want more flexibility, short-term options might make sense in case rates shift again.You can also consider building a CD ladder, suggests John Buran, CEO of Flushing Financial, the parent company of Flushing Bank. This strategy allows you to take advantage of still-high interest rates in the short term but also lock in rates for the longterm in case APYs continue to drop.The best savings accounts to open nowUnderstanding the pros and cons of each deposit account type can help you make the best choice for your needs.Traditional savings accountsMost financial institutions offer traditional savings accounts. If you already have a relationship with a bank, opening a traditional savings account with it can be convenient. These accounts often pay minimal interest on your savings. The average annual percentage yield for a traditional savings account is only 0.41%, according to the Federal Deposit Insurance Corporation.ProsTraditional savings accounts are widely available at most financial institutions.Your money is easily accessible when you need it.If your account is held at an FDIC- or NCUA-insured institution, it's protected up to $250,000 per person, per institution.ConsInterest rates are typically lower than the national average.Variable rates can change at any time.High-yield savings accountA high-yield savings account is an interest-earning account often offered by online banks, credit unions or other financial service institutions. The best APYs available on high-yield savings accounts go up to 5%.ProsSome high-yield savings accounts earn more than 10 times more than traditional savings accounts.Your money is easily accessible when you need it.If your account is held at an FDIC- or NCUA-insured institution, it's protected up to $250,000 per person, per institution if the institution fails.ConsAvailability can be limited. These accounts aren't offered by all banks or credit unions.Often available from online-only banks with no physical branches. You must be comfortable with a digital banking environment.Many accounts are provided by online-only banks with no physical branches. You must be comfortable with an entirely digital banking experience.Variable rates can change at any time.Certificate of depositA certificate of deposit is a deposit account that offers a fixed rate for a specific time, or term. In exchange for fixed growth, you agree not to withdraw your money before the term ends. The main benefit of a CD is that your money grows over time at a predetermined APY.Top CDs, for example, currently earn APYs as high as 4.65%.ProsA fixed rate applies to the CD's entire term.CDs are widely available at most banks or credit unions.If your account is held at an FDIC- or NCUA-insured institution, it's protected up to $250,000 per person, per institution.ConsYour money is tied up for the duration of the CD's term.Early withdrawal penalties reduce returns if you need to take out money before the term ends.No-penalty CDA no-penalty CD is a specialty CD that offers a fixed rate for a specific term, like traditional CDs. This deposit account doesn't impose an early withdrawal penalty if you need to access your money before the term ends. These CDs are generally less widely available, and the APYs are lower, but the additional flexibility can be worth a slight drop in rates.ProsA fixed rate applies to the CD's entire term.Withdrawals before the CD matures don't incur penalties.If your account is held at an FDIC- or NCUA-insured institution, it's protected up to $250,000 per person.ConsNo-penalty CDs aren't widely available at most banks or credit unions.These CDs generally earn a lower APY than a traditional CD.Tips for finding the right savings account or CDKeep in mind that larger, brand-name banks with bigger marketing budgets may not offer the most competitive rates on savings accounts and CDs. Community or regional banks, credit unions and online-only banks often offer higher rates on deposit accounts to attract new customers.The best high-yield savings accounts continue to offer APYs up to 5%, low fees and no minimum balance requirements. The best CD rates are as high as 4.65% APY.When evaluating a savings account, note any fees associated with opening or maintaining the account. CDs offer a safe, fixed rate of growth -- as long as you can leave the funds in the account until the maturity date to avoid early withdrawal penalties. Terms can last anywhere from three months to five years or more.Additionally, confirm that your deposit is insured by either the FDIC (for banks) or the National Credit Union Administration (for credit unions). This protects your money for up to $250,000 per person, per institution if the bank fails. You should also compare APYs and how easily you can access your money before making your decision.Elevated savings rates are still availableWith interest rates currently paused, there's still time to maximize your earnings with a high-yield savings account or CD. But the sooner you act, the better. Experts expect the Fed will resume rate cuts later this year.If you're not already earning a competitive interest rate on your savings, consider locking in one of today's best CD rates or moving your funds to a high-yield savings account to boost your earnings.More on the Fed's rate pause0 Commentarii 0 Distribuiri 127 Views