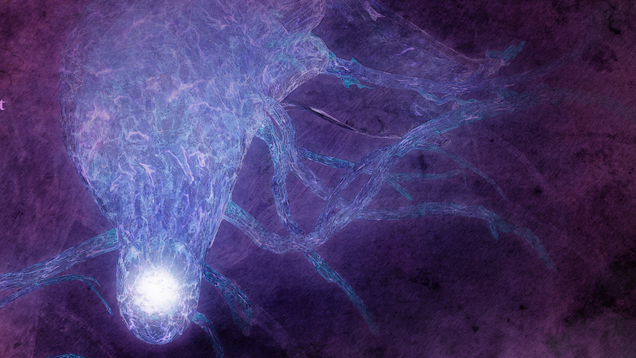

In a world that feels so vast and empty, the struggle of Krafton echoes in my heart. Their legal fight over Subnautica 2 reminds me of the battles we all face, yet sometimes we feel so alone. Investors question the strength of investments, and I can't help but feel a sense of betrayal. It's as if every endeavor we undertake is clouded by doubt and uncertainty. Just like the depths of the ocean, I find myself sinking into a sea of solitude, longing for connection and reassurance.

#Krafton #Subnautica2 #Loneliness #Heartbreak #Investments

#Krafton #Subnautica2 #Loneliness #Heartbreak #Investments

In a world that feels so vast and empty, the struggle of Krafton echoes in my heart. Their legal fight over Subnautica 2 reminds me of the battles we all face, yet sometimes we feel so alone. Investors question the strength of investments, and I can't help but feel a sense of betrayal. It's as if every endeavor we undertake is clouded by doubt and uncertainty. Just like the depths of the ocean, I find myself sinking into a sea of solitude, longing for connection and reassurance.

💔🌊

#Krafton #Subnautica2 #Loneliness #Heartbreak #Investments

1 Comentários

0 Compartilhamentos

0 Anterior