0 Commentarii

0 Distribuiri

Director

Director

-

Vă rugăm să vă autentificați pentru a vă dori, partaja și comenta!

-

GAMERANT.COMMarvel Rivals: How to Save RatatoskrMarvel Rivals has a lot of hidden lore and Easter eggs that allow the players to experience stories different from those of the Marvel Universe. Players can meet characters like Bats the Ghost Dog or Spider-Zero, interact with them in different secret locations, and earn rewards for it.0 Commentarii 0 Distribuiri

GAMERANT.COMMarvel Rivals: How to Save RatatoskrMarvel Rivals has a lot of hidden lore and Easter eggs that allow the players to experience stories different from those of the Marvel Universe. Players can meet characters like Bats the Ghost Dog or Spider-Zero, interact with them in different secret locations, and earn rewards for it.0 Commentarii 0 Distribuiri -

GAMERANT.COMTokyo Ghoul Author Ishida Sui Set To Release A New MangaFans of the incredibly popular series, Tokyo Ghoul, are always looking for new content from the legendary mangaka, Ishida Sui.0 Commentarii 0 Distribuiri

GAMERANT.COMTokyo Ghoul Author Ishida Sui Set To Release A New MangaFans of the incredibly popular series, Tokyo Ghoul, are always looking for new content from the legendary mangaka, Ishida Sui.0 Commentarii 0 Distribuiri -

UXDESIGN.CCWhy is healthcare design so painful?Is the problem in the systems, the doctors, or the patients?Just relax. Those were the words I heard as I sat on the examination table, and the confident, older German doctor exited my exam room. I looked down at my bare foot, confused. Was that it? Was my appointment over? Was just relax this physicians professional recommendation to treat my hurtingfoot?Still not sure what was happening, I put my sock, shoe, and jacket back on, exited the room, and went home feeling disappointed and frustrated.This wasnt my first doctors appointment ever, of course. In fact, in my 30-something years, Ive had interactions with multiple types of physicians, and healthcare systems, around the world. Ive lived in Sweden, the U.S., and Germanythree countries with different structures and cultural expectations. The Swedish system is mostly public, the U.S. is mostly private, and Germany is a mix of both. My personal belief is that healthcare is a human right and should be provided to all citizens. However, this is not an article about universal vs. Private healthcarethats a whole other story. Rather, its a series of questions and reflections on why healthcare design is so painful, no matter where in the world youre experiencing it.As a designer, Im passionate about human-centered design and creation experiences that uplift, empower, and help people. So I cant help but wonder: when it comes to healthcare, where does it all breakdown?Is it thesystem?Most people would agree that healthcare systems, no matter where you live, are incredibly complex. The number of stakeholders, the pressure, the money involved, the government regulationstheyre often so tangled and interdependent that many physicians dont even fully understand the inner workings.Having experienced three different healthcare systems in my life, I can confidently tell you that none of them seem to favor human-centered design. In the U.S., people who are already in pain are handed more stress and anxiety by having to navigate referrals, bills, copays, and other insurance black holes. In Sweden, you might spend months waiting for an MRI (albeit a free one), all the while knowing that after the MRI, it may be several more months until youre able to receive surgery or treatment. A similarly broken system most likely played a role in my two-minute interaction with Dr. Just Relax in Germany, leaving me staring blankly at my foot as he rushed off to his nextpatient.Humans have solved many challenges in our modern world. So why havent we figured out a way to implement large-scale human-centered design solutions within any of thesesystems?Ive seen many inspiring experiments in bringing restorative, human-centered design to healthcare. Most recently, I went to an exhibition about spaces that heal at a local museum here inMunich.Das Kranke(n)haus exhibit inMunichThe exhibition Das Kranke(n)haus features 13 international case studies that demonstrate how the use of evidence-based design tools can lead to creating more healing hospital environments and architecture, and after visiting, I felt a sense of hope for health care and humanity. I had a similar feeling the first time I watched Mass Design Group founder Michael Murphys Ted talk Architecture thats built toheal.These are only two examples, of course. And Im sure there are many more out there. But why are these the exceptions, not the norm? Is it that the health care system is too complex, and everyone who tries to implement these kinds of changes at a mass scale fails because of the size, complexity, and seemingly purposeful confusion of the system? Or is curing patients simply not a sustainable business modeland everyone knows it, except the patients?Is it thedoctors?My recent interaction with the German foot specialist was frustrating, but not unusual. Like many other physicians, it didnt seem like he was interested in taking the time to listen to my concerns or understand my situation. At one point, he even mentioned how his wife overreacted about foot pain once, too, which both seemed like a very gender-biased comment, and also, wasnt helpful to me in any way. It was the opposite of empathetic, which is what we all hope for from our physicians. Maybe his medical advice was actually right for my situation. Maybe there was nothing clinically wrong with my foot, and I did just need to rest it. But I, the patient, left the room more frustrated and confused than when I came in. The problem wasnt so much the advice itself but rather the way he spoke, or rather didnt speak, to me. I felt like a box on a piece of paper that he needed to check-off in order to move onto the next one, rather than a person who needed to be heard, acknowledged, and caredfor.I recently saw an Instagram reel comparing doctors on TV to doctors in real life. The skit is meant to contrast the lack of engagement and questionable advice we get from our own doctors, to the way fake MDs on TV go above and beyond to help their patients with everything. The clip is unquestionably funny, but also incredibly truthfulwhich makes the comments even harder toread.Ive never worked in the medical field, so I can only imagine what its like to be a doctor in our current landscape. Youre asked to be a scientific expert and a walking textbook, while also having great social skills, a sense of humor, and a calming bedside manner. Youre given five minutes to see each patient because insurance carriers are only interested in maximizing their profitsand you have a three-month waiting list for appointmentsand any time youre not spending with patients is dedicated to finishing and filing paperwork. Honestly, it sounds like it might be just as frustrating being a doctor as it is being a patient sometimes.But where does the responsibility actually lie? And where can the challenges be solved? Is the pressure from the system so great that it genuinely prevents doctors from more thoroughly investigating patient problems, or taking an extra minute to ask how someone is really doing? Or does the issue go back even further in the chainwhere medical schools, teaching hospitals, and professional mentors need to be providing doctors with different training, skill sets, and compassion practices in order to interact in a more human-centered way?Are we, the patients, theproblem?When I go to the doctor, I expect to be met with curiosity and compassion. I expect to be seen by a physician who asks me questions, who pays attention to my answers, and who tries to understand my unique circumstances. I expect to leavefeeling better. But more often than not, Im disappointed. The advice I receive is often shallow, and the time I get to spend sharing my concerns is typically limited. This is all without taking into account the cold, physical space of most doctors officesits hard to just relax in a room that doesnt center care and well-being. With my designer hat on, I am constantly noticing the lack of warmth in many of these environments. Maybe its naive, but I believe that healthcare spaces, and experiences, should be designed SO well that even the most vulnerable are seen, treated, and regarded with respect, care, andlove.I often ask myself if these expectations are too high, or too idealistic.. Many of my closest friends would say that I overanalyze many things when it comes to design in the world around me. Writing about it here probably proves them right. And yet in an industry that touches literally every human being, oftentimes in incredibly vulnerable states, I believe that bringing a critical eye is necessary if were ever going to createchange.This post asks a lot of questions, and I know that the answers are varied and complex. BUT they are questions that we need to keep bringingup.Does healthcare have to be this painful? Is there a better way, or should I justrelax?Resources:Health Design Thinking(book)Architecture thats meant to heal (TEDtalk)Das Kranke(n)haus (exhibit)Why is healthcare design so painful? was originally published in UX Collective on Medium, where people are continuing the conversation by highlighting and responding to this story.0 Commentarii 0 Distribuiri

UXDESIGN.CCWhy is healthcare design so painful?Is the problem in the systems, the doctors, or the patients?Just relax. Those were the words I heard as I sat on the examination table, and the confident, older German doctor exited my exam room. I looked down at my bare foot, confused. Was that it? Was my appointment over? Was just relax this physicians professional recommendation to treat my hurtingfoot?Still not sure what was happening, I put my sock, shoe, and jacket back on, exited the room, and went home feeling disappointed and frustrated.This wasnt my first doctors appointment ever, of course. In fact, in my 30-something years, Ive had interactions with multiple types of physicians, and healthcare systems, around the world. Ive lived in Sweden, the U.S., and Germanythree countries with different structures and cultural expectations. The Swedish system is mostly public, the U.S. is mostly private, and Germany is a mix of both. My personal belief is that healthcare is a human right and should be provided to all citizens. However, this is not an article about universal vs. Private healthcarethats a whole other story. Rather, its a series of questions and reflections on why healthcare design is so painful, no matter where in the world youre experiencing it.As a designer, Im passionate about human-centered design and creation experiences that uplift, empower, and help people. So I cant help but wonder: when it comes to healthcare, where does it all breakdown?Is it thesystem?Most people would agree that healthcare systems, no matter where you live, are incredibly complex. The number of stakeholders, the pressure, the money involved, the government regulationstheyre often so tangled and interdependent that many physicians dont even fully understand the inner workings.Having experienced three different healthcare systems in my life, I can confidently tell you that none of them seem to favor human-centered design. In the U.S., people who are already in pain are handed more stress and anxiety by having to navigate referrals, bills, copays, and other insurance black holes. In Sweden, you might spend months waiting for an MRI (albeit a free one), all the while knowing that after the MRI, it may be several more months until youre able to receive surgery or treatment. A similarly broken system most likely played a role in my two-minute interaction with Dr. Just Relax in Germany, leaving me staring blankly at my foot as he rushed off to his nextpatient.Humans have solved many challenges in our modern world. So why havent we figured out a way to implement large-scale human-centered design solutions within any of thesesystems?Ive seen many inspiring experiments in bringing restorative, human-centered design to healthcare. Most recently, I went to an exhibition about spaces that heal at a local museum here inMunich.Das Kranke(n)haus exhibit inMunichThe exhibition Das Kranke(n)haus features 13 international case studies that demonstrate how the use of evidence-based design tools can lead to creating more healing hospital environments and architecture, and after visiting, I felt a sense of hope for health care and humanity. I had a similar feeling the first time I watched Mass Design Group founder Michael Murphys Ted talk Architecture thats built toheal.These are only two examples, of course. And Im sure there are many more out there. But why are these the exceptions, not the norm? Is it that the health care system is too complex, and everyone who tries to implement these kinds of changes at a mass scale fails because of the size, complexity, and seemingly purposeful confusion of the system? Or is curing patients simply not a sustainable business modeland everyone knows it, except the patients?Is it thedoctors?My recent interaction with the German foot specialist was frustrating, but not unusual. Like many other physicians, it didnt seem like he was interested in taking the time to listen to my concerns or understand my situation. At one point, he even mentioned how his wife overreacted about foot pain once, too, which both seemed like a very gender-biased comment, and also, wasnt helpful to me in any way. It was the opposite of empathetic, which is what we all hope for from our physicians. Maybe his medical advice was actually right for my situation. Maybe there was nothing clinically wrong with my foot, and I did just need to rest it. But I, the patient, left the room more frustrated and confused than when I came in. The problem wasnt so much the advice itself but rather the way he spoke, or rather didnt speak, to me. I felt like a box on a piece of paper that he needed to check-off in order to move onto the next one, rather than a person who needed to be heard, acknowledged, and caredfor.I recently saw an Instagram reel comparing doctors on TV to doctors in real life. The skit is meant to contrast the lack of engagement and questionable advice we get from our own doctors, to the way fake MDs on TV go above and beyond to help their patients with everything. The clip is unquestionably funny, but also incredibly truthfulwhich makes the comments even harder toread.Ive never worked in the medical field, so I can only imagine what its like to be a doctor in our current landscape. Youre asked to be a scientific expert and a walking textbook, while also having great social skills, a sense of humor, and a calming bedside manner. Youre given five minutes to see each patient because insurance carriers are only interested in maximizing their profitsand you have a three-month waiting list for appointmentsand any time youre not spending with patients is dedicated to finishing and filing paperwork. Honestly, it sounds like it might be just as frustrating being a doctor as it is being a patient sometimes.But where does the responsibility actually lie? And where can the challenges be solved? Is the pressure from the system so great that it genuinely prevents doctors from more thoroughly investigating patient problems, or taking an extra minute to ask how someone is really doing? Or does the issue go back even further in the chainwhere medical schools, teaching hospitals, and professional mentors need to be providing doctors with different training, skill sets, and compassion practices in order to interact in a more human-centered way?Are we, the patients, theproblem?When I go to the doctor, I expect to be met with curiosity and compassion. I expect to be seen by a physician who asks me questions, who pays attention to my answers, and who tries to understand my unique circumstances. I expect to leavefeeling better. But more often than not, Im disappointed. The advice I receive is often shallow, and the time I get to spend sharing my concerns is typically limited. This is all without taking into account the cold, physical space of most doctors officesits hard to just relax in a room that doesnt center care and well-being. With my designer hat on, I am constantly noticing the lack of warmth in many of these environments. Maybe its naive, but I believe that healthcare spaces, and experiences, should be designed SO well that even the most vulnerable are seen, treated, and regarded with respect, care, andlove.I often ask myself if these expectations are too high, or too idealistic.. Many of my closest friends would say that I overanalyze many things when it comes to design in the world around me. Writing about it here probably proves them right. And yet in an industry that touches literally every human being, oftentimes in incredibly vulnerable states, I believe that bringing a critical eye is necessary if were ever going to createchange.This post asks a lot of questions, and I know that the answers are varied and complex. BUT they are questions that we need to keep bringingup.Does healthcare have to be this painful? Is there a better way, or should I justrelax?Resources:Health Design Thinking(book)Architecture thats meant to heal (TEDtalk)Das Kranke(n)haus (exhibit)Why is healthcare design so painful? was originally published in UX Collective on Medium, where people are continuing the conversation by highlighting and responding to this story.0 Commentarii 0 Distribuiri -

UXDESIGN.CCFigmas not a design toolits a Rube Goldberg machine for avoiding codeFigmas not a design toolits a Rube Goldberg machine for avoidingcodeThe absurdity of spending countless hours crafting interactive designs in a medium no one will everuse.Image source: artsy.netSomewhere, a designer is meticulously adjusting auto-layout settings in Figmacrafting an intricate set of nested components, master variants, and esoteric constraintsall to simulate the behavior of a simplebutton.They pat themselves on the back, believing theyve mastered digital design. Meanwhile, a developer glances at the file, sighs, and codes the button in fiveminutes.This, my friends, is the state of design todaya profession increasingly dominated by individuals who have convinced themselves that learning to code is beneath them, but will spend hours constructing elaborate and needlessly complex prototypes in Figmalike someone determined to build a Rube Goldberg machine to flip a pancake, all because they refuse to touch aspatula.Image source: https://mymodernmet.com/modern-rube-goldberg-machine/For those who dont know, a Rube Goldberg machine is a deliberately complicated and impractical contraption built to perform a simple task in the most indirect way imaginablelike setting off a series of dominoes, gears, levers, and pulleys just to pour a cup of coffee. Sure, it works in theory, but its needlessly complicated, inefficient, and disconnected from how things function inreality.Similarly, designers crafting elaborate prototypes in Figma to mimic basic digital interactions are essentially building digital Rube Goldberg machines. If youre going to spend hours creating intricate simulations in Figma, you might as well put that effort directly into codebecause in the end, code is where your designs must ultimately function.The cognitive dissonance of no-code designersA funny thing has happened in the design world. While other technical fields are expanding their skill setsmarketers are learning SQL and Python to better analyze data and automate tasks, product managers are embracing programming languages to enhance collaboration with developers, and copywriters are using automation to streamline content creationsome designers seem to be moving in the opposite direction.Instead of embracing even a rudimentary understanding of HTML, CSS, or JavaScript, designers have retreated into a fortress of abstraction. Theyll tweak their Figma files endlessly, push back on any technical constraints, and then smugly hand over their perfect designonly to be baffled when development comes back with a hundred questions about feasibility.The irony? Ive seen designers on Reddit complain about how developers never implement their vision correctly.NewsflashIf you dont understand even basic developer language, dont be surprised when your work gets lost in translation.The myth of the puredesignerThe argument against learning code often goes something likethis:Designers should focus on design. Learning code limits creativity. Its not our job to worry about development.Cute sentiment. But heres the problemdesign, at its core, has always been constrained by medium and execution. Architects dont just sketch fantasy structures and expect engineers to figure it out. Industrial designers dont just create wild, unbuildable chair concepts and assume factories will make itwork.And yet, digital designers somehow believe they are the exceptionthat they can create whatever they want in Figma and just toss it over thewall.A pure designer who refuses to learn code is like a playwright who refuses to understand how a stage works. Sure, you can write grandiose scenes where a castle explodes into fireworks while a dragon skydives through the wreckage, but dont be shocked when the director hands your script back and says, Yeah, we cant dothat.Figma masterythe designers securityblanketLets be clearFigma is a fantastic tool. But the obsession with making it the toolturning it into an entire ecosystem where designers never have to interact with codeis a symptom of a deeperproblem.I get itIm old enough to remember when Flash was the Figma of its time, and I loved it. I could build entire websites without touching a line of code. Unlike Figma, though, we could actually publish those sites without rebuilding them elsewhere.But when Flash was killed off, I learned to codeand that turned out to be a great thing. It gave me an invaluable skill that allows me to create and communicate in the digital space with a level of precision and fluency I wouldnt trade for anything.Image source: thenounproject.comThe industry has coddled digital designers into thinking they can exist in a bubble of vector shapes and auto-layouts, building increasingly complex systems of components, design tokens, and variantsall while actively avoiding the fundamental principles of the medium they are designing for.Imagine a chef who refuses to touch a stove but insists they should still be in charge of the restaurants menu. Or a car designer who never bothers to learn about aerodynamics. Thats what a Figma-only designer isa person who obsesses over visual perfection but has no grasp of how their work will actually function in the realworld.The fear of coding usually stems from uncertainty, not complexityLets not sugarcoat itlearning code isnt hard. This isnt about becoming a full-stack engineer or writing production-level React components. Were talking about basic web literacyunderstanding how CSS affects layout, why JavaScript controls interactivity, and how browsers actually renderdesign.But too many designers cling to the excuse that learning code is too technical, too left-brained, or not creative enough. And yet, these same people will gleefully spend hours wrestling with Figmas prototype settings, constructing elaborate, component libraries that require a PhD to decipher.So lets call it what it isfear. Not of the code itself, but of being held accountable. I get it, Ive been there. When I first started, coding felt like this huge, scary thing. Because once you actually understand how it works, you cant just blame developers for your designs fallingapart.Image source:RedditTime to grow up, designersDesign is a craft. And a real craftsperson understands the tools, materials, and constraints of their trade. Digital designers who refuse to learn even the basics of front-end development are like architects who have never set foot on a construction site. They are spectators in their own professioncontent to create artifacts, rather than real, usable products.So, if youre a designer who still thinks code isnt your concern, heres my advicedrop the Rube Goldberg act, pick up the damn spatula, and start cooking. You might just find that the pancakes turns outbetter.Dont miss out! Join my email list and receive the latestcontent.Figmas not a design toolits a Rube Goldberg machine for avoiding code was originally published in UX Collective on Medium, where people are continuing the conversation by highlighting and responding to this story.0 Commentarii 0 Distribuiri

UXDESIGN.CCFigmas not a design toolits a Rube Goldberg machine for avoiding codeFigmas not a design toolits a Rube Goldberg machine for avoidingcodeThe absurdity of spending countless hours crafting interactive designs in a medium no one will everuse.Image source: artsy.netSomewhere, a designer is meticulously adjusting auto-layout settings in Figmacrafting an intricate set of nested components, master variants, and esoteric constraintsall to simulate the behavior of a simplebutton.They pat themselves on the back, believing theyve mastered digital design. Meanwhile, a developer glances at the file, sighs, and codes the button in fiveminutes.This, my friends, is the state of design todaya profession increasingly dominated by individuals who have convinced themselves that learning to code is beneath them, but will spend hours constructing elaborate and needlessly complex prototypes in Figmalike someone determined to build a Rube Goldberg machine to flip a pancake, all because they refuse to touch aspatula.Image source: https://mymodernmet.com/modern-rube-goldberg-machine/For those who dont know, a Rube Goldberg machine is a deliberately complicated and impractical contraption built to perform a simple task in the most indirect way imaginablelike setting off a series of dominoes, gears, levers, and pulleys just to pour a cup of coffee. Sure, it works in theory, but its needlessly complicated, inefficient, and disconnected from how things function inreality.Similarly, designers crafting elaborate prototypes in Figma to mimic basic digital interactions are essentially building digital Rube Goldberg machines. If youre going to spend hours creating intricate simulations in Figma, you might as well put that effort directly into codebecause in the end, code is where your designs must ultimately function.The cognitive dissonance of no-code designersA funny thing has happened in the design world. While other technical fields are expanding their skill setsmarketers are learning SQL and Python to better analyze data and automate tasks, product managers are embracing programming languages to enhance collaboration with developers, and copywriters are using automation to streamline content creationsome designers seem to be moving in the opposite direction.Instead of embracing even a rudimentary understanding of HTML, CSS, or JavaScript, designers have retreated into a fortress of abstraction. Theyll tweak their Figma files endlessly, push back on any technical constraints, and then smugly hand over their perfect designonly to be baffled when development comes back with a hundred questions about feasibility.The irony? Ive seen designers on Reddit complain about how developers never implement their vision correctly.NewsflashIf you dont understand even basic developer language, dont be surprised when your work gets lost in translation.The myth of the puredesignerThe argument against learning code often goes something likethis:Designers should focus on design. Learning code limits creativity. Its not our job to worry about development.Cute sentiment. But heres the problemdesign, at its core, has always been constrained by medium and execution. Architects dont just sketch fantasy structures and expect engineers to figure it out. Industrial designers dont just create wild, unbuildable chair concepts and assume factories will make itwork.And yet, digital designers somehow believe they are the exceptionthat they can create whatever they want in Figma and just toss it over thewall.A pure designer who refuses to learn code is like a playwright who refuses to understand how a stage works. Sure, you can write grandiose scenes where a castle explodes into fireworks while a dragon skydives through the wreckage, but dont be shocked when the director hands your script back and says, Yeah, we cant dothat.Figma masterythe designers securityblanketLets be clearFigma is a fantastic tool. But the obsession with making it the toolturning it into an entire ecosystem where designers never have to interact with codeis a symptom of a deeperproblem.I get itIm old enough to remember when Flash was the Figma of its time, and I loved it. I could build entire websites without touching a line of code. Unlike Figma, though, we could actually publish those sites without rebuilding them elsewhere.But when Flash was killed off, I learned to codeand that turned out to be a great thing. It gave me an invaluable skill that allows me to create and communicate in the digital space with a level of precision and fluency I wouldnt trade for anything.Image source: thenounproject.comThe industry has coddled digital designers into thinking they can exist in a bubble of vector shapes and auto-layouts, building increasingly complex systems of components, design tokens, and variantsall while actively avoiding the fundamental principles of the medium they are designing for.Imagine a chef who refuses to touch a stove but insists they should still be in charge of the restaurants menu. Or a car designer who never bothers to learn about aerodynamics. Thats what a Figma-only designer isa person who obsesses over visual perfection but has no grasp of how their work will actually function in the realworld.The fear of coding usually stems from uncertainty, not complexityLets not sugarcoat itlearning code isnt hard. This isnt about becoming a full-stack engineer or writing production-level React components. Were talking about basic web literacyunderstanding how CSS affects layout, why JavaScript controls interactivity, and how browsers actually renderdesign.But too many designers cling to the excuse that learning code is too technical, too left-brained, or not creative enough. And yet, these same people will gleefully spend hours wrestling with Figmas prototype settings, constructing elaborate, component libraries that require a PhD to decipher.So lets call it what it isfear. Not of the code itself, but of being held accountable. I get it, Ive been there. When I first started, coding felt like this huge, scary thing. Because once you actually understand how it works, you cant just blame developers for your designs fallingapart.Image source:RedditTime to grow up, designersDesign is a craft. And a real craftsperson understands the tools, materials, and constraints of their trade. Digital designers who refuse to learn even the basics of front-end development are like architects who have never set foot on a construction site. They are spectators in their own professioncontent to create artifacts, rather than real, usable products.So, if youre a designer who still thinks code isnt your concern, heres my advicedrop the Rube Goldberg act, pick up the damn spatula, and start cooking. You might just find that the pancakes turns outbetter.Dont miss out! Join my email list and receive the latestcontent.Figmas not a design toolits a Rube Goldberg machine for avoiding code was originally published in UX Collective on Medium, where people are continuing the conversation by highlighting and responding to this story.0 Commentarii 0 Distribuiri -

WWW.ENGADGET.COMDirector of rural broadband program exits with a warning about shift to worse satellite internetEvan Feinman, who directed the $42.5 billion Broadband Equity, Access, and Deployment (BEAD) Program meant to bring high-speed internet access to rural areas, exited the role on Friday after he was not reappointed for a new term, according to ProPublicas Craig Silverman. In an email sent to staffers, which Silverman shared screenshots of on Bluesky, Feinman warned against changes proposed by the new administration that could benefit technology that delivers slower speeds at higher costs to the household paying the bill in order to line Elon Musk's pockets.BEAD was established in 2021, and the new Secretary of Commerce Howard Lutnick recently announced that the Commerce Department would be overhauling the program, which he said has not connected a single person to the internet due to the previous administration's handling of it. In a statement, Lutnick called for a tech-neutral stance, which would do away with the preference for faster fiber connections and open the door for a shift toward satellite internet like that offered by Elon Musks Starlink. Lutnick also slammed woke mandates, favoritism towards certain technologies, and burdensome regulations.In the email shared on Sunday, Feinman urged colleagues to speak up in favor of removing needless requirements, but warned against a shift away from fiber. The bottom line is, he wrote:The new administration seems to want to make changes that ignore the clear direction laid out by Congress, reduce the number of American homes and businesses that get fiber connections, and increase the number that get satellite connections. The degree of that shift remains unknown, but regardless of size, it will be a disservice to rural and small-town America. Stranding all or part of rural America with worse internet so that we can make the worlds richest man even richer is yet another in a long line of betrayals by Washington.This article originally appeared on Engadget at https://www.engadget.com/big-tech/director-of-rural-broadband-program-exits-with-a-warning-about-shift-to-worse-satellite-internet-223204374.html?src=rss0 Commentarii 0 Distribuiri

-

WWW.YANKODESIGN.COMThe Dynamic Leaves Tower With Geometric Planters Is Set To Transform Vlores SkylinePlanned to ascend in Vlore, along Albanias picturesque Riviera, The Leaves by Davide Macullo Architects is designed as an extension of its striking natural environment. This tower embodies an organic representation of nature, light, and its location, effortlessly blending into the landscape. Its form is attuned to the rolling contours of the land and the rising treetops.Composed of two interlocking volumes, the building rotates to present reflective surfaces that capture the Mediterranean light. A three-dimensional, hieratic facade featuring geometric planters allows vibrant greenery to flourish within its architecture. The use of prefabricated concrete panels, shaded in five tones to mimic the natural palette of the surrounding landscape across the four seasons, further integrates the structure into its setting.Designer: David Macullo ArchitectsSituated in a unique location between the sea and mountains and oriented towards the sunset, the sites geological formations significantly influence the architectural approach. The design by Davide Macullo Architects draws inspiration from the natural forces that have sculpted the landscape, such as its elevated ridges and carved valleys. This reflects a philosophy of construction in harmony with the environment rather than imposing on it.The Leaves features rotating volumes that create reflective surfaces that interact dynamically with the ever-shifting daylight. This design approach ensures that the building adapts to its surroundings throughout the day. The facades protruding elements also serve to deconstruct the volume, rendering it both permeable and lightweight. These projections mimic the leaves of the surrounding treetops, capturing the play of light and shadow. They provide sun protection during the hot summer months while permitting sunlight to filter into the interiors during the winter, enhancing the buildings energy efficiency and occupant comfort.To maintain a genuine connection with the Genius Loci, or the unique spirit of the place, the design consciously avoids relying on technological interventions. Instead, it achieves a focus on sustainability solely through architectural elements. This approach ensures that the building remains true to its environment and context. The floor plan is meticulously designed in a perfectly square grid, which highlights the buildings central significance and its harmonious relationship with the natural undulations of the land. This geometric precision serves as a visual and structural anchor, emphasizing the buildings role as a focal point within the landscape.The square functions as a pivotal element around which both the context and the buildings projections revolve. This clever design evokes the fluid motion of a spiral or helix, suggesting movement and dynamism. Such a configuration enhances the architectural aesthetic and reinforces the buildings integration into its surroundings, allowing it to echo the natural rhythms and forms of the landscape in which it resides.The post The Dynamic Leaves Tower With Geometric Planters Is Set To Transform Vlores Skyline first appeared on Yanko Design.0 Commentarii 0 Distribuiri

WWW.YANKODESIGN.COMThe Dynamic Leaves Tower With Geometric Planters Is Set To Transform Vlores SkylinePlanned to ascend in Vlore, along Albanias picturesque Riviera, The Leaves by Davide Macullo Architects is designed as an extension of its striking natural environment. This tower embodies an organic representation of nature, light, and its location, effortlessly blending into the landscape. Its form is attuned to the rolling contours of the land and the rising treetops.Composed of two interlocking volumes, the building rotates to present reflective surfaces that capture the Mediterranean light. A three-dimensional, hieratic facade featuring geometric planters allows vibrant greenery to flourish within its architecture. The use of prefabricated concrete panels, shaded in five tones to mimic the natural palette of the surrounding landscape across the four seasons, further integrates the structure into its setting.Designer: David Macullo ArchitectsSituated in a unique location between the sea and mountains and oriented towards the sunset, the sites geological formations significantly influence the architectural approach. The design by Davide Macullo Architects draws inspiration from the natural forces that have sculpted the landscape, such as its elevated ridges and carved valleys. This reflects a philosophy of construction in harmony with the environment rather than imposing on it.The Leaves features rotating volumes that create reflective surfaces that interact dynamically with the ever-shifting daylight. This design approach ensures that the building adapts to its surroundings throughout the day. The facades protruding elements also serve to deconstruct the volume, rendering it both permeable and lightweight. These projections mimic the leaves of the surrounding treetops, capturing the play of light and shadow. They provide sun protection during the hot summer months while permitting sunlight to filter into the interiors during the winter, enhancing the buildings energy efficiency and occupant comfort.To maintain a genuine connection with the Genius Loci, or the unique spirit of the place, the design consciously avoids relying on technological interventions. Instead, it achieves a focus on sustainability solely through architectural elements. This approach ensures that the building remains true to its environment and context. The floor plan is meticulously designed in a perfectly square grid, which highlights the buildings central significance and its harmonious relationship with the natural undulations of the land. This geometric precision serves as a visual and structural anchor, emphasizing the buildings role as a focal point within the landscape.The square functions as a pivotal element around which both the context and the buildings projections revolve. This clever design evokes the fluid motion of a spiral or helix, suggesting movement and dynamism. Such a configuration enhances the architectural aesthetic and reinforces the buildings integration into its surroundings, allowing it to echo the natural rhythms and forms of the landscape in which it resides.The post The Dynamic Leaves Tower With Geometric Planters Is Set To Transform Vlores Skyline first appeared on Yanko Design.0 Commentarii 0 Distribuiri -

WWW.YANKODESIGN.COMAngular Brilliance: The Dallas A-Frame That Transforms Spatial Constraints Into Design BrillianceThe A-frame house represents one of architectures most recognizable formsa silhouette so elemental it can be drawn with just three lines. This triangular structure, defined by steeply pitched roof planes that extend nearly to the ground, gained immense popularity in post-war America as an affordable and distinctive alternative to conventional home designs. Most commonly associated with vacation cabins in mountain or lakeside settings, the A-frame has rarely been translated into sophisticated urban residential architecture.Designer: Jack MorganIn Dallas, however, one exceptional residence challenges this typologys rustic associations. Standing at 7707 Mason Dells Drive, this striking A-frame home transforms what might be considered a limiting structural form into an expansive living environment where light, volume, and material work in harmonious concert.Jack Morgans Architectural LegacyThis architectural gem represents the vision of Jack Morgan, who designed the home in 1966 for its original owners, Marvin and Vivian Jones. The property remained in the same family until recently, making its market appearance at $3 million, a rare opportunity to acquire a piece of Dallas architectural history. Morgans design showcases his mastery of midcentury principles through bold lines and a seamless indoor-outdoor connection that defines the eras finest residential work.The property contains personal elements that reflect the original owners story, including a boulder on the front lawn that was reportedly a memento from one of Marvins first real estate deals. Such details add layers of historical significance to the homes architectural importance.Morgans work extends beyond this A-frame. He also co-designed the celebrated Meadows Building in Dallas with J.N. McCammon. This A-frame in the upscale JanMar neighborhood shows how versatile and innovative Morgan was as an architect.The Distinctive ProfileThe home announces itself through its unmistakable silhouettea sharply pitched roof that creates the classic triangular A-frame profile against the Texas sky. What elevates this particular example is its sophisticated material execution. Warm brick walls provide substantial mass and textural richness, while the front faade features a dramatic glass entrance that creates an immediate visual focal point.This entrance deserves careful examination. Framed in black metal with expansive glass panels, it creates a transparent portal that offers glimpses into the illuminated interior. The contrast between solid brick walls and a glass-filled entrance establishes a visual rhythm that continues throughout the home. The house number 7707 is integrated into the composition, adding a subtle graphic element to the faade.The surrounding landscape complements the architecture with a restrained approachmanicured shrubs and a simple aggregate walkway lead visitors to the entrance. Mature trees frame the property, their organic forms softening the geometric precision of the architecture while providing natural context.Interior Volume: Light and Space TransformedStepping inside reveals the true advantage of the A-frame designextraordinary vertical space that creates a sense of volume rarely found in residential architecture. The interior soars upward, following the roofs dramatic pitch, with exposed wooden beams traversing the white ceiling. These structural elements add warmth and visual rhythm while emphasizing the height of the space.The most remarkable feature is the wall of glass that forms the rear of the main living area. These floor-to-ceiling windows dissolve the boundary between inside and outside, flooding the interior with natural light while framing views of the surrounding landscape. This transparency transforms the outdoor environment into a living backdrop that shifts with daylight and seasons.Terrazzo flooring provides a sophisticated foundation for the space. This classic midcentury materialwith its speckled pattern and subtle reflective qualityadds visual texture while bouncing light throughout the interior. The result is a space that feels larger than its actual dimensions, with light amplified and diffused across surfaces.A Thoughtful Renovation for Modern LivingWhile preserving the integrity of Morgans original design, the home has undergone a meticulous renovation that adapts the space for contemporary living. The thoughtful transformation removed several interior walls to create an effortless flow between the great room and the reimagined chefs kitchen. This open concept, as the listing notes, makes calling something open concept proud to be open concept.The kitchen represents a masterclass in modern luxury with its oversized islandso huge its literally a continent, according to the listing. Premium appliances elevate the culinary experience, including a 48 Wolf range, a SubZero refrigerator and freezer combo, a SubZero wine cooler, a Scotsman ice maker, and a Cove dishwasher. Custom walnut cabinetry enriches the space, harmonizing with the restored parquet and terrazzo floors throughout the home.Soaring vaulted and beamed ceilings anchor the grand living space, which is illuminated by $50,000 in Troy Lighting chandeliers. These chandeliers serve as both functional lighting and artistic focal points. Their metallic finish creates moments of brilliance as they catch and reflect light throughout the day.The renovation included complete updates to essential systems, including new HVAC, a tankless water heater, and a modernized electrical and plumbing infrastructure. These behind-the-scenes improvements ensure the home functions as beautifully as it looks.Unique Features: From Indoor Pool to Living TreePerhaps the most extraordinary feature of this 4,189-square-foot residence is its stunning indoor pool area, which adds nearly 1,800 additional square feet to the home. Complete with a wet bar and an adjacent library lined with custom wood shelving, this space transforms the home into an entertainers dream, allowing for swimming under the stars regardless of weather conditions.The primary suite opens to a solarium through custom three-track sliders, offering a serene, light-filled retreat. In a remarkable integration of architecture and nature, a living tree grows through the solariums floor and extends through the ceiling, creating a seamless connection between the built environment and the natural world.The redesigned bathrooms exude sophistication with exotic quartz, Frank Lloyd Wright collection fixtures, smart toilets, and a luxurious wet room with a freestanding tub. While not a Wright creation, these thoughtful references to the legendary architects work create a deliberate connection to his design legacy.The dining area deserves special mentionpositioned to take advantage of the dramatic glass walls, it creates a space where, as the listing poetically describes, laughter fills the air and the aroma of delicious food wafts through the space. The large, inviting table becomes a centerpiece for gathering, sharing stories, and creating memories.Material Dialogue and Thoughtful ContrastsThe interior creates a sophisticated conversation between materials that balances warmth and coolness, texture and smoothness. Rich wood paneling on select walls provides tactile depth and visual warmth while white surfaces elsewhere maximize light reflection. The exposed brick interior walls echo the exterior treatment, creating continuity between inside and outside.The furniture selection demonstrates a refined approach to contemporary living within a midcentury shell. Clean-lined gray sofas anchor the living space without competing with the architecture. Cognac leather ottomans add warmth and textural contrast. The brass-accented coffee table introduces metallic elements that catch light and add visual interest without overwhelming the space.In one variation of the A-frame design seen in the images, warm wood ceiling cladding creates a more intimate, cabin-like atmosphere while still maintaining the dramatic A-frame geometry. This demonstrates the versatility of the A-frame concept, which can shift from grand and open to cozy and enveloping through material choices.Light ChoreographyPerhaps the most compelling aspect of this home is how it choreographs the experience of light. The vast glass expanses allow sunlight to penetrate deep into the interior, creating ever-changing patterns as the sun moves across the sky. The high ceilings prevent the space from feeling confined despite the triangular constraints, instead creating a cathedral-like atmosphere of openness and elevation.The home demonstrates how architectural constraintsin this case, the triangular limitations of the A-framecan become opportunities for dramatic spatial experiences. Rather than fighting against the sloped walls, the design embraces them as defining elements that create a unique living environment, unlike conventional homes.Urban Sophistication in A-Frame FormThis Dallas A-frame represents a sophisticated interpretation of a form often associated with vacation cabins and mountain retreats. By executing the A-frame in brick rather than the more typical wood cladding, and by incorporating refined finishes and furnishings, the home elevates what could be a casual architectural style into something permanently residential and sophisticated.Set on 0.61 acres in the prestigious JanMar neighborhood, the homes successful integration of dramatic form, thoughtful material selection, and connection to the outdoors creates a living environment that feels both sheltering and expansive. It demonstrates how architectural boldness, when executed with restraint and attention to detail, can create spaces that remain relevant and compelling across decades.As this remarkable property enters the market at $3 million, it offers more than just a homeit presents an opportunity to inhabit a piece of architectural poetry where geometric constraints have been transformed into spatial liberation. In the hands of a visionary architect like Jack Morgan, the simple A-frame form becomes something extraordinary: a living environment that continues to inspire and delight more than half a century after its creation.The post Angular Brilliance: The Dallas A-Frame That Transforms Spatial Constraints Into Design Brilliance first appeared on Yanko Design.0 Commentarii 0 Distribuiri

WWW.YANKODESIGN.COMAngular Brilliance: The Dallas A-Frame That Transforms Spatial Constraints Into Design BrillianceThe A-frame house represents one of architectures most recognizable formsa silhouette so elemental it can be drawn with just three lines. This triangular structure, defined by steeply pitched roof planes that extend nearly to the ground, gained immense popularity in post-war America as an affordable and distinctive alternative to conventional home designs. Most commonly associated with vacation cabins in mountain or lakeside settings, the A-frame has rarely been translated into sophisticated urban residential architecture.Designer: Jack MorganIn Dallas, however, one exceptional residence challenges this typologys rustic associations. Standing at 7707 Mason Dells Drive, this striking A-frame home transforms what might be considered a limiting structural form into an expansive living environment where light, volume, and material work in harmonious concert.Jack Morgans Architectural LegacyThis architectural gem represents the vision of Jack Morgan, who designed the home in 1966 for its original owners, Marvin and Vivian Jones. The property remained in the same family until recently, making its market appearance at $3 million, a rare opportunity to acquire a piece of Dallas architectural history. Morgans design showcases his mastery of midcentury principles through bold lines and a seamless indoor-outdoor connection that defines the eras finest residential work.The property contains personal elements that reflect the original owners story, including a boulder on the front lawn that was reportedly a memento from one of Marvins first real estate deals. Such details add layers of historical significance to the homes architectural importance.Morgans work extends beyond this A-frame. He also co-designed the celebrated Meadows Building in Dallas with J.N. McCammon. This A-frame in the upscale JanMar neighborhood shows how versatile and innovative Morgan was as an architect.The Distinctive ProfileThe home announces itself through its unmistakable silhouettea sharply pitched roof that creates the classic triangular A-frame profile against the Texas sky. What elevates this particular example is its sophisticated material execution. Warm brick walls provide substantial mass and textural richness, while the front faade features a dramatic glass entrance that creates an immediate visual focal point.This entrance deserves careful examination. Framed in black metal with expansive glass panels, it creates a transparent portal that offers glimpses into the illuminated interior. The contrast between solid brick walls and a glass-filled entrance establishes a visual rhythm that continues throughout the home. The house number 7707 is integrated into the composition, adding a subtle graphic element to the faade.The surrounding landscape complements the architecture with a restrained approachmanicured shrubs and a simple aggregate walkway lead visitors to the entrance. Mature trees frame the property, their organic forms softening the geometric precision of the architecture while providing natural context.Interior Volume: Light and Space TransformedStepping inside reveals the true advantage of the A-frame designextraordinary vertical space that creates a sense of volume rarely found in residential architecture. The interior soars upward, following the roofs dramatic pitch, with exposed wooden beams traversing the white ceiling. These structural elements add warmth and visual rhythm while emphasizing the height of the space.The most remarkable feature is the wall of glass that forms the rear of the main living area. These floor-to-ceiling windows dissolve the boundary between inside and outside, flooding the interior with natural light while framing views of the surrounding landscape. This transparency transforms the outdoor environment into a living backdrop that shifts with daylight and seasons.Terrazzo flooring provides a sophisticated foundation for the space. This classic midcentury materialwith its speckled pattern and subtle reflective qualityadds visual texture while bouncing light throughout the interior. The result is a space that feels larger than its actual dimensions, with light amplified and diffused across surfaces.A Thoughtful Renovation for Modern LivingWhile preserving the integrity of Morgans original design, the home has undergone a meticulous renovation that adapts the space for contemporary living. The thoughtful transformation removed several interior walls to create an effortless flow between the great room and the reimagined chefs kitchen. This open concept, as the listing notes, makes calling something open concept proud to be open concept.The kitchen represents a masterclass in modern luxury with its oversized islandso huge its literally a continent, according to the listing. Premium appliances elevate the culinary experience, including a 48 Wolf range, a SubZero refrigerator and freezer combo, a SubZero wine cooler, a Scotsman ice maker, and a Cove dishwasher. Custom walnut cabinetry enriches the space, harmonizing with the restored parquet and terrazzo floors throughout the home.Soaring vaulted and beamed ceilings anchor the grand living space, which is illuminated by $50,000 in Troy Lighting chandeliers. These chandeliers serve as both functional lighting and artistic focal points. Their metallic finish creates moments of brilliance as they catch and reflect light throughout the day.The renovation included complete updates to essential systems, including new HVAC, a tankless water heater, and a modernized electrical and plumbing infrastructure. These behind-the-scenes improvements ensure the home functions as beautifully as it looks.Unique Features: From Indoor Pool to Living TreePerhaps the most extraordinary feature of this 4,189-square-foot residence is its stunning indoor pool area, which adds nearly 1,800 additional square feet to the home. Complete with a wet bar and an adjacent library lined with custom wood shelving, this space transforms the home into an entertainers dream, allowing for swimming under the stars regardless of weather conditions.The primary suite opens to a solarium through custom three-track sliders, offering a serene, light-filled retreat. In a remarkable integration of architecture and nature, a living tree grows through the solariums floor and extends through the ceiling, creating a seamless connection between the built environment and the natural world.The redesigned bathrooms exude sophistication with exotic quartz, Frank Lloyd Wright collection fixtures, smart toilets, and a luxurious wet room with a freestanding tub. While not a Wright creation, these thoughtful references to the legendary architects work create a deliberate connection to his design legacy.The dining area deserves special mentionpositioned to take advantage of the dramatic glass walls, it creates a space where, as the listing poetically describes, laughter fills the air and the aroma of delicious food wafts through the space. The large, inviting table becomes a centerpiece for gathering, sharing stories, and creating memories.Material Dialogue and Thoughtful ContrastsThe interior creates a sophisticated conversation between materials that balances warmth and coolness, texture and smoothness. Rich wood paneling on select walls provides tactile depth and visual warmth while white surfaces elsewhere maximize light reflection. The exposed brick interior walls echo the exterior treatment, creating continuity between inside and outside.The furniture selection demonstrates a refined approach to contemporary living within a midcentury shell. Clean-lined gray sofas anchor the living space without competing with the architecture. Cognac leather ottomans add warmth and textural contrast. The brass-accented coffee table introduces metallic elements that catch light and add visual interest without overwhelming the space.In one variation of the A-frame design seen in the images, warm wood ceiling cladding creates a more intimate, cabin-like atmosphere while still maintaining the dramatic A-frame geometry. This demonstrates the versatility of the A-frame concept, which can shift from grand and open to cozy and enveloping through material choices.Light ChoreographyPerhaps the most compelling aspect of this home is how it choreographs the experience of light. The vast glass expanses allow sunlight to penetrate deep into the interior, creating ever-changing patterns as the sun moves across the sky. The high ceilings prevent the space from feeling confined despite the triangular constraints, instead creating a cathedral-like atmosphere of openness and elevation.The home demonstrates how architectural constraintsin this case, the triangular limitations of the A-framecan become opportunities for dramatic spatial experiences. Rather than fighting against the sloped walls, the design embraces them as defining elements that create a unique living environment, unlike conventional homes.Urban Sophistication in A-Frame FormThis Dallas A-frame represents a sophisticated interpretation of a form often associated with vacation cabins and mountain retreats. By executing the A-frame in brick rather than the more typical wood cladding, and by incorporating refined finishes and furnishings, the home elevates what could be a casual architectural style into something permanently residential and sophisticated.Set on 0.61 acres in the prestigious JanMar neighborhood, the homes successful integration of dramatic form, thoughtful material selection, and connection to the outdoors creates a living environment that feels both sheltering and expansive. It demonstrates how architectural boldness, when executed with restraint and attention to detail, can create spaces that remain relevant and compelling across decades.As this remarkable property enters the market at $3 million, it offers more than just a homeit presents an opportunity to inhabit a piece of architectural poetry where geometric constraints have been transformed into spatial liberation. In the hands of a visionary architect like Jack Morgan, the simple A-frame form becomes something extraordinary: a living environment that continues to inspire and delight more than half a century after its creation.The post Angular Brilliance: The Dallas A-Frame That Transforms Spatial Constraints Into Design Brilliance first appeared on Yanko Design.0 Commentarii 0 Distribuiri -

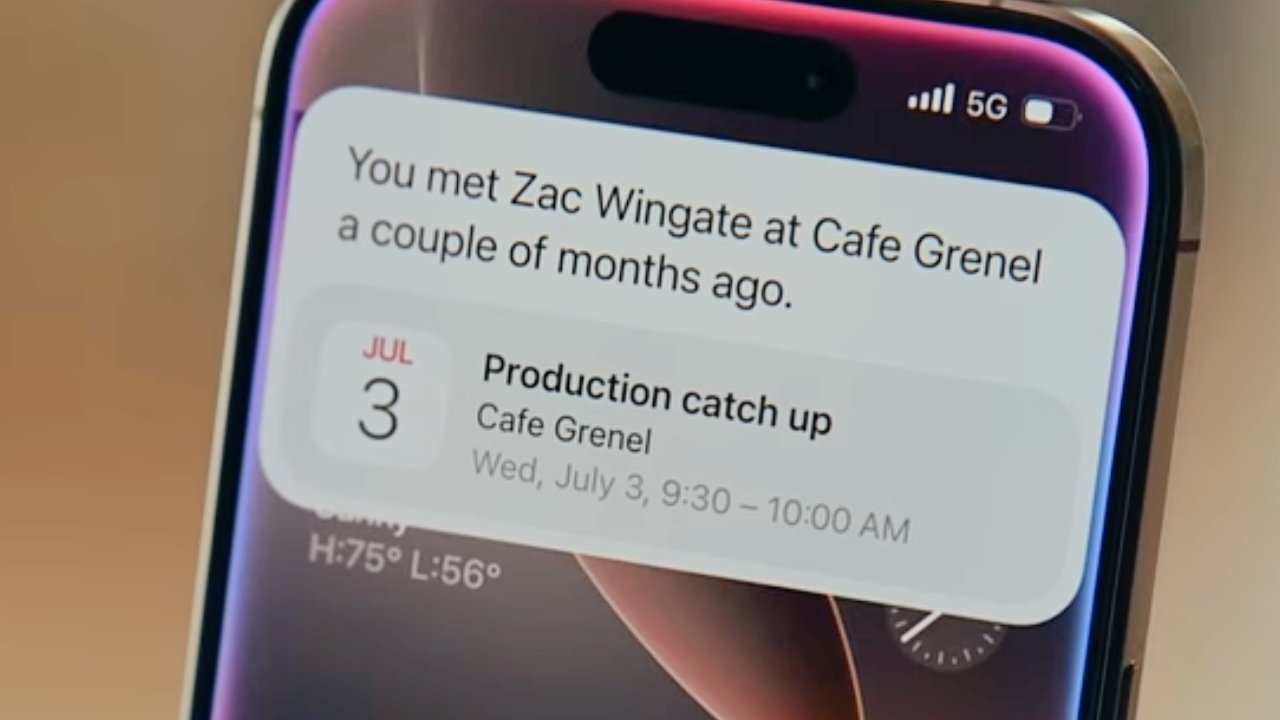

APPLEINSIDER.COMApple will try to right the Apple Intelligence Siri ship, but don't expect firingsApple's ongoing promise to improve its vocal assistant Siri with Apple Intelligence has still not been fulfilled, and looks to be a failure at multiple levels of the executive management team.Siri's upgrade to leverage Apple Intelligence will be a focus at Apple's annual retreat.The head of Apple's Siri efforts, Robby Walker, has at least privately acknowledged the problems, calling them "embarrassing" and "disappointing." Apple's advance marketing of features that weren't yet ready has been, he acknowledged, part of the problem.It's clear, based on the marketing of the features that began late last year, that Apple or at least its marketing department expected more Apple Intelligence features to have arrived by now, reports Bloomberg. This would have included Siri gaining on-screen awareness, personal context, and improved voice control both of which are now officially delayed. Rumor Score: Likely Continue Reading on AppleInsider | Discuss on our Forums0 Commentarii 0 Distribuiri

APPLEINSIDER.COMApple will try to right the Apple Intelligence Siri ship, but don't expect firingsApple's ongoing promise to improve its vocal assistant Siri with Apple Intelligence has still not been fulfilled, and looks to be a failure at multiple levels of the executive management team.Siri's upgrade to leverage Apple Intelligence will be a focus at Apple's annual retreat.The head of Apple's Siri efforts, Robby Walker, has at least privately acknowledged the problems, calling them "embarrassing" and "disappointing." Apple's advance marketing of features that weren't yet ready has been, he acknowledged, part of the problem.It's clear, based on the marketing of the features that began late last year, that Apple or at least its marketing department expected more Apple Intelligence features to have arrived by now, reports Bloomberg. This would have included Siri gaining on-screen awareness, personal context, and improved voice control both of which are now officially delayed. Rumor Score: Likely Continue Reading on AppleInsider | Discuss on our Forums0 Commentarii 0 Distribuiri -

GAMINGBOLT.COMSilent Hill f 10 Brand-New Things Weve Learned About ItAfter delivering one of last years best games withSilent Hill 2,Konami looks intent on keeping its resurgent psychological horror franchises momentum going.Silent Hill f,the series next mainline entry and its first new entry in over a decade was officially announced in October 2022, and now that the aforementioned Bloober Team remake is out of the way, all attention has shifted tof.At a recent Silent Hill Transmission, Konami and co-developer NeoBards Entertainment offered another look at the upcoming title with a brand-new trailer, while also revealing a bunch of new details on its story, setting, and more. Here, were going to go over some of those details.SETTINGEvery game in theSilent Hillseries up to this point has been set in the eponymous fictional American town, butSilent Hill fis doing things differently. As previously confirmed, in a series first, the game is set in Japan, in a remote mountainous town in the 1960s. Named Ebisugaoka, the games setting is based on Kanayama, a real village in Japan. As explained by series producer Motoi Okamoto during the recent Transmission, the games development team traveled to Kanayama to take reference pictures and record sounds of day-to-day life in the village so they could recreate it in as much detail as possible. According to writer Ryukishi07, Kanayama served as the perfect inspiration forSilent Hill fssetting because he could really feel its history when he visited it and was fascinated by its labyrinthine alleyways.PROTAGONISTWe dont know much aboutSilent Hill fswider cast of characters, but pertinent details have at least been revealed on the games protagonist- Shimizu Hinako, a teenage girl who, according to the games official website, was cheerful and energetic as a child but has grown to become much more restrained as she struggles under the pressure of expectations from her friends, family, and society.Interestingly, it also looks like shes going to have greater agency in the story than the series track record would suggest. Speaking during the recent Transmission, Ryukishi07 said, Up until now, I have played everySilent Hillgame, and one thing I noticed is that many of the female characters are put through a great deal of suffering throughout their lives, why is why I thought if this game is going to have a female protagonist, then I want her to be able to make her own decisions for better or for worse amid her struggles. I dont want her to be just pulled along by the story, but to find her own answers. That was the kind of protagonist, or at least, the kind of story that I wanted to create.STORYNow that we know more aboutSilent Hill fssetting and protagonist- what should we expect from its story? Well, its not going to be a picnic, which you may have guessed. As the game begins, the town of Ebisugaoka is a fairly uneventful one, and Hinakos own life doesnt have much to stand out either. Things quickly descend into madness, however, when a deep, ominous fog rolls in and covers the entire town, and as a result, is completely transformed. Places that were once familiar to Hinako have been twisted beyond recognition by unspeakable and nightmarish dangers, and it now falls to her to navigate Ebisugaoka in order to survive and maybe even try and save her home.JAPANESE HORRORSetting the game in Japan was obviously a very deliberate choice on Konamis part, with the developers emphasizing during the recent showcase just how heavilySilent Hill fwill lean into Japanese horror and themes. Series producer Motoi Okamoto explained, While Silent Hill fretains the series core elements of psychological horror, we challenged ourselves by setting the game in Japan and leaning into those themes.He added later, I believe theSilent Hillseries was born out of blending the essence of Japanese horror with the essence of western horror. However, as it was based in the West for the longest time, it felt like the Japanese influence was fading. And so, this made us think, what if we go in the opposite direction and make it 100 percent Japanese horror? And this game is the result.CENTRAL THEMESomething that the recent Transmission hammered home more than once wasSilent Hill fscentral theme, which, according to sOkamoto, is finding the beauty in terror, which, in turn, informed other aspects of the experience as well, from story to art design (more on that in a bit). Okamoto explained, A noticeable feature of Japanese horror is the idea that terror can be found within beauty. When something becomes too immensely beautiful and perfect, it instead becomes deeply unsettling. And so, players will experience this world through the eyes of a young girl who is faced with a beautiful yet terrifying decision. We want them to experience how these contrasting elements co-exist.STILL FOCUSED ON PSYCHOLOGICAL HORRORMany will probably have wondered why aSilent Hillgame that isnt set in the town of Silent Hill is even called that, and interestingly enough, that was a question that writer Ryukishi07 posed as well- before arriving at the conclusion that a focus on psychological horror to create unsettling dread is whats central to the franchises DNA. Thats something thatSilent Hill fis going to continue focusing on. According to the writer, the game will remain true to the series tradition of portraying characters struggles with the evil within themselves, sin, discontent, and conflict in a visually striking way.ART STYLE AND MONSTER DESIGNKonami confirmed back in 2022 thatJapanese artist kera would serve as the lead art and creature designer onSilent Hill f,and during the recent Transmission, we got to hear more on what thatll entail. According to kera, the core idea was to create something that felt unique and in keeping with the games focus on Japanese horror and its central theme of blending beauty and terror. The artist says, I had to consider everything thats come inSilent Hillbefore, and figure out how to take this game in a different direction, but still beSilent Hill.It might not be the exact same blood-smeared, rustic scenery, but I sincerely hope youll enjoy our vision and the world weve created.MUSICAkira Yamaoka has been composingSilent Hillmusic for pretty much as long asSilent Hillhas been around, and sure enough, hes returning to do the same forSilent Hill fas well. Specifically, he will be composing the games Fog World music, while the Otherworld music is being composed by Kensuke Inage. Meanwhile, Japanese musicians dai and xaki who have worked with Ryukishi07 on his past projects have also contributed.PC REQUIREMENTSWe havent seen gameplay footage forSilent Hill fyet, nor do we know when exactly it will be releasing, but interestingly enough, Konami has already revealed its PC requirements. On minimum settings, to run the game at 720p and 30 FPS, youll need either an i5-8400 or a Ryzen 5 2600, along with either a GeForce GTX 1070 Ti or a Radeon RX 5700. Meanwhile, for recommended settings (which will run at 60 FPS in Performance Mode and 30 FPS in Quality Mode), youll need either an i7-9700 or a Ryzen 5 5500, and either a GeForce RTX 2080 or AMD Radeon RX 6800XT. On minimum, an SSD is recommended, while on recommended settings, one is necessary. On either setting, youll also need 16 GB of RAM and about 50 GB of free storage space.PLATFORMSSilent Hill 2may have launched as a PS5 console exclusive last year, butSilent Hill fisnt following suit. Konami has confirmed that whenever it is the game releases, it will be available on PS5, Xbox Series X/S, and PC. On the latter, you can find it on Steam, Epic Games Store, and Windows Store. The game is also available to be wishlisted on all platforms.0 Commentarii 0 Distribuiri

GAMINGBOLT.COMSilent Hill f 10 Brand-New Things Weve Learned About ItAfter delivering one of last years best games withSilent Hill 2,Konami looks intent on keeping its resurgent psychological horror franchises momentum going.Silent Hill f,the series next mainline entry and its first new entry in over a decade was officially announced in October 2022, and now that the aforementioned Bloober Team remake is out of the way, all attention has shifted tof.At a recent Silent Hill Transmission, Konami and co-developer NeoBards Entertainment offered another look at the upcoming title with a brand-new trailer, while also revealing a bunch of new details on its story, setting, and more. Here, were going to go over some of those details.SETTINGEvery game in theSilent Hillseries up to this point has been set in the eponymous fictional American town, butSilent Hill fis doing things differently. As previously confirmed, in a series first, the game is set in Japan, in a remote mountainous town in the 1960s. Named Ebisugaoka, the games setting is based on Kanayama, a real village in Japan. As explained by series producer Motoi Okamoto during the recent Transmission, the games development team traveled to Kanayama to take reference pictures and record sounds of day-to-day life in the village so they could recreate it in as much detail as possible. According to writer Ryukishi07, Kanayama served as the perfect inspiration forSilent Hill fssetting because he could really feel its history when he visited it and was fascinated by its labyrinthine alleyways.PROTAGONISTWe dont know much aboutSilent Hill fswider cast of characters, but pertinent details have at least been revealed on the games protagonist- Shimizu Hinako, a teenage girl who, according to the games official website, was cheerful and energetic as a child but has grown to become much more restrained as she struggles under the pressure of expectations from her friends, family, and society.Interestingly, it also looks like shes going to have greater agency in the story than the series track record would suggest. Speaking during the recent Transmission, Ryukishi07 said, Up until now, I have played everySilent Hillgame, and one thing I noticed is that many of the female characters are put through a great deal of suffering throughout their lives, why is why I thought if this game is going to have a female protagonist, then I want her to be able to make her own decisions for better or for worse amid her struggles. I dont want her to be just pulled along by the story, but to find her own answers. That was the kind of protagonist, or at least, the kind of story that I wanted to create.STORYNow that we know more aboutSilent Hill fssetting and protagonist- what should we expect from its story? Well, its not going to be a picnic, which you may have guessed. As the game begins, the town of Ebisugaoka is a fairly uneventful one, and Hinakos own life doesnt have much to stand out either. Things quickly descend into madness, however, when a deep, ominous fog rolls in and covers the entire town, and as a result, is completely transformed. Places that were once familiar to Hinako have been twisted beyond recognition by unspeakable and nightmarish dangers, and it now falls to her to navigate Ebisugaoka in order to survive and maybe even try and save her home.JAPANESE HORRORSetting the game in Japan was obviously a very deliberate choice on Konamis part, with the developers emphasizing during the recent showcase just how heavilySilent Hill fwill lean into Japanese horror and themes. Series producer Motoi Okamoto explained, While Silent Hill fretains the series core elements of psychological horror, we challenged ourselves by setting the game in Japan and leaning into those themes.He added later, I believe theSilent Hillseries was born out of blending the essence of Japanese horror with the essence of western horror. However, as it was based in the West for the longest time, it felt like the Japanese influence was fading. And so, this made us think, what if we go in the opposite direction and make it 100 percent Japanese horror? And this game is the result.CENTRAL THEMESomething that the recent Transmission hammered home more than once wasSilent Hill fscentral theme, which, according to sOkamoto, is finding the beauty in terror, which, in turn, informed other aspects of the experience as well, from story to art design (more on that in a bit). Okamoto explained, A noticeable feature of Japanese horror is the idea that terror can be found within beauty. When something becomes too immensely beautiful and perfect, it instead becomes deeply unsettling. And so, players will experience this world through the eyes of a young girl who is faced with a beautiful yet terrifying decision. We want them to experience how these contrasting elements co-exist.STILL FOCUSED ON PSYCHOLOGICAL HORRORMany will probably have wondered why aSilent Hillgame that isnt set in the town of Silent Hill is even called that, and interestingly enough, that was a question that writer Ryukishi07 posed as well- before arriving at the conclusion that a focus on psychological horror to create unsettling dread is whats central to the franchises DNA. Thats something thatSilent Hill fis going to continue focusing on. According to the writer, the game will remain true to the series tradition of portraying characters struggles with the evil within themselves, sin, discontent, and conflict in a visually striking way.ART STYLE AND MONSTER DESIGNKonami confirmed back in 2022 thatJapanese artist kera would serve as the lead art and creature designer onSilent Hill f,and during the recent Transmission, we got to hear more on what thatll entail. According to kera, the core idea was to create something that felt unique and in keeping with the games focus on Japanese horror and its central theme of blending beauty and terror. The artist says, I had to consider everything thats come inSilent Hillbefore, and figure out how to take this game in a different direction, but still beSilent Hill.It might not be the exact same blood-smeared, rustic scenery, but I sincerely hope youll enjoy our vision and the world weve created.MUSICAkira Yamaoka has been composingSilent Hillmusic for pretty much as long asSilent Hillhas been around, and sure enough, hes returning to do the same forSilent Hill fas well. Specifically, he will be composing the games Fog World music, while the Otherworld music is being composed by Kensuke Inage. Meanwhile, Japanese musicians dai and xaki who have worked with Ryukishi07 on his past projects have also contributed.PC REQUIREMENTSWe havent seen gameplay footage forSilent Hill fyet, nor do we know when exactly it will be releasing, but interestingly enough, Konami has already revealed its PC requirements. On minimum settings, to run the game at 720p and 30 FPS, youll need either an i5-8400 or a Ryzen 5 2600, along with either a GeForce GTX 1070 Ti or a Radeon RX 5700. Meanwhile, for recommended settings (which will run at 60 FPS in Performance Mode and 30 FPS in Quality Mode), youll need either an i7-9700 or a Ryzen 5 5500, and either a GeForce RTX 2080 or AMD Radeon RX 6800XT. On minimum, an SSD is recommended, while on recommended settings, one is necessary. On either setting, youll also need 16 GB of RAM and about 50 GB of free storage space.PLATFORMSSilent Hill 2may have launched as a PS5 console exclusive last year, butSilent Hill fisnt following suit. Konami has confirmed that whenever it is the game releases, it will be available on PS5, Xbox Series X/S, and PC. On the latter, you can find it on Steam, Epic Games Store, and Windows Store. The game is also available to be wishlisted on all platforms.0 Commentarii 0 Distribuiri