At the Bitcoin Conference, the Republicans were for sale

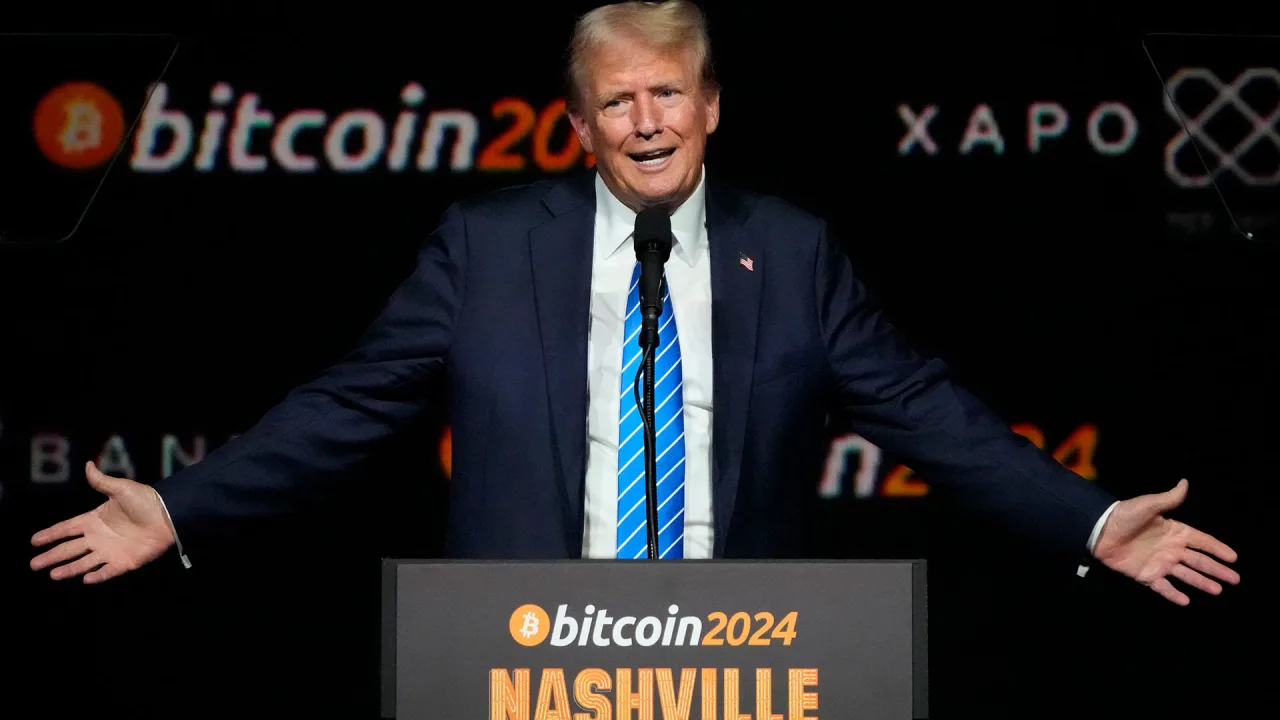

“I want to make a big announcement,” said Faryar Shirzad, the chief policy officer of Coinbase, to a nearly empty room. His words echoed across the massive hall at the Bitcoin Conference, deep in the caverns of The Venetian Expo in Las Vegas, and it wasn’t apparent how many people were watching on the livestream. Then again, somebody out there may have been interested in the panelists he was interviewing, one of whom was unusual by Bitcoin Conference standards: Chris LaCivita, the political consultant who’d co-chaired Donald Trump’s 2024 presidential campaign. “I am super proud to say it on this stage,” Shirzad continued, addressing the dozens of people scattered across 5,000 chairs. “We have just become a major sponsor of the America250 effort.” My jaw dropped. Coinbase, the world’s largest crypto exchange, the owner of 12 percent of the world’s Bitcoin supply, and listed on the S&P 500, was paying for Trump to hold a military parade.No wonder they made the announcement in an empty room. Today was “Code and Country”: an entire day of MAGA-themed panels on the Nakamoto Main Stage, full of Republican legislators, White House officials, and political operatives, all of whom praised Trump as the savior of the crypto world. But Code and Country was part of Industry Day, which was VIP only and closed to General Admission holders — the people with the tickets, who flocked to the conference seeking wisdom from brilliant technologists and fabulously wealthy crypto moguls, who believed that decentralized currency on a blockchain could not be controlled by government authoritarians. They’d have drowned Shirzad in boos if they saw him give money to Donald Trump’s campaign manager, and they would have stormed the Nakamoto stage if they knew the purpose of America250. America250 is a nonprofit established by Congress during Barack Obama’s presidency with a mundane mission: to plan the nationwide festivities for July 4th, 2026, the 250th anniversary of the signing of the Declaration of Independence. “Who remembers the Bicentennial in 1976?” the co-chair, former U.S. Treasurer Rosie Rios, asked the crowd. “I remember it like it was yesterday, and this one is going to be bigger and better.” But then Trump got re-elected, appointed LaCivita as co-chair, and suddenly, the party was starting earlier. The week before the conference, America250 announced that it would host a “Grand Military Parade” on June 14th to celebrate the U.S. Army’s 250th birthday, releasing tickets for prime seats along the parade route and near the Washington Monument on their website, hosting other festivities on the National Mall, and credentialing the press covering the event.According to the most recent statements from Army officials, the parade will include hundreds of cannons, dozens of Black Hawk and Chinook helicopters, fighter jets, bombers, and 150 military vehicles, including Bradley Fighting Vehicles, Stryker Fighting Vehicles, Humvees, and if the logistics work out, 25M1 Abrams tanks. Trump had spent years trying to get the government to throw a military parade — primarily because he’d attended a Bastille Day parade in France and became jealous — and now that he was back in office, he’d finally eliminated everyone in the government who previously told him that the budget didn’t exist for such a parade, that the tank treads would ruin the streets and collapse the bridges, that the optics of tanks, guns and soldiers marching down Constitution Avenue were too authoritarian and fascist. June 14th also happens to be Donald Trump’s birthday.And Coinbase, whose CEO once told his employees to stop bringing politics into the workplace, was now footing the bill — if not for this military parade watch party, then for the one inevitably happening next year, when America actually turns 250, or any other festivities between now and then that may or may not fall on Trump’s birthday.I had to keep reminding myself that I was at the Bitcoin Conference. I’d been desperately looking for the goofy, degenerate party vibes that my coworkers who’d covered previous crypto conferences told me about: inflated swans with QR codes. Multimillionaires strolling around the Nakamoto Stage in shiba inu pajamas. Folks who communicated in memes and acronyms. Celebrity athletes who were actual celebrities. “Bitcoin yoga,” whatever that was. Afterparties with drugs, lots of drugs, and probably the mind-bending designer kind. And hey, Las Vegas was the global capital of goofy, degenerate partying. But no, I was stuck in a prolonged flashback to every single Republican event I’ve covered over the past ten years – Trump rallies, conservative conferences, GOP conventions, and MAGA fundraisers, with Lee Greenwood’s “God Bless the USA” playing on an endless loop. There was an emcee endlessly praising Trump, encouraging the audience to clap for Trump, and reminding everyone about how great it was that Trump spoke at the Conference last year, which all sounds even stranger when said in an Australian accent. In addition to LaCivita, there were four GOP Congressmen, four GOP Senators, one Trump-appointed SEC Commissioner, one Treasury Official, two senior White House officials, and two of Trump’s sons. All of them, too, spent time praising Trump as the first “crypto president.”The titles of the panels seemed to be run through some sort of MAGA generative AI system: The Next Golden Age of America. The American Super Grid. Making America the Global Bitcoin Superpower. The New Declaration of Independence: Bitcoin and the Path Out of the U.S. National Debt Crisis.Uncancleable: Bitcoin, Rumble & Free Speech Technology.The only difference was that this MAGA conference was funded by crypto. And if crypto was paying for a MAGA conference, and they had to play “God Bless the USA,” they were bringing in a string quartet.Annoyed that I had not yet seen a single Shiba Inu — no, Jim Justice’s celebrity bulldog was not the same thing — I left Nakamoto and went back to the press area. It hadn’t turned into Fox News yet, but I could see MAGA’s presence seeping into the world of podcasters and vloggers. A Newsmax reporterwas interviewing White House official Bo Hines, right before he was hustled onstage for a panel with a member of the U.S. Treasury. Soon, Rep. Byron Donaldswas doing an interview gauntlet while his senior aides stood by, one wearing a pink plaid blazer that could have easily been Brooks Brothers. Over on the Genesis Stage, the CEO of PragerU, a right wing media company that attacks higher education, was interviewing the CEO of the 1792 Exchange, a right-wing nonprofit that attacks companies for engaging in “woke business practices” such as diversity initiatives.I walked into the main expo center, past a crypto podcaster in a sequined bomber jacket talking to a Wall Street Journal reporter. For some reason, his presence was a relief. Even though he was clearly a Trump supporter — his jacket said TRUMP: THE GOLDEN AGE on the back — there was something more janky and homegrown, less corporate, about him. But the moment I looked up and saw a massive sign that said STEAKTOSHI, the unease returned. A ghoulish-looking group of executives from Steak ‘n Shake, the fast food company with over 450 locations across the globe, had gathered under the sign in a replica of the restaurant. They were selling jars of beef tallow, with a choice of grass-fed or Wagyu, and giving out a MAKE FRYING OIL TALLOW AGAIN hat with every purchase an overt embrace of the right-wing conspiracy that cooking with regular seed oils would lower one’s testosterone.Andrew Gordon, the head of Main Street Crypto PAC, had been to five previous Bitcoin Conferences and worked on crypto tax policy since 2014. He’d seen Trump speak at the last conference in Nashville during the election, and the audience – not typically unquestioning MAGA superfans – had melted into adoring goo in Trump’s presence. But now that Trump was using his presidential powers to establish a Bitcoin reserve, roll back federal investigations into crypto companies, and order massive changes to financial regulatory policies — in short, changing the entire market on crypto’s behalf with the stroke of a pen — Gordon clocked a notable vibe shift this year. “There are people wearing suits at a Bitcoin conference,” he told me wryly back in the press lounge.. The change wasn’t due to a new breed of Suit People flooding in. It was the Bitcoin veterans the ones who’d been coming to the conference for years, dressed in loud Versace jackets or old holey t-shirts – who were now in business attire. “They’re now recognizing the level of formality and how serious it is.”According to the Bitcoin Conference organizers, out of the 35,000-plus attendees in Vegas this year, 17.1 percent of them were categorized as “institutional and corporate decision-makers” — a vague way to describe politicians, corporate executives, and the rest of the C-suite world. Whenever they weren’t speaking onstage, they were conducting interviews with outlets hand-selected from dozens of media requests that had been filtered through the conference organizers, or in Q&A sessions with people who’d bought the Whale Pass and could access the VIP Lounge.They were sidebarring with crypto CEOs outside the conference for round tables, privately meeting Senators for lunch and White House officials for dinner. Gordon himself had just held a private breakfast for industry insiders, with GOP Senators Marsha Blackburn and Cynthia Lummis as special guests. And for the very, very wealthy, MAGA Inc., Trump’s primary super PAC, was holding a fundraising dinner in Vegas that night, with Vance, Don Jr., and Eric Trump in attendance. That ticket, according to The Washington Post, cost million per person.It was the kind of amoral, backroom behavior that would have sent the General Admission attendees into a rage — and they did the next day, when the convention opened to them. During one extremely packed talk at the Genesis Stage called Are Bitcoiners Becoming Sycophants of the State?, a moderator asked the four panelists what they’d like to say to Vance and Sacks and all the politicians who’d been there yesterday. And Erik Cason erupted.“‘What you’re doing is actually immoral and bad. You hurt people. You actively want to use the state to implement violence against others.’ That’s like, fucked up and wrong,” said Cason, the author of “Cryptosovereignty,” to a crowd of hundreds. “If you personally wanna like, go to Yemen and try to stab those people, that’s on you. But asking other people to go do that – it is a fucked up and terrible thing.” He grew more heated. “And also fuck you. You’re not, like, a king. You’re supposed to be liable to the law, too. And I don’t appreciate you trying to think that that you just get to advance the state however the fuck you want, because you have power.”“These are the violent thugs who killed hundreds of millions of people over the last century,” agreed Bruce Fenton of Chainstone Labs. “They have nothing on us. All we wanna do is run some code and trade it around our nerd money. Leave us alone.”The audience burst into cheers and applause. Bitcoin was the promise of freedom from the government, who’d murdered and stolen and tried to control their lives, and now that their wealth was on the blockchain, no one could take their sovereignty. “Personally, I don’t really care what theythink,” said American HODL, whose title on the conference site was “guy with 6.15 bitcoin,” the derision clear in his voice. “They are employees who work for us, so their thoughts and opinions on the matter are irrelevant. Do what the fuck we tell you to do. I don’t work for you. I’m not underneath you. You’re underneath me.” But the politicians weren’t going to listen to them, much less talk to them. The politicians spent the conference surrounded by aides and security who stopped people from approaching – I’m sorry, the Senator has to leave for an engagement now – or safely inside the VIP rooms with the -dollar Whale Pass holders and the million-dollar donors. By the time American HODL said that the politicians worked for him, they were on flights out of Vegas, having gotten what they wanted from Code and Country, an event that was closed to General Admission pass holders.Coinbase’s executives were at Code and Country, however. Coinbase held over 984,000 Bitcoin, more coins than American HODL could mine in a lifetime. And Coinbase was now a sponsor of Donald Trump’s birthday military parade. The Nakamoto Stage during Code + Country at the Bitcoin Conference.After David Sacks and the Winklevoss twins finished explaining how Trump had saved the crypto industry from Sen. Elizabeth Warren, I was jonesing for a drink. A few other reporters on the ground had told me about “Code, Country and Cocktails,” the America250 afterparty held at the Ayu Dayclub at Resort World, and I signed up immediately. Reporters at past Bitcoin Conferences had promised legendary side-event depravity, and I hoped I would find it there. As I entered the lush, tropical nightclub, I saw two white-gloved hands sticking out the side of the wall, each holding a glass of champagne at crotch level. I reached out for a flute, thinking it was maybe just a fucked-up piece of art, and gasped as the hand let go of the stem, disappeared into the hole, and emerged seconds later with another full champagne glass. Past the champagne glory hole wall — there was really no other way to describe it — was a massive outdoor swimming pool, surrounded by chefs serving up endless portions of steak frites, unguarded magnums of Moët casually stacked in ice buckets, the professional Beautiful Women of Las Vegas draped around Peter Schiff, the famous economist/podcaster/Bitcoin skeptic. When not booked for private events, the crescent-shaped pool at Ayu would be filled with drunk people in swim suits, dancing to DJ Kaskade. No one was in the pool tonight. Depravity was not happening here. In fact, there was more networking going on than partying, and it was somehow more engaging than Bone Thugs-N-Harmony suddenly appearing onstage to perform. And it was distinctly not just about making money in crypto. A good percentage of this crowd wore some derivative of a MAGA hat, and anyone who could show off their photos of them with Trump did so. This, I realized, was how crypto bros did politics — a new game for them, where success and influence was not necessarily quantifiable. “Crypto got Trump elected,” Greg Grseziak, an agent who manages crypto influencers, told me, showing me his Trump photo opp. “In four years, this is going to be the biggest event in the presidential race.”Grzesiak walked off to do more networking, I finished my glory hole champagne, and in the meantime, Bone Thugs had started performing “East 1999”. A fellow reporter leaned over. “Who do you think those guys are?” he asked, pointing to a group of extremely tall white men in suits and lanyards, standing behind a velvet rope to the left of the stage.I walked over to investigate. They looked like the group of Steak ‘n Shake executives I met at the Expo Hall — the ones with the beef tallow jars and derivative MAGA hats — and they were lurking next to the stage, watching the rappers like vultures but barely moving to the music. This scene was too preposterous to actually be real: Steak ‘n Shake executives, at the Bitcoin Conference, attending a party for America250, in the VIP section, during a Bone Thugs-n-Harmony set? “Shout out to Steak ‘n Shake for being the first fast food restaurant to accept Bitcoin!” announced one of the Bones. The company logo appeared on a screen above his head.No flashy Vegas magiccould mask what I just saw. This party was co-sponsored by a MAGA-branded fast-food chain owned by Sardar Biglari, a businessman who had purchased Maxim, became its editor-in-chief, and used the smutty magazine to endorse Trump in 2024. So was Frax, the stablecoin exchange, and Exodus, one of the biggest crypto wallet companies in the market. Bitcoin Magazine’s logo flashed across the stage at one point, as editor-in-chief David Bailey, in his own derivative MAGA hat, tried to hype up the crowd for J.D. Vance’s speech the next day.For some unknown reason, these companies were all putting their money into America250, and as I had to keep reminding myself, America250 — the government nonprofit in charge of planning the country’s celebrations of the 250th anniversary of the Declaration’s signing — was currently working to get tanks in the streets of Washington DC for Donald Trump’s birthday. I went for one last champagne flute from the glory hole, just for the novelty, and as the hand disappeared back into the wall, I caught something I’d missed earlier: above the hole was a logo for TRON, the blockchain exchange run by billionaire Justin Sun. He had faced several fraud investigations from the SEC that magically disappeared after he invested million in a Trump family crypto company, and seemed more than happy to keep throwing crypto money at Trump. Recently, he won the $TRUMP meme coin dinner, spending over million on the token in exchange for a private and controversial dinner with the president.TRON was also cosponsoring the America250 party.Earlier, I’d run into the Australian emcee in the elevator of The Palazzo. She’d spent the day teetering across the Nakamoto Stage in dainty kitten heels, a pinstriped blazer and miniskirt suit set, and given the gratuitous Trump praising and the fact she was blonde, I had stereotyped her as MAGA to the core. But the program was over and she was holding her heels by their ankle straps, barefoot and sighing in relief. This was not her usual style, she told an attendee. She’d take a pair of sneakers over heels if she could. But the conference organizers had told her to dress up because there were senators in attendance. “Tomorrow, the real Bitcoiners are coming,” she said, and she’d get to wear flat shoes. And the next morning, on the day of Vance’s speech, I found myself stuck outside the conference with the “real Bitcoiners.” In spite of all the emails that the conference had sent me reminding me of how strict security measures would be, possibly to overcorrect from last year’s utter shitshow around Trump’s appearance, I’d woken up too late, eaten my bagel too leisurely, got sidetracked by a police officer-turned-Bitcoin investor excited I was wearing orange, and barely missed the cutoff for the Secret Service to let me in. But the conference had set up televisions with a live feed of Vance’s speech, and the rest of the general admission attendees were remarkably chill about it, opting to mingle in the hallways until the Secret Service left. I found myself in a smaller crowd near the expo hall door, next to a young man carrying a live miniature Shiba Inu, and the podcaster I’d seen earlier in the sequined bomber jacket. He introduced himself as Action CEO, and with nothing else to do but wait — “You can watch thereplay,” he reassured me, “these events are mainly about networking” — we got to talking. “I’m actually excited that Trump isn’t even here, I’ll be honest with you,” he said, speaking with a rapid cadence. Trump was ultimately just one guy, and the fact that he sent his underlings and political allies — the ones who could actually implement his grand promises for the crypto industry — proved he hadn’t just been paying lip service. That said, it had come with some uncomfortable changes, including the re-emergence of Justin Sun. “It’s a little bit concerning when you say, All right, we don’t care what you did in the past. Come on out, clean slate,” he continued. “That’s the concern right now for most people. Seeing people that did wrong by the space coming back and acting like nothing happened? That’s a little concerning.” And not just that: Sun was back in the United States, having dinner with Trump, and giving him millions of dollars. “If you’re sitting in a room and having a conversation, people are literally gonna go, yeah, it’s kind of sketch that this guy is back here after everything that’s happened. You’re not gonna see it published, because it’s not a popular opinion, but we’re all definitely talking about it.” If Action’s friends weren’t comfortable talking about it openly, that fraudsters with enough money were suddenly back in the mix, it was certainly not the kind of conversation the CEOs were going to have in front of the General Admission crowd.But behind closed doors — or at least at the Code and Country panels, where the base pass attendees couldn’t boo them — they gave a sense of what their backroom conversations with the Trump administration did look like.“I was actually at a dinner last night and one of the things that someone from the admin said was, What if we give you guys everything you want and then you guys forget? Because there’s midterms in 2026, and hopefully 2028, and beyond,” said Sam Kazemian, the founder and CEO of Frax, which had sponsored the America250 party. “But one of the things I said was: We as an industry are very, very loyal. The crypto community has a very, very, very strong memory. And once this industry is legalized, is transparent, is safe, all of the big players understand that this wasn’t possible without this administration, this Congress, this Senate. We’re lifelong, career-long allies.”“Loyalty” is a dangerous concept with this president, who’s cheated on his three wives, stopped paying the legal fees for employees who’d taken the fall for him, ended the careers of sympathetic MAGA Republicans for insufficiently coddling him, withdrew security for government employees experiencing death threats for the sin of contradicting him in public by citing facts. It was only weeks ago that he and Vance were publicly screaming at Ukrainian president Volodymyr Zelensky, who was at the White House to request more aid in the war against Russia, for not saying “thank you” in front of the cameras. It would be less than a week before he began threatening to cancel all of Elon Musk’s government contracts when the billionaire criticized the size of Trump’s budget, even though Musk had given him millions and helped him purge the government. And if you were to find a photo of any political leader, billionaire or CEO standing vacant-eyed next to Trump and shaking his hand, the circumstances are practically a given: they had recently made him unhappy, either for criticizing him, making an imagined slight, or simply asserting themselves. The only way they could avoid public humiliation, or their businesses being crushed via executive order, was to go to Mar-a-Lago, tell the world that the president was wonderful, and underwrite a giant party for his birthday military parade. Maybe Kazemian knew he was being tested, or maybe the 32-year old Ron Paul superfan had no idea what the administration was asking of him. Either way, he responded correctly. At least one person at the conference was thinking about ways that the government could betray the Bitcoin community. As the panel on Bitcoiners becoming sycophants of the state wrapped up, and the other panelists finished telling the government pigs to go fuck themselves and keep their hands off their nerd money, the moderator turned to Casey Rodarmor, a software engineer-turned-crypto influencer, for the last question: “Tell everyone here why Bitcoin wins, regardless of what happens.”“Oh, man, I don’t know if Bitcoin wins, regardless of what happens,” he responded, frowning. He had already gamed out one feasible situation where Bitcoin lost: “If we all of a sudden saw a very rapid inflation in a lot of fiat currencies, and there was a plausible scapegoat in Bitcoin all over the world, and they were able to make a sort of marketing claim that Bitcoin is causing this — Bitcoin is making your savings go to zero, it’s causing this carnage to the economy — If that happens worldwide, I think that’s really scary.” The moderator froze, the crowd murmured nervously, and I thought about the number of times Trump had blamed a group of people for problems they’d never caused. An awful lot of them were now being deported. “I take that seriously,” Rodarmor continued. “I don’t know that Bitcoin will succeed. I think that Bitcoin is incredibly strong, it’s incredibly difficult to fuck up. But in that case… man, I don’t know.” I had asked Action CEO earlier if Kazemian, the Frax CEO, was right — if the crypto world was unquestioningly loyal to Trump, if their support of him was unconditional. “Oh, it’s definitely conditional,” he said without hesitation, as his Trump jacket glittered under the fluorescent lights. “It’s a matter of, are you going to be doing the right things by us, by the people who are here?” We walked down the expo hall, past booths promising life-changing technological marvels, alongside thousands of people flooding into Nakamoto Hall, ready to learn how to become unfathomably rich, who paid to be there.The audience of “Are Bitcoiners Becoming Sychophants of the State?”, Day Two of the Bitcoin ConferenceSee More:

#bitcoin #conference #republicans #were #sale

At the Bitcoin Conference, the Republicans were for sale

“I want to make a big announcement,” said Faryar Shirzad, the chief policy officer of Coinbase, to a nearly empty room. His words echoed across the massive hall at the Bitcoin Conference, deep in the caverns of The Venetian Expo in Las Vegas, and it wasn’t apparent how many people were watching on the livestream. Then again, somebody out there may have been interested in the panelists he was interviewing, one of whom was unusual by Bitcoin Conference standards: Chris LaCivita, the political consultant who’d co-chaired Donald Trump’s 2024 presidential campaign. “I am super proud to say it on this stage,” Shirzad continued, addressing the dozens of people scattered across 5,000 chairs. “We have just become a major sponsor of the America250 effort.” My jaw dropped. Coinbase, the world’s largest crypto exchange, the owner of 12 percent of the world’s Bitcoin supply, and listed on the S&P 500, was paying for Trump to hold a military parade.No wonder they made the announcement in an empty room. Today was “Code and Country”: an entire day of MAGA-themed panels on the Nakamoto Main Stage, full of Republican legislators, White House officials, and political operatives, all of whom praised Trump as the savior of the crypto world. But Code and Country was part of Industry Day, which was VIP only and closed to General Admission holders — the people with the tickets, who flocked to the conference seeking wisdom from brilliant technologists and fabulously wealthy crypto moguls, who believed that decentralized currency on a blockchain could not be controlled by government authoritarians. They’d have drowned Shirzad in boos if they saw him give money to Donald Trump’s campaign manager, and they would have stormed the Nakamoto stage if they knew the purpose of America250. America250 is a nonprofit established by Congress during Barack Obama’s presidency with a mundane mission: to plan the nationwide festivities for July 4th, 2026, the 250th anniversary of the signing of the Declaration of Independence. “Who remembers the Bicentennial in 1976?” the co-chair, former U.S. Treasurer Rosie Rios, asked the crowd. “I remember it like it was yesterday, and this one is going to be bigger and better.” But then Trump got re-elected, appointed LaCivita as co-chair, and suddenly, the party was starting earlier. The week before the conference, America250 announced that it would host a “Grand Military Parade” on June 14th to celebrate the U.S. Army’s 250th birthday, releasing tickets for prime seats along the parade route and near the Washington Monument on their website, hosting other festivities on the National Mall, and credentialing the press covering the event.According to the most recent statements from Army officials, the parade will include hundreds of cannons, dozens of Black Hawk and Chinook helicopters, fighter jets, bombers, and 150 military vehicles, including Bradley Fighting Vehicles, Stryker Fighting Vehicles, Humvees, and if the logistics work out, 25M1 Abrams tanks. Trump had spent years trying to get the government to throw a military parade — primarily because he’d attended a Bastille Day parade in France and became jealous — and now that he was back in office, he’d finally eliminated everyone in the government who previously told him that the budget didn’t exist for such a parade, that the tank treads would ruin the streets and collapse the bridges, that the optics of tanks, guns and soldiers marching down Constitution Avenue were too authoritarian and fascist. June 14th also happens to be Donald Trump’s birthday.And Coinbase, whose CEO once told his employees to stop bringing politics into the workplace, was now footing the bill — if not for this military parade watch party, then for the one inevitably happening next year, when America actually turns 250, or any other festivities between now and then that may or may not fall on Trump’s birthday.I had to keep reminding myself that I was at the Bitcoin Conference. I’d been desperately looking for the goofy, degenerate party vibes that my coworkers who’d covered previous crypto conferences told me about: inflated swans with QR codes. Multimillionaires strolling around the Nakamoto Stage in shiba inu pajamas. Folks who communicated in memes and acronyms. Celebrity athletes who were actual celebrities. “Bitcoin yoga,” whatever that was. Afterparties with drugs, lots of drugs, and probably the mind-bending designer kind. And hey, Las Vegas was the global capital of goofy, degenerate partying. But no, I was stuck in a prolonged flashback to every single Republican event I’ve covered over the past ten years – Trump rallies, conservative conferences, GOP conventions, and MAGA fundraisers, with Lee Greenwood’s “God Bless the USA” playing on an endless loop. There was an emcee endlessly praising Trump, encouraging the audience to clap for Trump, and reminding everyone about how great it was that Trump spoke at the Conference last year, which all sounds even stranger when said in an Australian accent. In addition to LaCivita, there were four GOP Congressmen, four GOP Senators, one Trump-appointed SEC Commissioner, one Treasury Official, two senior White House officials, and two of Trump’s sons. All of them, too, spent time praising Trump as the first “crypto president.”The titles of the panels seemed to be run through some sort of MAGA generative AI system: The Next Golden Age of America. The American Super Grid. Making America the Global Bitcoin Superpower. The New Declaration of Independence: Bitcoin and the Path Out of the U.S. National Debt Crisis.Uncancleable: Bitcoin, Rumble & Free Speech Technology.The only difference was that this MAGA conference was funded by crypto. And if crypto was paying for a MAGA conference, and they had to play “God Bless the USA,” they were bringing in a string quartet.Annoyed that I had not yet seen a single Shiba Inu — no, Jim Justice’s celebrity bulldog was not the same thing — I left Nakamoto and went back to the press area. It hadn’t turned into Fox News yet, but I could see MAGA’s presence seeping into the world of podcasters and vloggers. A Newsmax reporterwas interviewing White House official Bo Hines, right before he was hustled onstage for a panel with a member of the U.S. Treasury. Soon, Rep. Byron Donaldswas doing an interview gauntlet while his senior aides stood by, one wearing a pink plaid blazer that could have easily been Brooks Brothers. Over on the Genesis Stage, the CEO of PragerU, a right wing media company that attacks higher education, was interviewing the CEO of the 1792 Exchange, a right-wing nonprofit that attacks companies for engaging in “woke business practices” such as diversity initiatives.I walked into the main expo center, past a crypto podcaster in a sequined bomber jacket talking to a Wall Street Journal reporter. For some reason, his presence was a relief. Even though he was clearly a Trump supporter — his jacket said TRUMP: THE GOLDEN AGE on the back — there was something more janky and homegrown, less corporate, about him. But the moment I looked up and saw a massive sign that said STEAKTOSHI, the unease returned. A ghoulish-looking group of executives from Steak ‘n Shake, the fast food company with over 450 locations across the globe, had gathered under the sign in a replica of the restaurant. They were selling jars of beef tallow, with a choice of grass-fed or Wagyu, and giving out a MAKE FRYING OIL TALLOW AGAIN hat with every purchase an overt embrace of the right-wing conspiracy that cooking with regular seed oils would lower one’s testosterone.Andrew Gordon, the head of Main Street Crypto PAC, had been to five previous Bitcoin Conferences and worked on crypto tax policy since 2014. He’d seen Trump speak at the last conference in Nashville during the election, and the audience – not typically unquestioning MAGA superfans – had melted into adoring goo in Trump’s presence. But now that Trump was using his presidential powers to establish a Bitcoin reserve, roll back federal investigations into crypto companies, and order massive changes to financial regulatory policies — in short, changing the entire market on crypto’s behalf with the stroke of a pen — Gordon clocked a notable vibe shift this year. “There are people wearing suits at a Bitcoin conference,” he told me wryly back in the press lounge.. The change wasn’t due to a new breed of Suit People flooding in. It was the Bitcoin veterans the ones who’d been coming to the conference for years, dressed in loud Versace jackets or old holey t-shirts – who were now in business attire. “They’re now recognizing the level of formality and how serious it is.”According to the Bitcoin Conference organizers, out of the 35,000-plus attendees in Vegas this year, 17.1 percent of them were categorized as “institutional and corporate decision-makers” — a vague way to describe politicians, corporate executives, and the rest of the C-suite world. Whenever they weren’t speaking onstage, they were conducting interviews with outlets hand-selected from dozens of media requests that had been filtered through the conference organizers, or in Q&A sessions with people who’d bought the Whale Pass and could access the VIP Lounge.They were sidebarring with crypto CEOs outside the conference for round tables, privately meeting Senators for lunch and White House officials for dinner. Gordon himself had just held a private breakfast for industry insiders, with GOP Senators Marsha Blackburn and Cynthia Lummis as special guests. And for the very, very wealthy, MAGA Inc., Trump’s primary super PAC, was holding a fundraising dinner in Vegas that night, with Vance, Don Jr., and Eric Trump in attendance. That ticket, according to The Washington Post, cost million per person.It was the kind of amoral, backroom behavior that would have sent the General Admission attendees into a rage — and they did the next day, when the convention opened to them. During one extremely packed talk at the Genesis Stage called Are Bitcoiners Becoming Sycophants of the State?, a moderator asked the four panelists what they’d like to say to Vance and Sacks and all the politicians who’d been there yesterday. And Erik Cason erupted.“‘What you’re doing is actually immoral and bad. You hurt people. You actively want to use the state to implement violence against others.’

That’s like, fucked up and wrong,” said Cason, the author of “Cryptosovereignty,” to a crowd of hundreds. “If you personally wanna like, go to Yemen and try to stab those people, that’s on you. But asking other people to go do that – it is a fucked up and terrible thing.” He grew more heated. “And also fuck you. You’re not, like, a king. You’re supposed to be liable to the law, too.

And I don’t appreciate you trying to think that that you just get to advance the state however the fuck you want, because you have power.”“These are the violent thugs who killed hundreds of millions of people over the last century,” agreed Bruce Fenton of Chainstone Labs. “They have nothing on us. All we wanna do is run some code and trade it around our nerd money. Leave us alone.”The audience burst into cheers and applause. Bitcoin was the promise of freedom from the government, who’d murdered and stolen and tried to control their lives, and now that their wealth was on the blockchain, no one could take their sovereignty. “Personally, I don’t really care what theythink,” said American HODL, whose title on the conference site was “guy with 6.15 bitcoin,” the derision clear in his voice. “They are employees who work for us, so their thoughts and opinions on the matter are irrelevant. Do what the fuck we tell you to do.

I don’t work for you. I’m not underneath you. You’re underneath me.” But the politicians weren’t going to listen to them, much less talk to them. The politicians spent the conference surrounded by aides and security who stopped people from approaching – I’m sorry, the Senator has to leave for an engagement now – or safely inside the VIP rooms with the -dollar Whale Pass holders and the million-dollar donors. By the time American HODL said that the politicians worked for him, they were on flights out of Vegas, having gotten what they wanted from Code and Country, an event that was closed to General Admission pass holders.Coinbase’s executives were at Code and Country, however. Coinbase held over 984,000 Bitcoin, more coins than American HODL could mine in a lifetime. And Coinbase was now a sponsor of Donald Trump’s birthday military parade. The Nakamoto Stage during Code + Country at the Bitcoin Conference.After David Sacks and the Winklevoss twins finished explaining how Trump had saved the crypto industry from Sen. Elizabeth Warren, I was jonesing for a drink. A few other reporters on the ground had told me about “Code, Country and Cocktails,” the America250 afterparty held at the Ayu Dayclub at Resort World, and I signed up immediately. Reporters at past Bitcoin Conferences had promised legendary side-event depravity, and I hoped I would find it there. As I entered the lush, tropical nightclub, I saw two white-gloved hands sticking out the side of the wall, each holding a glass of champagne at crotch level. I reached out for a flute, thinking it was maybe just a fucked-up piece of art, and gasped as the hand let go of the stem, disappeared into the hole, and emerged seconds later with another full champagne glass. Past the champagne glory hole wall — there was really no other way to describe it — was a massive outdoor swimming pool, surrounded by chefs serving up endless portions of steak frites, unguarded magnums of Moët casually stacked in ice buckets, the professional Beautiful Women of Las Vegas draped around Peter Schiff, the famous economist/podcaster/Bitcoin skeptic. When not booked for private events, the crescent-shaped pool at Ayu would be filled with drunk people in swim suits, dancing to DJ Kaskade. No one was in the pool tonight. Depravity was not happening here. In fact, there was more networking going on than partying, and it was somehow more engaging than Bone Thugs-N-Harmony suddenly appearing onstage to perform. And it was distinctly not just about making money in crypto. A good percentage of this crowd wore some derivative of a MAGA hat, and anyone who could show off their photos of them with Trump did so. This, I realized, was how crypto bros did politics — a new game for them, where success and influence was not necessarily quantifiable. “Crypto got Trump elected,” Greg Grseziak, an agent who manages crypto influencers, told me, showing me his Trump photo opp. “In four years, this is going to be the biggest event in the presidential race.”Grzesiak walked off to do more networking, I finished my glory hole champagne, and in the meantime, Bone Thugs had started performing “East 1999”. A fellow reporter leaned over. “Who do you think those guys are?” he asked, pointing to a group of extremely tall white men in suits and lanyards, standing behind a velvet rope to the left of the stage.I walked over to investigate. They looked like the group of Steak ‘n Shake executives I met at the Expo Hall — the ones with the beef tallow jars and derivative MAGA hats — and they were lurking next to the stage, watching the rappers like vultures but barely moving to the music. This scene was too preposterous to actually be real: Steak ‘n Shake executives, at the Bitcoin Conference, attending a party for America250, in the VIP section, during a Bone Thugs-n-Harmony set? “Shout out to Steak ‘n Shake for being the first fast food restaurant to accept Bitcoin!” announced one of the Bones. The company logo appeared on a screen above his head.No flashy Vegas magiccould mask what I just saw. This party was co-sponsored by a MAGA-branded fast-food chain owned by Sardar Biglari, a businessman who had purchased Maxim, became its editor-in-chief, and used the smutty magazine to endorse Trump in 2024. So was Frax, the stablecoin exchange, and Exodus, one of the biggest crypto wallet companies in the market. Bitcoin Magazine’s logo flashed across the stage at one point, as editor-in-chief David Bailey, in his own derivative MAGA hat, tried to hype up the crowd for J.D. Vance’s speech the next day.For some unknown reason, these companies were all putting their money into America250, and as I had to keep reminding myself, America250 — the government nonprofit in charge of planning the country’s celebrations of the 250th anniversary of the Declaration’s signing — was currently working to get tanks in the streets of Washington DC for Donald Trump’s birthday. I went for one last champagne flute from the glory hole, just for the novelty, and as the hand disappeared back into the wall, I caught something I’d missed earlier: above the hole was a logo for TRON, the blockchain exchange run by billionaire Justin Sun. He had faced several fraud investigations from the SEC that magically disappeared after he invested million in a Trump family crypto company, and seemed more than happy to keep throwing crypto money at Trump. Recently, he won the $TRUMP meme coin dinner, spending over million on the token in exchange for a private and controversial dinner with the president.TRON was also cosponsoring the America250 party.Earlier, I’d run into the Australian emcee in the elevator of The Palazzo. She’d spent the day teetering across the Nakamoto Stage in dainty kitten heels, a pinstriped blazer and miniskirt suit set, and given the gratuitous Trump praising and the fact she was blonde, I had stereotyped her as MAGA to the core. But the program was over and she was holding her heels by their ankle straps, barefoot and sighing in relief. This was not her usual style, she told an attendee. She’d take a pair of sneakers over heels if she could. But the conference organizers had told her to dress up because there were senators in attendance. “Tomorrow, the real Bitcoiners are coming,” she said, and she’d get to wear flat shoes. And the next morning, on the day of Vance’s speech, I found myself stuck outside the conference with the “real Bitcoiners.” In spite of all the emails that the conference had sent me reminding me of how strict security measures would be, possibly to overcorrect from last year’s utter shitshow around Trump’s appearance, I’d woken up too late, eaten my bagel too leisurely, got sidetracked by a police officer-turned-Bitcoin investor excited I was wearing orange, and barely missed the cutoff for the Secret Service to let me in. But the conference had set up televisions with a live feed of Vance’s speech, and the rest of the general admission attendees were remarkably chill about it, opting to mingle in the hallways until the Secret Service left. I found myself in a smaller crowd near the expo hall door, next to a young man carrying a live miniature Shiba Inu, and the podcaster I’d seen earlier in the sequined bomber jacket. He introduced himself as Action CEO, and with nothing else to do but wait — “You can watch thereplay,” he reassured me, “these events are mainly about networking” — we got to talking. “I’m actually excited that Trump isn’t even here, I’ll be honest with you,” he said, speaking with a rapid cadence. Trump was ultimately just one guy, and the fact that he sent his underlings and political allies — the ones who could actually implement his grand promises for the crypto industry — proved he hadn’t just been paying lip service. That said, it had come with some uncomfortable changes, including the re-emergence of Justin Sun. “It’s a little bit concerning when you say, All right, we don’t care what you did in the past. Come on out, clean slate,” he continued. “That’s the concern right now for most people. Seeing people that did wrong by the space coming back and acting like nothing happened? That’s a little concerning.” And not just that: Sun was back in the United States, having dinner with Trump, and giving him millions of dollars. “If you’re sitting in a room and having a conversation, people are literally gonna go, yeah, it’s kind of sketch that this guy is back here after everything that’s happened. You’re not gonna see it published, because it’s not a popular opinion, but we’re all definitely talking about it.” If Action’s friends weren’t comfortable talking about it openly, that fraudsters with enough money were suddenly back in the mix, it was certainly not the kind of conversation the CEOs were going to have in front of the General Admission crowd.But behind closed doors — or at least at the Code and Country panels, where the base pass attendees couldn’t boo them — they gave a sense of what their backroom conversations with the Trump administration did look like.“I was actually at a dinner last night and one of the things that someone from the admin said was, What if we give you guys everything you want and then you guys forget? Because there’s midterms in 2026, and hopefully 2028, and beyond,” said Sam Kazemian, the founder and CEO of Frax, which had sponsored the America250 party. “But one of the things I said was: We as an industry are very, very loyal. The crypto community has a very, very, very strong memory. And once this industry is legalized, is transparent, is safe, all of the big players understand that this wasn’t possible without this administration, this Congress, this Senate. We’re lifelong, career-long allies.”“Loyalty” is a dangerous concept with this president, who’s cheated on his three wives, stopped paying the legal fees for employees who’d taken the fall for him, ended the careers of sympathetic MAGA Republicans for insufficiently coddling him, withdrew security for government employees experiencing death threats for the sin of contradicting him in public by citing facts. It was only weeks ago that he and Vance were publicly screaming at Ukrainian president Volodymyr Zelensky, who was at the White House to request more aid in the war against Russia, for not saying “thank you” in front of the cameras. It would be less than a week before he began threatening to cancel all of Elon Musk’s government contracts when the billionaire criticized the size of Trump’s budget, even though Musk had given him millions and helped him purge the government. And if you were to find a photo of any political leader, billionaire or CEO standing vacant-eyed next to Trump and shaking his hand, the circumstances are practically a given: they had recently made him unhappy, either for criticizing him, making an imagined slight, or simply asserting themselves. The only way they could avoid public humiliation, or their businesses being crushed via executive order, was to go to Mar-a-Lago, tell the world that the president was wonderful, and underwrite a giant party for his birthday military parade. Maybe Kazemian knew he was being tested, or maybe the 32-year old Ron Paul superfan had no idea what the administration was asking of him. Either way, he responded correctly. At least one person at the conference was thinking about ways that the government could betray the Bitcoin community. As the panel on Bitcoiners becoming sycophants of the state wrapped up, and the other panelists finished telling the government pigs to go fuck themselves and keep their hands off their nerd money, the moderator turned to Casey Rodarmor, a software engineer-turned-crypto influencer, for the last question: “Tell everyone here why Bitcoin wins, regardless of what happens.”“Oh, man, I don’t know if Bitcoin wins, regardless of what happens,” he responded, frowning. He had already gamed out one feasible situation where Bitcoin lost: “If we all of a sudden saw a very rapid inflation in a lot of fiat currencies, and there was a plausible scapegoat in Bitcoin all over the world, and they were able to make a sort of marketing claim that Bitcoin is causing this — Bitcoin is making your savings go to zero, it’s causing this carnage to the economy —

If that happens worldwide, I think that’s really scary.” The moderator froze, the crowd murmured nervously, and I thought about the number of times Trump had blamed a group of people for problems they’d never caused. An awful lot of them were now being deported. “I take that seriously,” Rodarmor continued. “I don’t know that Bitcoin will succeed. I think that Bitcoin is incredibly strong, it’s incredibly difficult to fuck up. But in that case… man, I don’t know.” I had asked Action CEO earlier if Kazemian, the Frax CEO, was right — if the crypto world was unquestioningly loyal to Trump, if their support of him was unconditional. “Oh, it’s definitely conditional,” he said without hesitation, as his Trump jacket glittered under the fluorescent lights. “It’s a matter of, are you going to be doing the right things by us, by the people who are here?” We walked down the expo hall, past booths promising life-changing technological marvels, alongside thousands of people flooding into Nakamoto Hall, ready to learn how to become unfathomably rich, who paid to be there.The audience of “Are Bitcoiners Becoming Sychophants of the State?”, Day Two of the Bitcoin ConferenceSee More:

#bitcoin #conference #republicans #were #sale